Introduction

The Norwegian pensions dashboard service is NorskPensjon.no.

On 20 June 2023, I had the absolute privilege of visiting the Norsk Pensjon team in Oslo on the penultimate stop of my Pensions REDUX tour.

The core purpose of the tour was to learn more about mature pensions dashboards’ user experiences (UXs) and user interfaces (UIs).

So the main findings below focus on the high-level UX and UI before, whilst, and after using Norsk Pensjon.

The Norwegian team were also very generous providing me with other insights, such as usage statistics, so I’ve included some of these findings too.

Before reading on, for context please do have a look at the Background and 10 General Comments page.

After reading the findings below, feel free to get in touch with me if you’d like to talk about dashboards, discuss the findings, and what they might mean for forthcoming pensions dashboards in the UK.

What’s on this page?

Other information about Norsk Pensjon

UX before using Norsk Pensjon

As well as being a dashboard, Norsk Pensjon is a pensions data retrieval service well known to Norwegians.

A Norwegian citizen can request to retrieve their pensions data through three different access routes, but always using the same central data retrieval mechanism (i.e. NorskPensjon):

- direct via the NorskPensjon.no website (c.60,000 data requests a month in 2023)

- via the Government’s State Pension service (c.80,000 data requests a month in 2023)

- via commercial apps, e.g. banking app (c.3,100,000 data requests a month in 2023)

See Usage of Norsk Pensjon below for more details on these statistics.

Originally launched in 2008, pensions data used to only be available to the NorskPensjon.no website. But then, after the central service had been running for seven years, from 2015 NorskPensjon-retrieved pension data has been made available to be viewed on other apps, such as banking apps, via Application Programming Interface (API) technology.

As I mentioned in my LinkedIn post at the time, Chief Executive Trond Tørstad said to me when I met with him and his team in Oslo:

“Every time people check their bank account on their banking app, they can request to see their pensions there too – we now get about 3 million requests a month”.

[Note this is the total number of requests rather than unique users – for context, bear in mind the Norwegian working age population is roughly 3.5 million.]

So most Norwegians know about Norsk Pensjon through their providers’ commercial apps which they use, and also through the media. I don’t cover commercial apps here. From here on, I’m showing examples of the direct access route, i.e. displaying pensions on the NorskPensjon.no website itself.

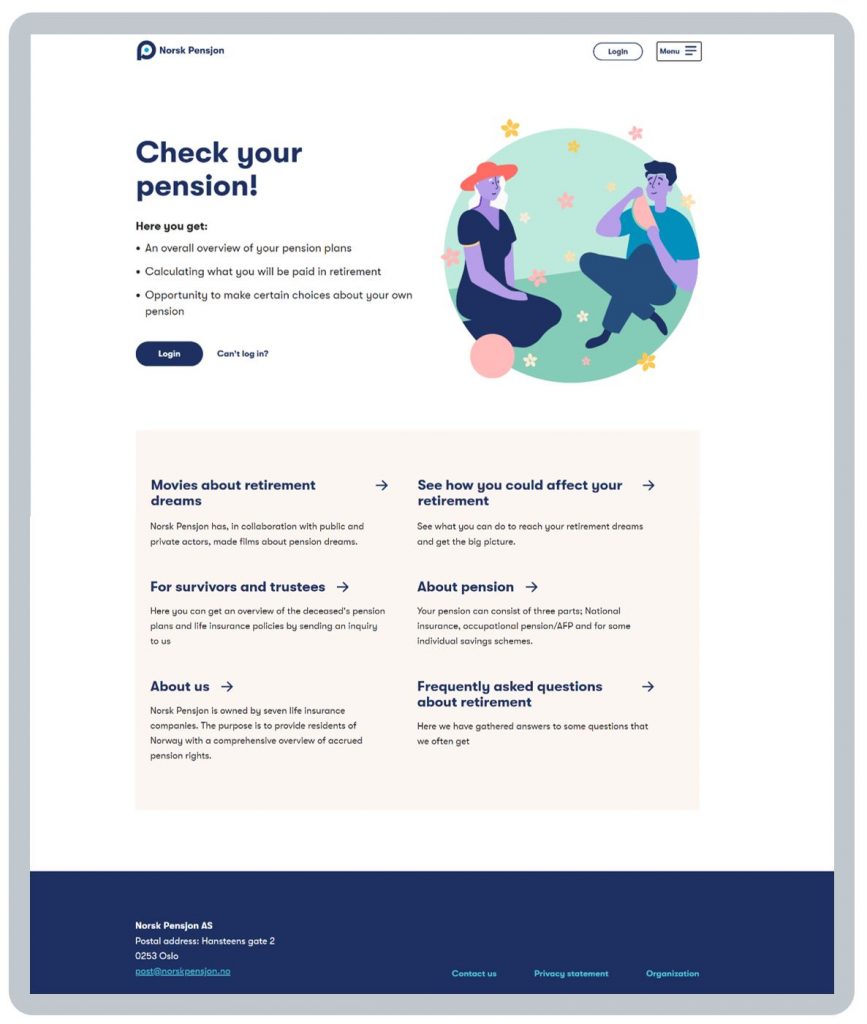

NorskPensjon.no has a very clear and self-explanatory homepage, with deliberately limited content (to keep things simple for users). It’s also quite jokily directive: “Check your pension!”. The service is 15 years old, but the user interface screenshots below were all redesigned in 2022 to keep the UI fresh and modern.

