What is ERICA?

Two strands, same issue

Separate teams

Adequacy is personal

A nationwide concept

Three core MOT checks

Visibility, direction, speed

Why we need ERICA now

Next steps (Q1 2026)

As of Feb 2026, this is draft content being discussed with various stakeholders. Some feedback received so far:

“I think this is a really great concept of how to engage consumers with their own position, which is brilliant”

“Bloody love this idea, it’s definitely the missing piece, and you are so right about things not being joined up”

“I like the ERICA framing, especially if it helps bridge the gap between projected income and lived expenditure. The industry needs more thinking like this.”

“Good piece – it all sounds so achievable and impactful”

“Definitely a webinar topic” … “Love the MOT analogy”

Please get in touch if ERICA is of interest for you – thanks.

What is ERICA?

ERICA is a new idea: a regular Estimated Retirement Income Check for Adequacy.

Think of it as the MOT for your retirement income.

A new regular consumer habit, or norm.

First, dashboards show your total Estimated Retirement Income (ERI), across all your different pensions.

But then, the ERICA habit turns your ERI into something bigger.

A regular adequacy check – simple, personal, repeatable and universal.

Not a new tool, but a new habit.

The adequacy of UK society’s retirement provision is debated at length in policy circles, but knowing whether you’re likely to have enough money to meet your needs, throughout your later life, is an intensely personal issue.

Yet the adequacy, or inadequacy, of people’s own retirement provision, is almost entirely invisible to millions of UK consumers.

We need to build a bridge from the policy debate on pensions adequacy to personal awareness via the implementation of pensions dashboards.

The ERICA habit is that bridge, just as dashboards are launching and adequacy is being reviewed.

Two strands, same issue

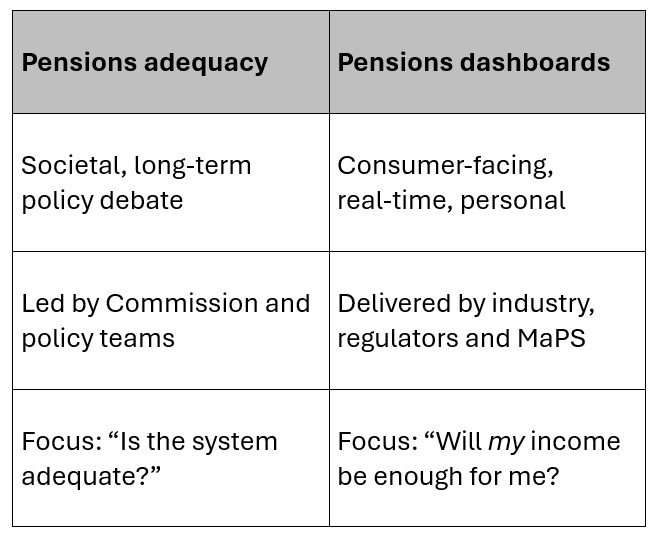

Pensions Adequacy (PA) is a complex, societal-level policy debate, taking place during the second half of the 2020s. It is the focus of The Pensions Commission.

Minister for Pensions, Torsten Bell MP, said in July 2025: “The new Pensions Commission has one task: to map out a path to a pensions system that is truly adequate, in the broadest sense of that word.”

