Responsible investment is now critical

In the 2020s, responsible investment (RI), especially climate-related, has become the priority topic for funded pension schemes and providers.

Cushon estimates the investments underpinning the average person’s pensions finance 23 tonnes of CO2 emissions a year, equivalent to running nine family cars each year, or burning 1,100 coal fires annually.

People care, but are largely unaware

When they find out about this, individuals really care. But most are completely unaware. We know this from new research from Nest Insight, DC Investment Forum (DCIF) reports in 2018 & 2020, and ShareAction videos.

Campaigning is working

Since the launch of Richard Curtis’s Make My Money Matter campaign in the summer of 2020, the following pioneer pension schemes and providers have made various net zero commitments (click the logos for details):

Pensions dashboards are coming too

Meanwhile, pensions dashboards are coming to the UK, covering all pensions.

An individual logging in to a dashboard will be able to see, for the first time, summary information about all of their pensions, together in once place.

That’s easily said, but a huge task to deliver. Government, regulators and the pensions industry are all working hard to make dashboards a reality from 2023 onwards. During 2020, I had the privilege of leading the development of the data standards for initial dashboards.

Could we bring these two themes together?

Seeing as the topic of RI is so critical, might it be possible to bring it together with the dashboards initiative, once pensions dashboards are up and running from the mid-2020s?

What simpler, or more important, way could there be for individuals to get engaged with their “later life” money?

Could dashboards easily show how green each of your pensions is?

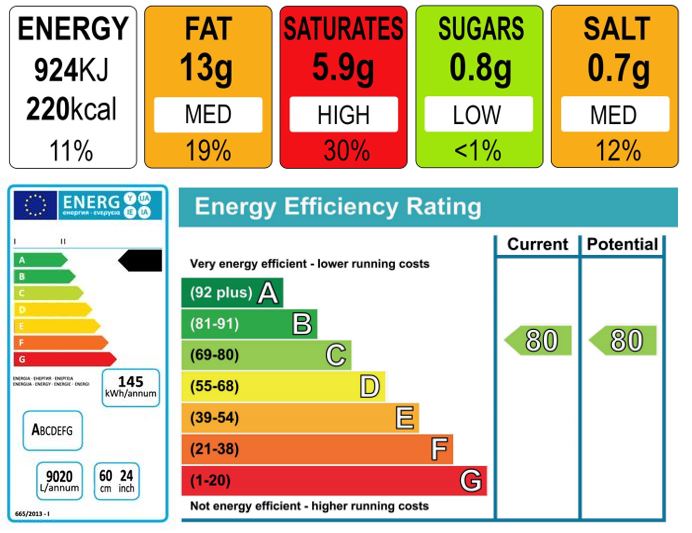

Imagine a simple list of your different pensions on a dashboard. Then, alongside each one, imagine a simple logo (or label) indicating how good for the planet each pension is.

Think of it as food labelling for pensions; or like the energy efficiency labelling of domestic appliances; or an Energy Performance Certificate (EPC) when you sell a house:

We already label: houses, fridges in houses, and food in fridges. Now it’s time to label the pensions with which we’ll buy that food when we’re older.

This could be incredibly powerful, dramatically increasing people’s engagement with their pensions, and their trust in their different pension providers. Evidence suggests it might even lead people to increase their pension contributions.

Is this a step too far?

It won’t be easy. If the Pensions Minister feels getting dashboards up and running is akin to the first labour of Hercules, then agreeing simple consistent labels to easily show individuals how “good” their different pensions are, will be akin to the second.

But shouldn’t we aspire to rise to this challenge in 2021, the year the UK hosts COP26? I’ve summarised the key current developments below.

Summary: the aspiration

The April 2018 DCIF report Navigating ESG: A Practical Guide said that:

“the pensions industry would do well to learn from the success of Fairtrade and develop an instantly recognisable logo to help members easily identify whether their pension money is being used for [sustainable] investing.”

The need is critical. The ambition is there. If you’d like to talk about how we, as a pension industry, might bring about “pensions labelling” on dashboards, please do get in touch.

Many thanks, Richard Smith, 8 February 2021

Key steps so far towards “pensions labelling” on dashboards

Like so much to do with money, this is an incredibly complicated topic.

But pensions dashboards are all about simplicity: showing largely unengaged individuals simple information about each of their pensions.

So below I’ve tried to boil down the key developments that might, in due course, lead towards a simple way of displaying on dashboards how “good for the planet” each of your pensions is.

The latest developments are first.

27 January 2021 – DWP consultation on climate change regulations

DWP begins a consultation on draft regulations and statutory guidance (brought about by the Pension Schemes Act 2021, once it’s received Royal Assent). This follows a previous DWP consultation that ran from August to October 2020.

From October 2021, the regulations will require large pension schemes (with assets of at least £5 billion) and all authorised master trusts to collect and assess data about greenhouse gas (GHG) emissions from the companies they invest in. They must then disclose this in a report in line with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD): this is called the scheme’s TCFD Report. The scheme’s main Annual Report must link to the TCFD Report, and annual benefit statements sent to members must also mention it.

The DWP consultation on the draft regulations covering these data and disclosure requirements closes on 10 March 2021.

I’m sure this is all very laudable, but does anyone honestly believe that a meaningful proportion of members are actually going to read, let alone understand, all this stuff?

And if, like me (and most other people), you have multiple pensions, are we really expected to locate, read and understand multiple schemes’ TCFD Reports? That’s just not going to happen, is it?

What members need is a simple metric, simply accessed digitally (on whichever pensions dashboard they choose to use) to show them how well each of their different pension schemes is doing with regards to climate change.

In this context, what’s really encouraging is DWP’s discussion about a simple metric to indicate a pension scheme investment portfolio’s “degree warming”. Such a metric could be an incredibly powerful tool, showing the global temperature rise associated with the GHG emissions from a given scheme’s investment portfolio. Or, in other words, the portfolio’s “alignment” with the net zero goal set in the 2016 Paris Agreement.

We’ve got a way to go, though, to define the methodology for such a metric.

Various consultations on this have been published recently:

November 2020 – NZAOA ongoing consultation

Through the Spring and Summer of 2020, the Net-Zero Asset Owners Alliance (NZAOA) consulted on a Version 1 “Methodological Criteria” document on the potential convergence of methodologies for carbon neutrality / “implied temperature rise” metrics. Following the consultation, in November 2020, NZAOA published a Version 2 Methodological Principles document and invited further comment.

9 November 2020 – PAT report

The Portfolio Alignment Team report Measuring Portfolio Alignment was produced to support the TCFD consultation with a focus on a “degree warming” metric. The report reviewed seven leading methods for estimating such a metric, and recommended exploring a dialogue with industry through the TCFD, IIGCC and NZAOA consultations.

29 October 2020 – TCFD consultation

The Task Force on Climate-related Financial Disclosures (TCFD) consultation on Forward-Looking Financial Sector Metrics ran from 29 October 2020 to 27 January 2021. The consultation paper considered a new metric, referred to as the “implied temperature rise (ITR)” of an investment portfolio, which aims to provide a forward-looking view of a portfolio’s carbon footprint. TCFD also sought to understand alternative forward-looking metrics. The results of the consultation are expected in 2021.

5 August 2020 – IIGCC consultation

The Institutional Investors Group on Climate Change (IIGCC) consultation on its Net Zero Investment Framework (NZIF) ran from 5 August to 25 September 2020. The NZIF aims to provide a comprehensive set of actions, metrics and methodologies which will enable pension schemes and providers, amongst others, to become net zero investors. The results of the consultation are expected in early 2021.