BLANK

What can you see before logging in?

The very clear and simple homepage shows:

- welcoming modern graphics to help users of different types feel the service is relevant to them

BLANK - clear definition of the service: the homepage explains that it’s an overview, showing total retirement income, with information about the choices you can make in respect of your pension

BLANK - links to supporting information, including:

BLANK

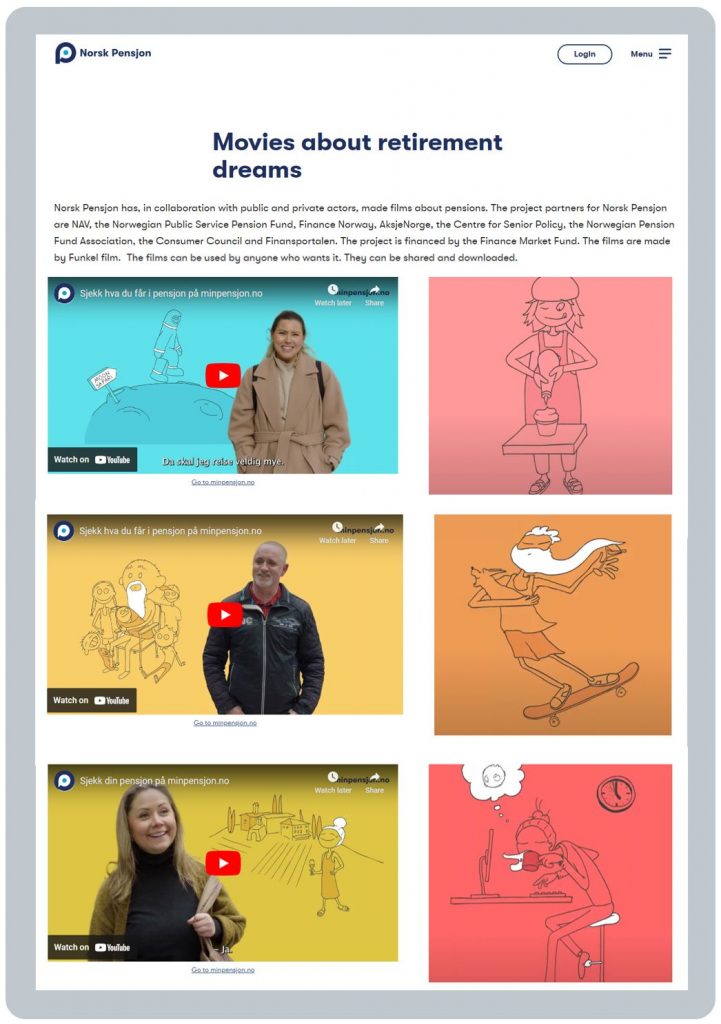

- some short videos (image below) on different people’s dreams for retirement, encouraging people to “check what you’re getting” on the dashboard

- information on what you can do to influence your pension

- background information on the Norwegian pension system generally

- some FAQs

- information about the service from Norsk Pensjon

- an option to enquire about a deceased person’s pensions

BLANK

- contact and organisational information for Norsk Pensjon.

BLANK

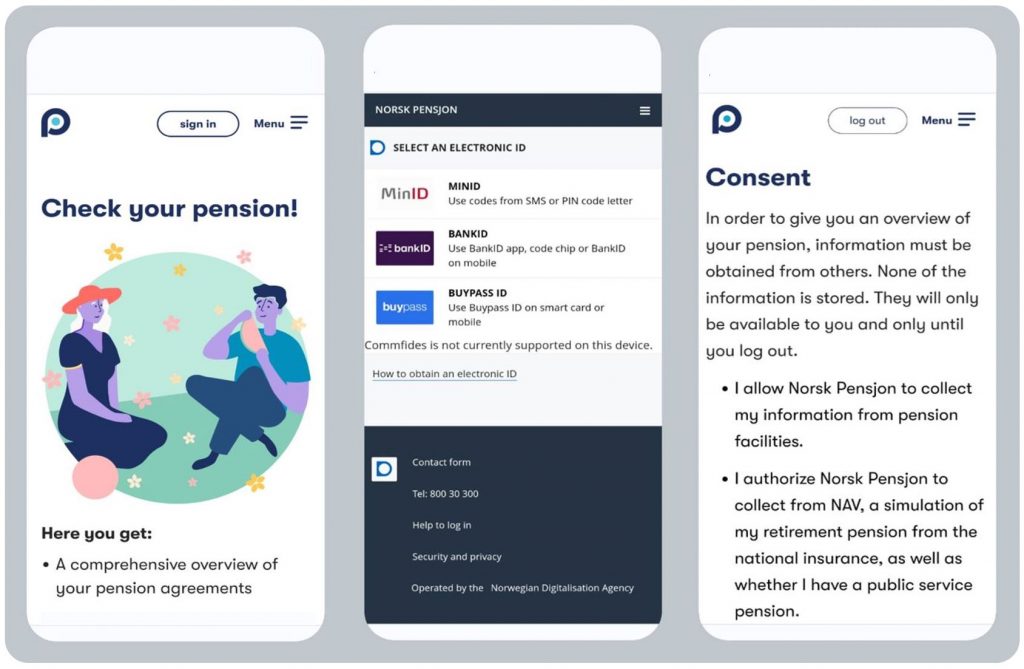

The homepage invites the user to log in, giving them options to use different digital identities, after which the user must also consent to Norsk Pensjon collecting their pension data from their different providers:

As explained in General Comment 5, there’s not much point covering Norway’s digital identity services in any detail here – they are what they are, and the UK’s identity service will be what it will be, i.e. there are no design choices to be made here by UK dashboard operators.

BLANK

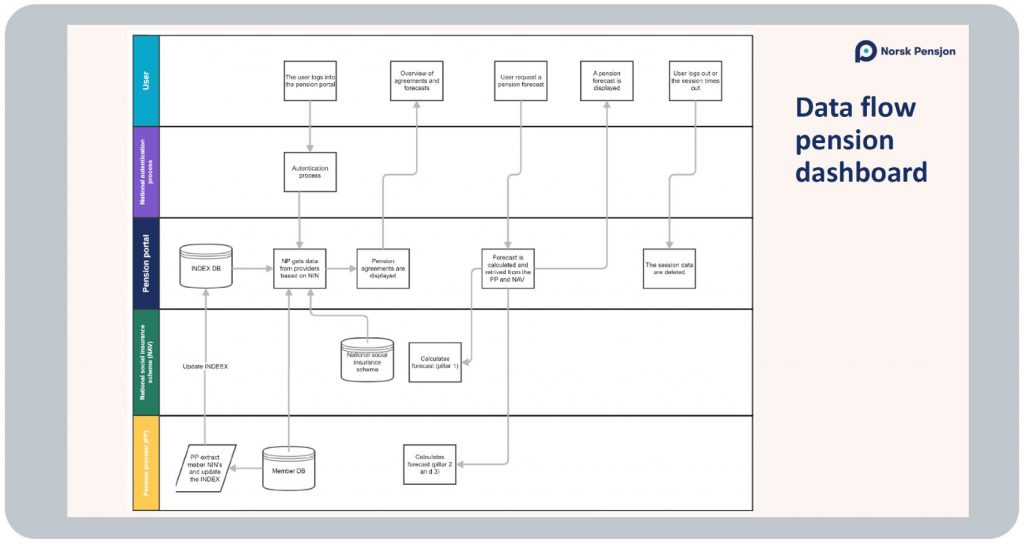

NorskPensjon holds a central store of which pension providers each citizen has pensions with (“INDEX DB” below). This, and the Norwegian National Identification Number (NIN), have been central to the success of the pensions dashboards initiative in Norway.

BLANK

UX whilst using Norsk Pensjon

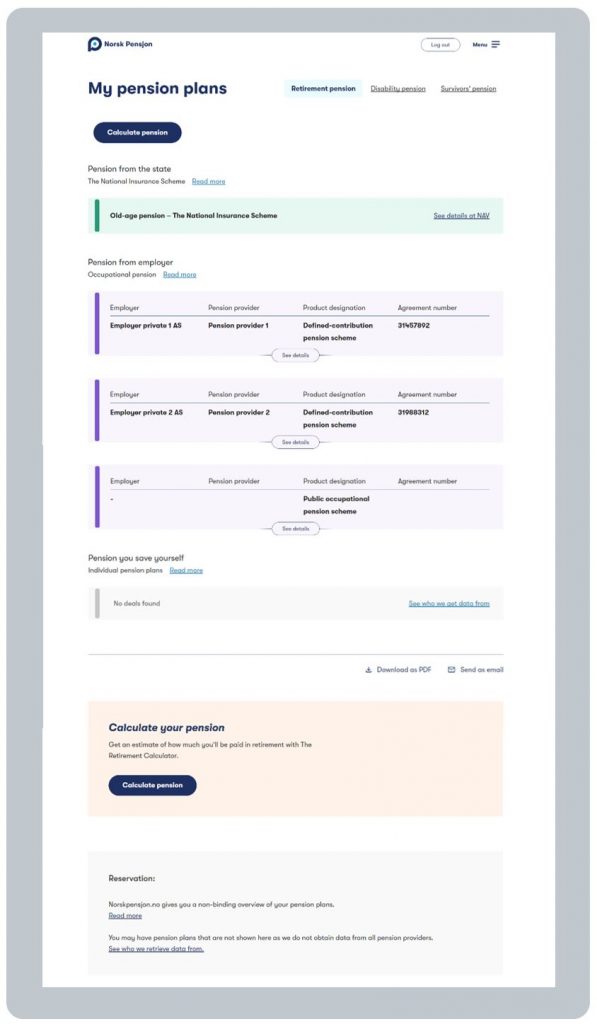

After logging in, and consenting to retrieval of their pension data, the user sees this “My pension plans” page, which is a list of the user’s pensions retrieved, but without any pension amounts shown:

The clear and simple list design shows:

- state pension (green): confirmation the user is entitled to Norwegian state pension

BLANK - workplace pensions (purple): showing for each pension found the employer and provider names, the pension type and the user’s account reference number

BLANK - private personal pension (blue) if the user has any (none in the above example)

BLANK - important limitations (“Reservation”) at the bottom, that a) Norskpensjon.no only provides a non-binding overview of the user’s pensions, and b) there may be some pensions which are missing (with a link to the list of participating pension providers)

BLANK - links to see disability and death benefits, but I won’t cover these here as they’re not so relevant for the UK (being out of scope for initial UK dashboards).

BLANK

At both the top and bottom of this page, the user can click the “Calculate pension” button to see what their pension amounts are.

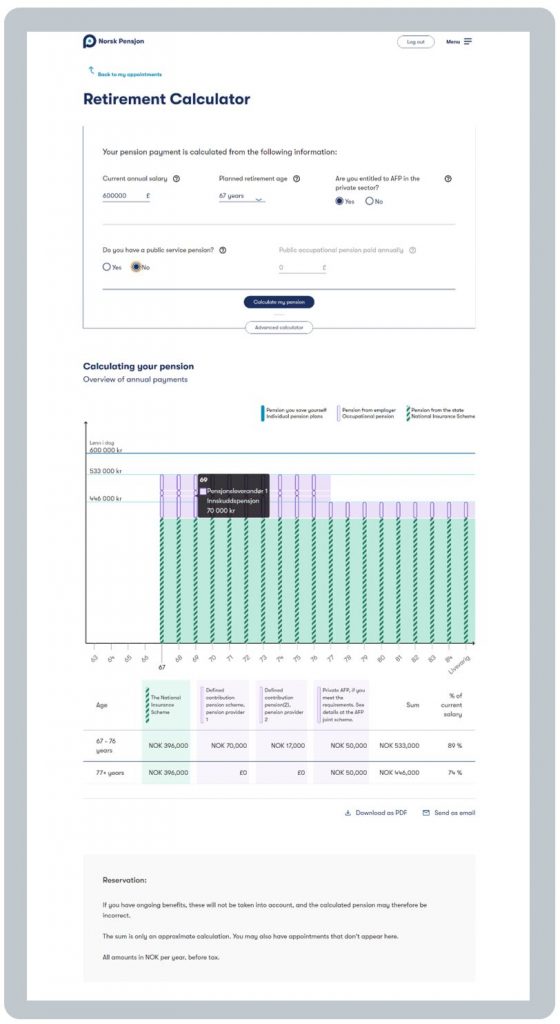

On clicking “Calculate pension”, the user is asked input their current annual salary and their planned retirement age (defaults to 67), after which they see this display of their pension amounts on the Retirement Calculator page:

The different elements on this very clear and simple “Retirement Calculator” page include:

- a retirement timeline from the user’s retirement onwards for many years, helping the user understand immediately that their retirement could last quite a long time

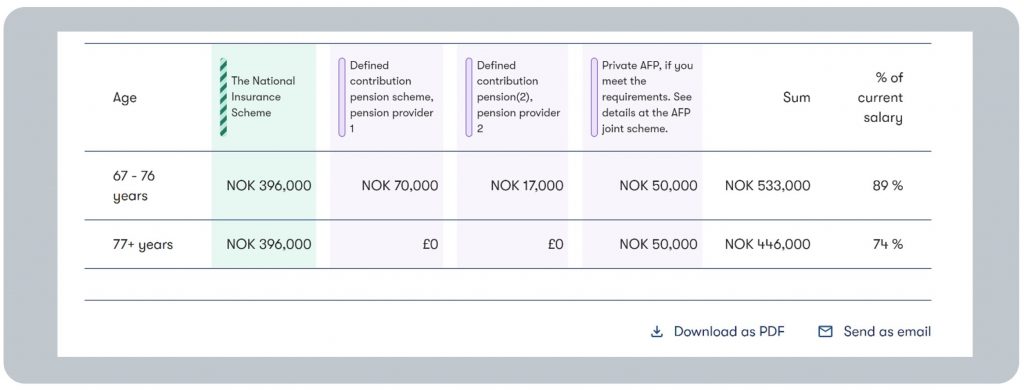

BLANK - total estimated yearly income the user might receive each year in retirement (in this example, at age 67 the annual pension is 533,000 NOK a year, or, at current exchange rates, £40,200 a year)

BLANK - colour-coded breakdown of pensions in each year of retirement (State green, Workplace purple, Personal blue – none in this example)

BLANK - ability to see each individual pension income amount by hovering over each amount (see the black box in the example above)

BLANK - comparator line showing salary today (“Lønn i dag”) so the user can start to think if their forecast total pension income might be enough to live in during retirement

BLANK - alternative retirement forecasts option by the user selecting an alternative retirement age (which can be from age 62 to age 75), plus the option to include more advanced calculation inputs such as overseas pensions, salary to be received alongside pension, and other inputs

BLANK - table of pension incomes figures, i.e. the same information as is shown on the timeline but presented in a clear table for users who prefer tabular to graphical layouts

BLANK - important limitations (“Reservation”) at the bottom, that a) any pension benefits already in payment are not shown, b) figures are only approximate, c) some pensions may be missing and d) all income figures are yearly amounts, in Norwegian Krona, before any tax due has been deducted.