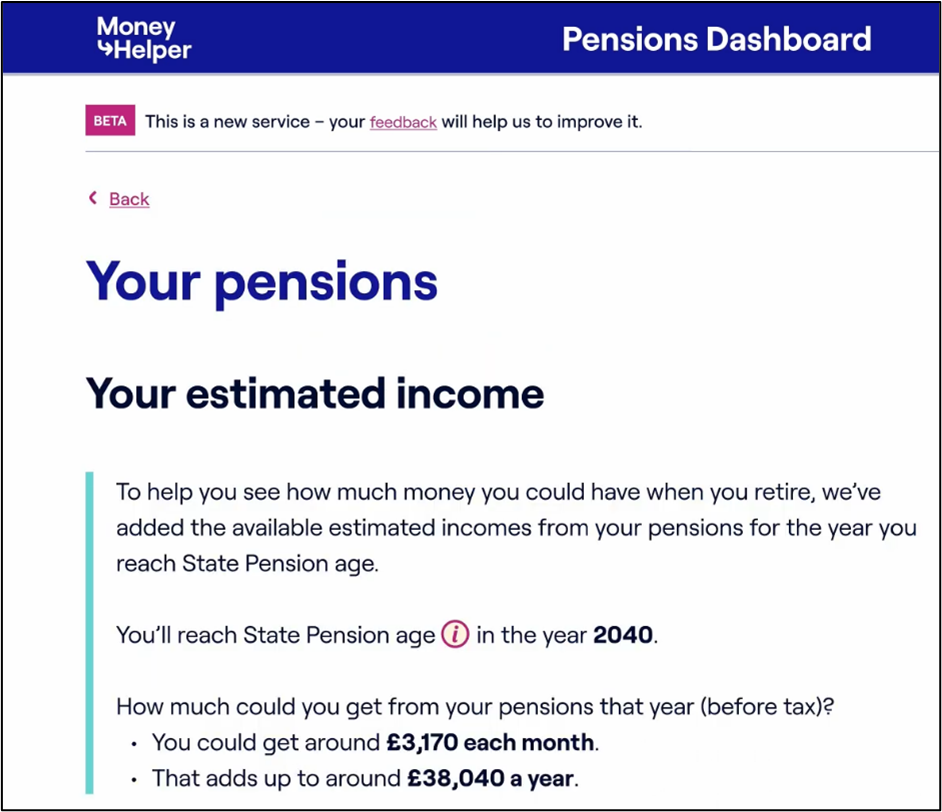

Pensions Dashboards (PD) is a complex, industry and government collaborative technological delivery programme. The MoneyHelper Pensions Dashboard (MHPD), operated by the government’s Money & Pensions Service (MaPS)*, enables users to securely view all their UK pensions together on their phones.

* and later, maybe, Private Sector Dashboards (PSDs)

Crucially, dashboards lead with the consumer’s total Estimated Retirement Income (ERI), i.e. the rough total amount of regular income (shown as both monthly and yearly amounts) that the user might be able to receive during their retirement from their State Pension age.

PA is treated as a societal issue, but PD shows that PA is in fact personal. It’s the same issue, just at societal- versus consumer-level.

ERICA connects these two worlds.

But why isn’t this connection happening already?

Separate teams

Across government, regulators and industry, PA and PD are being looked at by different teams of people:

- policy officials, statisticians and spokespeople are debating adequacy, whilst

- technologists, administrators and compliance teams are delivering dashboards.

Because of this separation of focus, the words “adequacy” and “dashboards” almost never appear in the same paragraph.

One rare exception was an August 2025 blog by TPR’s Patrick Coyne in which he said:

“pensions dashboards … highlight the

adequacy gap that many are facing”.

Patrick has made the key connection that, as well as being a societal-level issue, pensions adequacy is also highly personal to every UK working age adult.

Policy assesses adequacy with proxies – replacement rates, median pot sizes, distributional modelling – none of which map cleanly to individual adequacy.

Individual adequacy forces a view on “enough”, which, in turn, exposes system-level failure of UK pensions.

Is it any wonder no one wants to own that?!

Millions of consumers, however, need us to.

Adequacy is personal

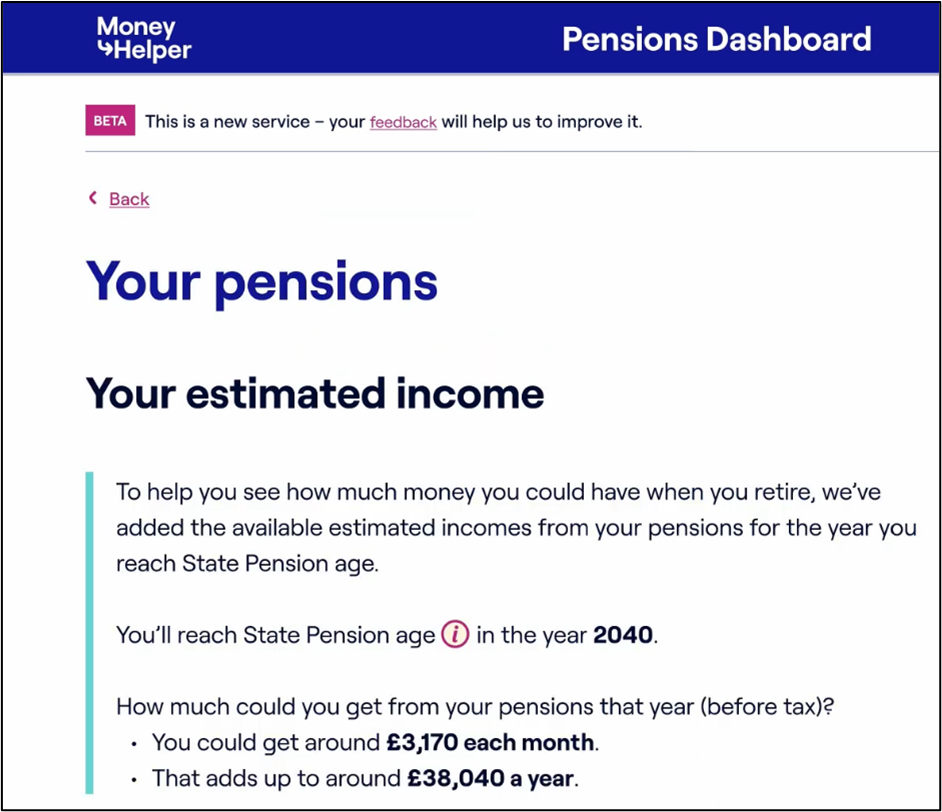

The first thing that consumers using the MHPD see is their total ERI. For most users, it’s the first time they will have ever seen this number.

Here’s an example (illustrative only – not final):

In this example, the user’s monthly income in retirement, from 2040 onwards, could be around £3,170 a month (before tax), until the user dies – whether it goes up once in payment is not shown.

On seeing that number, many users will ask:

“Is it enough?” **, or a fuller version of that question …

“Is £3,170 a month (before tax) adequate for my needs?”

** Scottish Widows has shown that consumers find three, straightforward, consistent questions really helpful for making sense of their pensions:

1. What have I got? 2. Is it enough? 3. What can I do?

Everybody’s financial needs in retirement are different, sometimes very different. So the answer to the key question “Is it enough?” is highly personal.

But people need an answer, even a rough & ready one. ERI is just a number; it doesn’t give users any context.

This is the gap that ERICA needs to fill, turning a raw income forecast into a personal adequacy check.

A nationwide concept

ERICA needs to be a nationally recognised, simple, standard concept, which consumers get.

The thing everybody knows you do to check if your MHPD ERI is enough to meet your needs in retirement.

It needs to be as ubiquitous as MOT tests for vehicles.

The MOT is actually highly analogous to ERICA.

Three core MOT checks

Why does the symbol for MOT testing have 3 triangles?

Today, MOT tests check over 20 different components of a vehicle’s controls.

But when MOT testing was first introduced, in 1960, it was extremely basic (just as ERICA needs to be initially).

Only three controls on vehicles were checked, represented by the three triangles in the MOT symbol.

The three tests checked that the driver could control:

- Visibility – do the lights work?, i.e. can you see ahead? (and also be seen)

BLANK - Direction – does the steering work? i.e. are you in control of where you want to go?

BLANK - Speed – do the brakes work? i.e. do you have control over how fast you get to your destination?

BLANK

These three simple checks on controlling visibility, direction and speed (VDS) – lights, steering, brakes on vehicles – are also analogous for ERICA.