BLANK

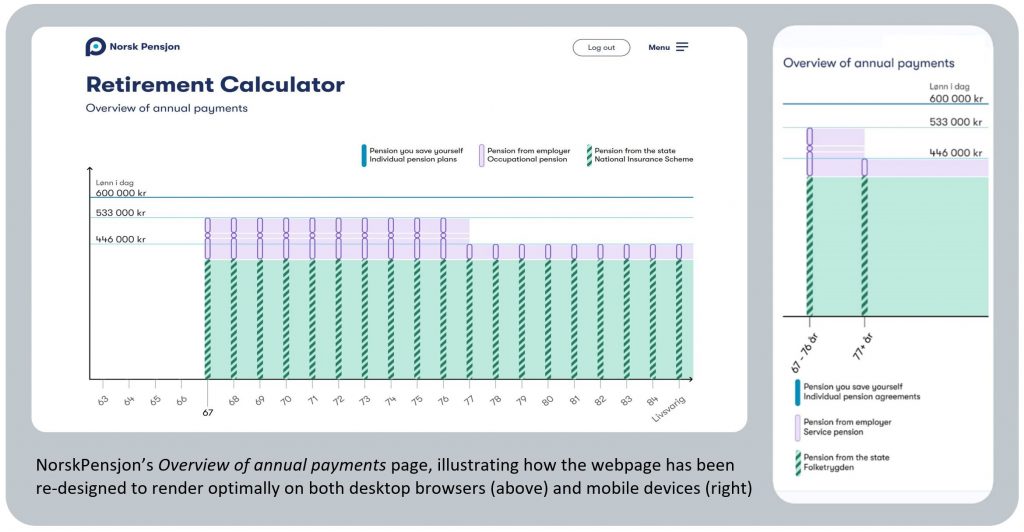

Optimising for mobile

Even though Norsk Pensjon was originally launched in 2008, the user interface was redesigned and refreshed in 2022 to keep in modern and relevant. As part of this redesign, the different pages were designed to render optimally on both mobile and desktop devices, such as the example below. Today, just over half of Norsk Pensjon usage (excluding access by commercial apps of course – see above) is via mobile devices.

BLANK

UX after using Norsk Pensjon

Many users’ core interest in their overall pension position can be boiled down to three simple questions:

- What have I got?

- Is it enough for me to live on in retirement?

- What can I do?

In Norway, the core focus of NorskPensjon.no is to help Norwegians answer question 1. Users can see clearly what total pension income they might get, from different potential retirement ages.

BLANK

To help with the second question (“Is it enough?”), users input their current salary to show how their forecast pension income compares with what they earn today.

NorskPensjon.no also allows users to download and email their pension information if they wish:

BLANK

In terms of the third question (“What can I do?”), NorskPensjon.no is focused on being impartial, so it lets users address this more subjective question themselves afterwards.

Most users view their Norsk Pensjon-retrieved pension data on commercial apps (see Usage of Norsk Pensjon below), so it is up to these apps to help users with any next steps this might wish to take.

For example, Norwegian citizens might take steps to:

- understand what pension income they may need in retirement

- learn more about pensions generally to give wider context

- speak with their providers, or an adviser or others who can help on pensions

- take appropriate steps to improve their pension position if they wish to do so.

Norsk Pensjon also offers an offline service where people who can’t log in can submit a form to get information about their pensions.

Taking action

As discussed in General Comment 7, the extent to which users actually make changes to their pension position after using NorskPensjon.no is not explicitly visible to the NorskPensjon.no team. This is because NorskPensjon deliberately focuses on offering an impartial “Find and View” service which primarily seeks to empower consumers, helping them to be better informed, so they are able to make better decisions.

BLANK

Usage of Norsk Pensjon

Norwegian citizens can request data (from their different pension arrangements) to be retrieved via three different “front-end” routes, but always using the same central data retrieval mechanism (NorskPensjon):

- direct via the NorskPensjon.no website

- via the Norwegian Government’s State (national insurance) Pension Scheme service

- via commercial apps, such as banking apps (about a dozen providers currently offer this).