Visibility, direction, speed

How do the three VDS concepts apply to ERICA?

Check 1. Visibility – “see where I’m going”

A consumer’s first key step is to use the MoneyHelper Pensions Dashboard (MHPD) to see their total Estimated Retirement Income (ERI) on the main summary page – for millions of consumers, it’s the MHPD which makes ERICA possible for the first time.

Check 2. Direction – “know where I want to go”

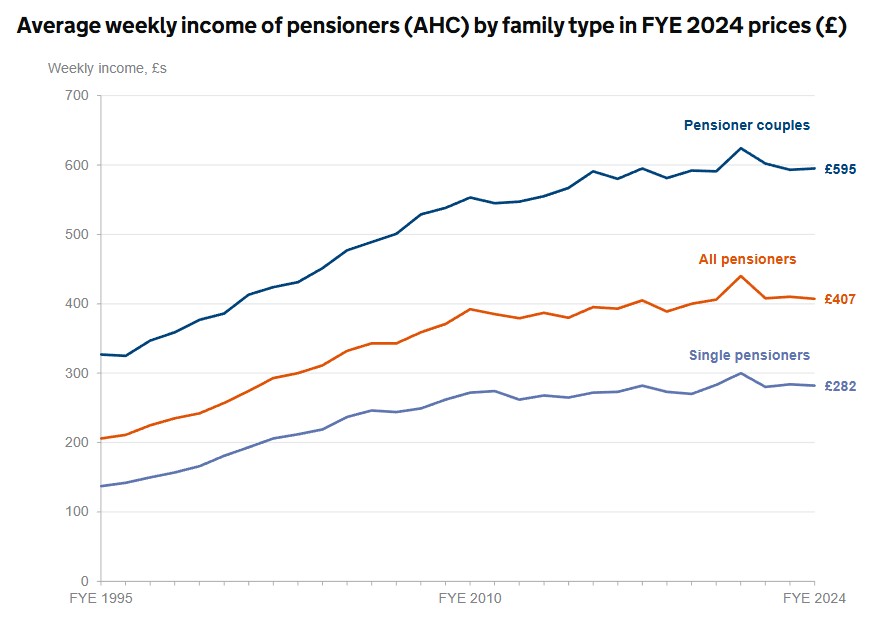

Next, apply context to your ERI. This is highly personal, but consumers could start with averages and / or benchmarks.

Accepting that everyone is different, a good average starting point might be to be shown the “total gross monthly income that average pensioners get today”:

After the deduction of direct taxes, and housing costs, the average income of all pensioners in 2024 was £407 a week, or £407 x 52 = £21,164 a year.

A net income of £21,164 a year (i.e. after tax) implies a gross pension (i.e. before tax) of £23,312 a year, or £1,943 a month.

Let’s call it roughly £2,000 a month (before tax).

So, a first yardstick for consumers could be “Is my total ERI (before tax) more or less than £2,000 a month?”

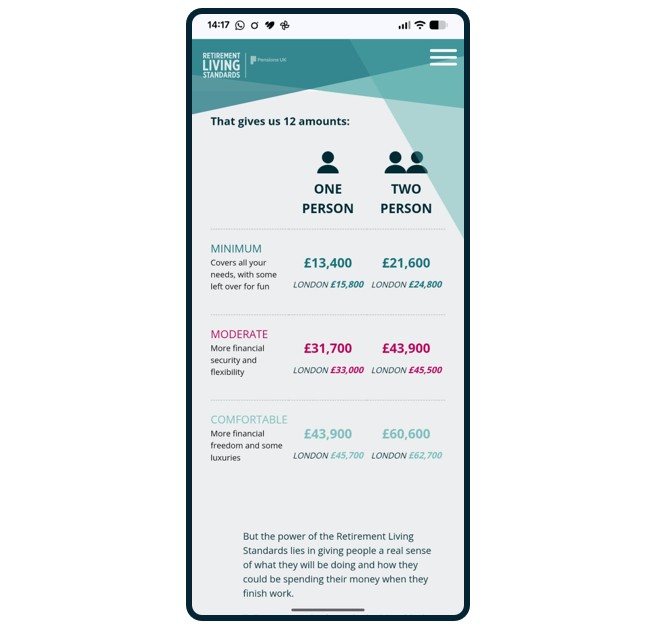

Then there are benchmarks, like the Retirement Living Standards developed by Pensions UK.