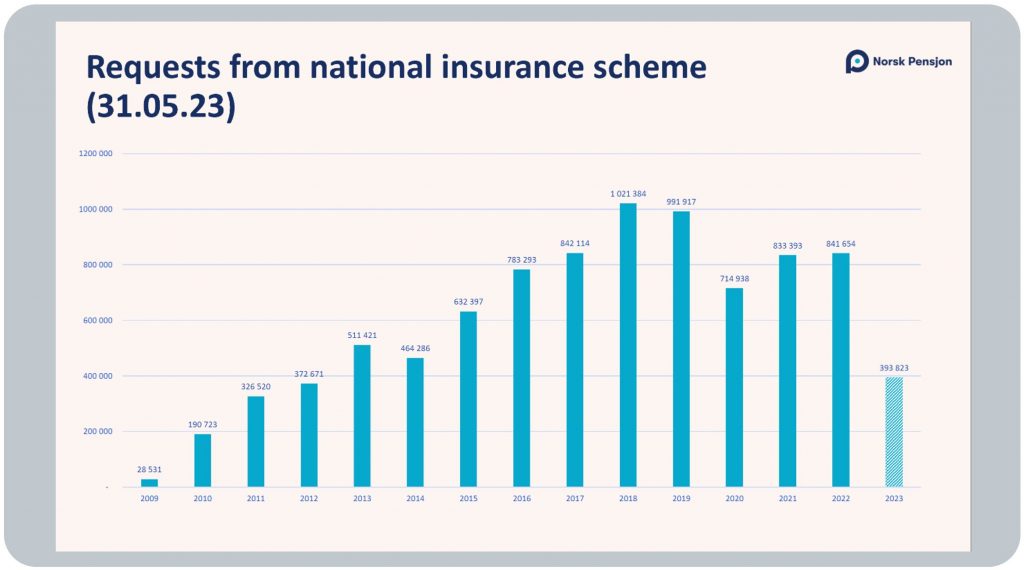

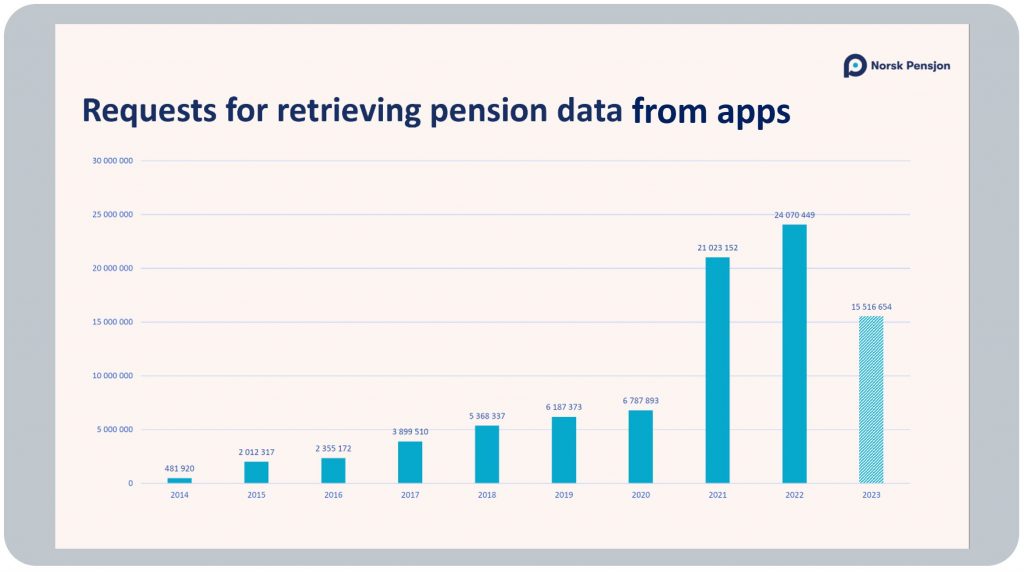

Usage via all three routes has been steadily increasing over the last decade (or the last nine years for commercial apps, as this access route was only made available from 2014/15):

In the graphs above, the 2023 figures are part year numbers for the five months January to May 2023.