Or you could ask your banking app to categorise your current spending today, and compare that to your ERI.

There are many, many opportunities for consumers to personalise what gross monthly income they’re aiming for in retirement. There’ll be lots more to say about the Direction check once ERICA is established as a concept.

Check 3. Speed – “control how fast I’ll get there”

If my total ERI a month (before tax) on the MHPD is less than what I’m aiming for, can I make changes to get me nearer to achieving the retirement income I want?

Options include things like increasing contributions, planning to retire later, seeing your other assets (like ISAs) alongside, etc.

ERICA needs to explain the pathways for making such changes very simply, and industry needs to make them as low friction as possible for consumers.

Again, there’ll be lots more to say about this as we move ever closer to the public launch of the MHPD.

Why we need ERICA now

The thinking above hopefully shows how the ERICA concept is the interpretive layer which makes the MHPD meaningful for consumers.

Much of the focus to date on pensions dashboards has been about connecting data, sometimes referred to as the “plumbing”. ERICA moves dashboards on from plumbing to purpose.

Everyone can talk about, and use, ERICA – becoming as ubiquitous as “MOT”.

In Q1 2026, the MHPD is live for private beta testing by real consumers, continuing through to Summer / Autumn 2026. After six month’s notice (promised by Ministers), the public launch of the MHPD could be some time in H1 2027.

We also have mandatory Guided Retirement (GR), currently in the Pension Schemes Bill, coming on stream from 2027 onwards, shifting the UK from separate pot‑size thinking to career-level retirement income‑based planning.

As we approach the MHPD public launch, and GR, the industry and those helping consumers need a simple, consistent approach for talking to consumers about their own individual pensions adequacy.

Without a standard, nationally recognised concept like ERICA, consumer confusion is highly likely.

ERICA provides this standard approach at exactly the moment it’s needed. ERICA gives consumers an income adequacy anchor just as MHPD and GR are coming on stream from 2027 onwards.

But we must keep things simple for consumers, at least initially.

ERICA is not a detailed financial plan, but a simple adequacy check: helpful for millions.

And of course, aggregated up, across hundreds of varied consumers, ERICA also provides highly useful inputs to the societal-level policy debate on adequacy.

In short, ERICA gives consumers confidence, policymakers coherence, and dashboards purpose.

Next steps (Q1 2026)

MHPD is already giving consumers a clear view of their ERI (in private beta testing currently, and growing).

ERICA turns that number into something people can understand, talk about, and act on.

Over the coming months, the focus is on making ERICA a shared language across the sector.

Priorities for Q1 2026

- Socialise and iterate the ERICA concept with policymakers, regulators, providers, consumer groups and other interested stakeholders

BLANK - Build consensus that a regular adequacy check should become a new consumer norm [Support for this type of concept started to build already on 27 January with the Social Market Foundation’s publication of its new research report recommending MaPS offer a pensions dashboard health check]

BLANK - Refine the adequacy messaging so that it works for both consumer and policy audiences

BLANK - Test the VDS (Visibility-Direction-Speed) framing with some real consumers

BLANK - Develop simple, repeatable ERICA prompts which could sit naturally within dashboard and wider consumer pension journeys.

We have a pensions adequacy problem in the UK, but no one owns it.

Ownership sits where pensions policy intersects with the consumer touchpoint.

Right now, that intersection doesn’t exist, but it’s coming, and soon.

ERICA is at that intersection, designed to be simple, memorable and universal.

The next phase is about refining the thinking and looking towards adoption.

RS 19.2.26