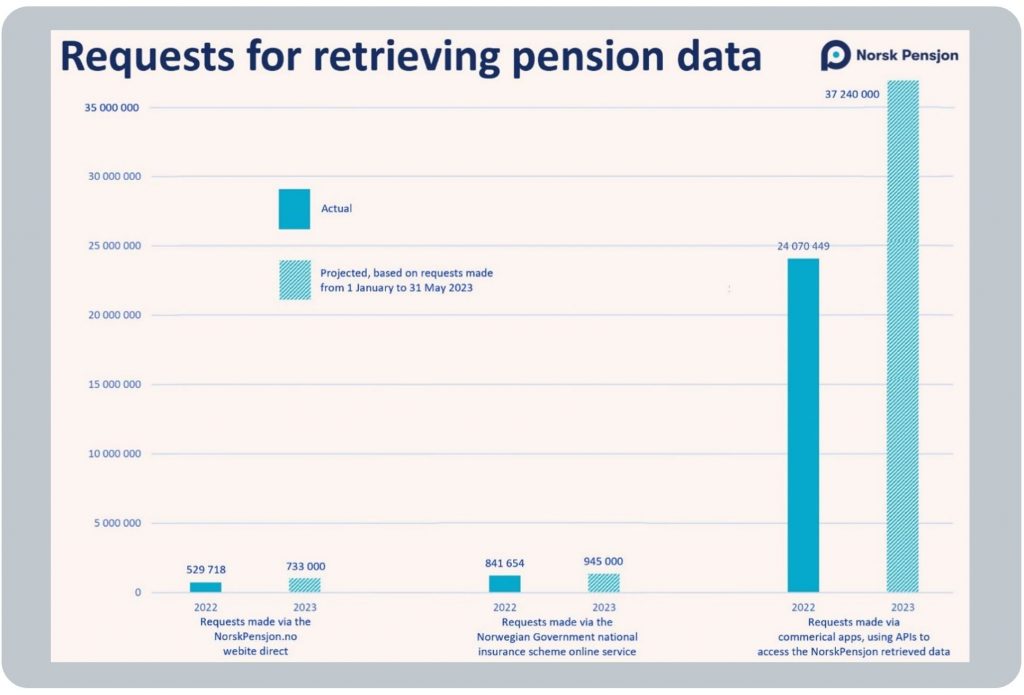

So most Norwegians are seeing their pensions data on commercial apps, and by quite some margin:

In 2022, data was requested 24.07 million times via apps compared to 1.37 million (i.e. 0.53m + 0.84m) via NorskPensjon direct and the Government service combined.

Based on Jan to May 2023, projected 2023 usage is 37.24m via apps and 1.68m (0.73m + 0.95m) via NorskPensjon / Govt. So people use apps to see their pension data 22 times more frequently than via the central and Government access routes combined.

Norwegian population

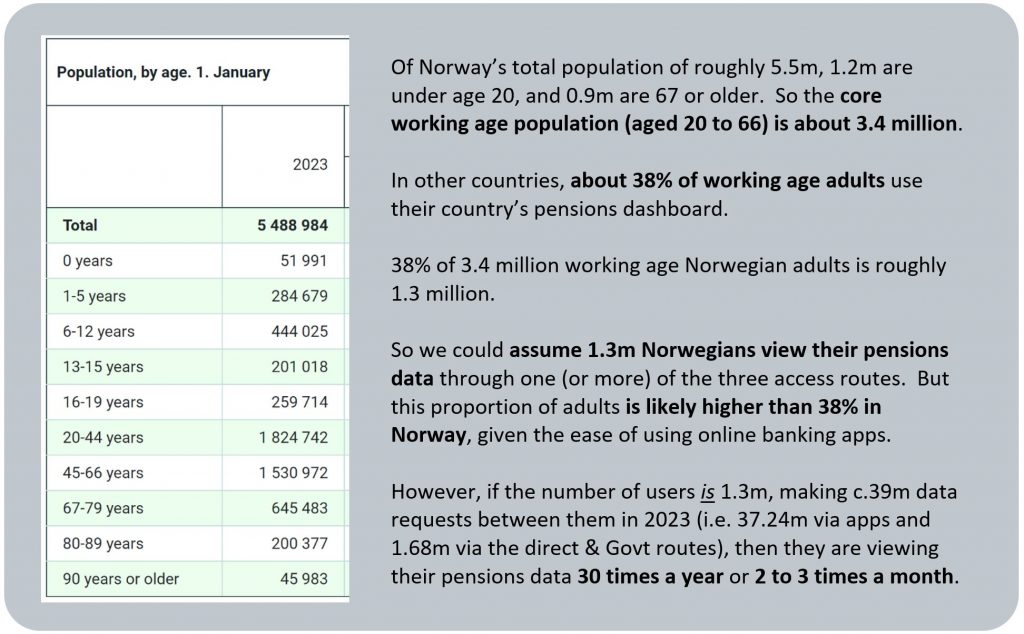

The above figures represent the number of data access requests, not the number of unique users.

The NorskPensjon team do not collect or record the necessary information needed to be able to identify unique users, or to breakdown usage, for example, age or gender.

For context though, as at 2023, the Norwegian population is just under 5½ million.

BLANK

Other information about Norsk Pensjon

The core purpose of my research tour in June 2023 was to learn more about mature pensions dashboards’ user experiences (UXs) and user interfaces (UIs). However, the Norwegian team were also very generous providing me with various other insights about the Norwegian dashboard, which I’ve summarised below.

This “Other information” section covers some summary points on the:

- history of Norsk Pensjon

- governance of Norsk Pensjon

- vision for Norsk Pensjon.

BLANK

History of Norsk Pensjon

In the autumn of 2006, Norsk Pensjon AS* was founded by seven life insurance companies.

* An AS (or aksjeselskap) is a type of privately owned limited liability commercial company in Norway

The online service was first launched in 2008, with data access being extended to commercial apps from 2015 (as described in Usage of Norsk Pensjon above).

Norsk Pensjon covers all three “pillars” of pension, i.e. pension from the National Insurance Scheme (the Norwegian State Pension), workplace pensions, and any private pension savings the user may have.

State Pension is supplied for everyone, but it is voluntary for pension providers to provide workplace and private pension information to Norsk Pensjon. Data coverage is currently as follows:

- Private sector workplace pensions, about 99%

- Public sector workplace pensions, about 80%

- Private (personal) pensions, 70 out of 100 providers supply information.

Governance of Norsk Pensjon

Norsk Pensjon AS is a not-for-profit industry company founded by seven providers in the pensions and insurance industry, all of which were then members of the Norwegian Financial Industry Confederation (FNH) – now Finans Norway, which is the trade association for Norway’s financial services industry.

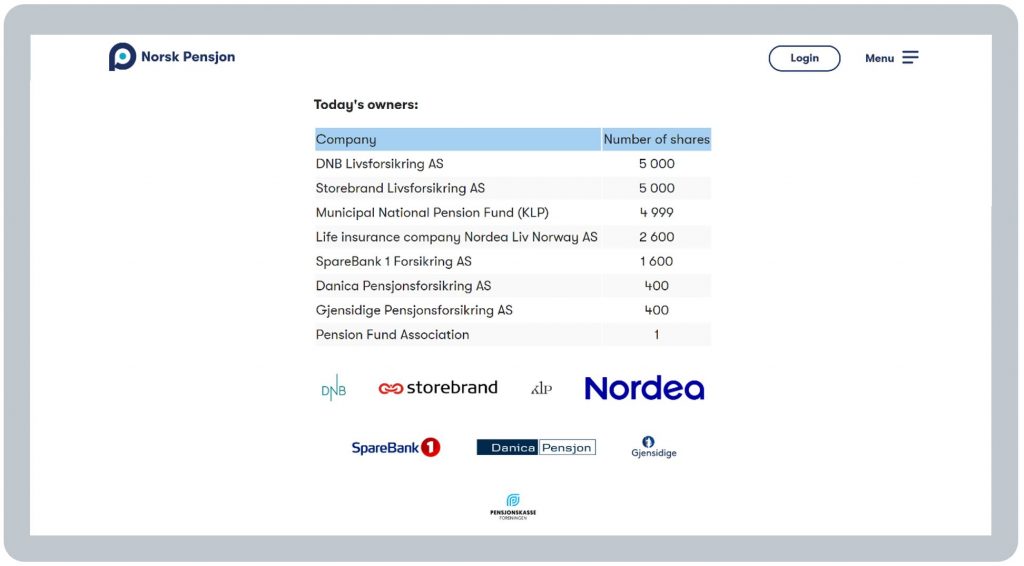

Any pension provider who supply pension information to Norsk Pensjon can become an owner, but you do not have to be an owner to submit pension information to the dashboard.

The current owners of the Norsk Pensjon AS company are listed on the About page of Norsk Pensjon:

Even though Norsk Pensjon is a private company owned by the largest life insurance companies in Norway, the dashboard is made possible through collaboration with the Norwegian Government’s Labour and Welfare Administration department. Norsk Pensjon has an Advisory Board where social partners, the Norwegian Labour and Welfare Administration, Ministry of Labour and other stakeholders are represented.

Norsk Pensjon AS only has four employees with operations outsourced to third parties.

Funding

As a not-for-profit, Norsk Pensjon AS only seeks to have income which covers its expenses.

The company’s operations are financed by all pension providers who supply information to Norsk Pensjon, based on the quantity of pension data they return, which generates about 50% of operating revenues.

The other 50% comes from providers who offer commercial apps to display the Norsk Pensjon-retrieved data to their customers (annual fee as well as a price per request).

For State Pensjon, both Norsk Pensjon and the Government cover their own costs.

It cost about €5 million to establish the service and annual operating costs are about €1.2 million.

Data standards

All pension providers who submit information to Norsk Pensjon must sign an agreement, which is the same for all providers. There is a separate agreement with the Norwegian Government for State Pension.

Pension provider supply pension forecast information, based on an industry standard calculation basis. Alternatively, pension providers can send their projection basis to Norsk Pensjon so that Norsk Pensjon can calculate the forecast (based on standard parameters, such as investment returns and charges).

Vision for Norsk Pensjon

Norsk Pensjon’s purpose has always been to establish and maintain a pension portal that will provide all Norwegian citizens with a comprehensive overview of expected future retirement income based on their entitlements from all pension sources.

Norsk Pensjon also provides online and infrastructure solutions in support of its main purpose.

Trond said Norsk Pensjon has been able to continue delivering against its core purpose because of three critical success criteria:

- Collaboration: A common understanding and trust between industry and Government on the requirements for a solution where Norwegian citizens can see a comprehensive pension overview

BLANK - Coverage: Being able to show State Pension, a critical mass of workplace pensions, and private personal pensions (a top issue raised by users if is one or more of their pensions are missing)

BLANK - Common ID: Norway’s national identity number (NIN) has been a crucial element contributing to the success Norsk Pensjon has been able, and continues, to achieve.

BLANK

Users feed back that they are very pleased with the “My pension plans” list of pensions (the equivalent of the UK’s “Find” step) as this is a very useful and important service in itself.

The total pension income forecast on the “Retirement Calculator” page (the equivalent of the UK’s “View” step) also helps Norwegians gain understanding and grow in confidence about their pensions (although remember than most users are seeing these pensions on commercial apps which are not covered here).

User feedback is really positive – here are three sample quotes from Norsk Pensjon users:

“I like the language – it explains things without too many difficult words”

“Simple overview that gives a good overview of my pensions”

“Easy to find out what I might get in retirement pension”

BLANK

Page content verified by the Norsk Pensjon team on 14 September 2023