15 December 2022 – Review of 22 blog

In his now customary (third) pre-Christmas end of year review blog, PDP Principal Chris Curry reflects on the enormous progress made towards pensions dashboards during 2022.

In 2023, the first data providers will be connected, and the first dashboards will (probably) be authorised by the FCA. Then large scale testing, refinement, and DAP! (which you may understand as the Dashboards Available Point, but I also think for all of us in pensions will be a tremendous moment of Dignity And Pride). Best wishes. See you on the 2023 page.

12 December 2022 – Regulations in force

Exactly three years after the 2019 General Election, the secondary legislation making pensions dashboards a reality comes into force (i.e. the Pensions Dashboards Regulations 2022 Statutory Instrument 1220).

This major milestone marks the end of an intensive five-year legislative process, including: a DWP Feasibility Study (announced Oct 2017), a Policy Consultation Document (Dec 2018), a DWP Command Paper (Apr 2019), a Pension Schemes Bill (first introduced to Parliament in Oct 2019 but then re-introduced in Jan 2020 after the General Election) which received Royal Assent to become primary legislation as the Pension Schemes Act 2021 in Feb 2021.

DWP also publishes guidance for schemes wishing to defer connecting to the ecosystem.

8 December 2022 – Webinar golddust

PDP host three webinars on dashboards standards, which are good fun to watch, but the absolute golddust is in the written Q&As made available afterwards:

- Data, Reporting & Technical:

Webinar replay, Written Q&As - Connection & Governance:

Webinar replay, Written Q&As - Design & FCA Consultations:

Webinar replay, Written Q&As

5 December 2022 – 6 months to prepare applications

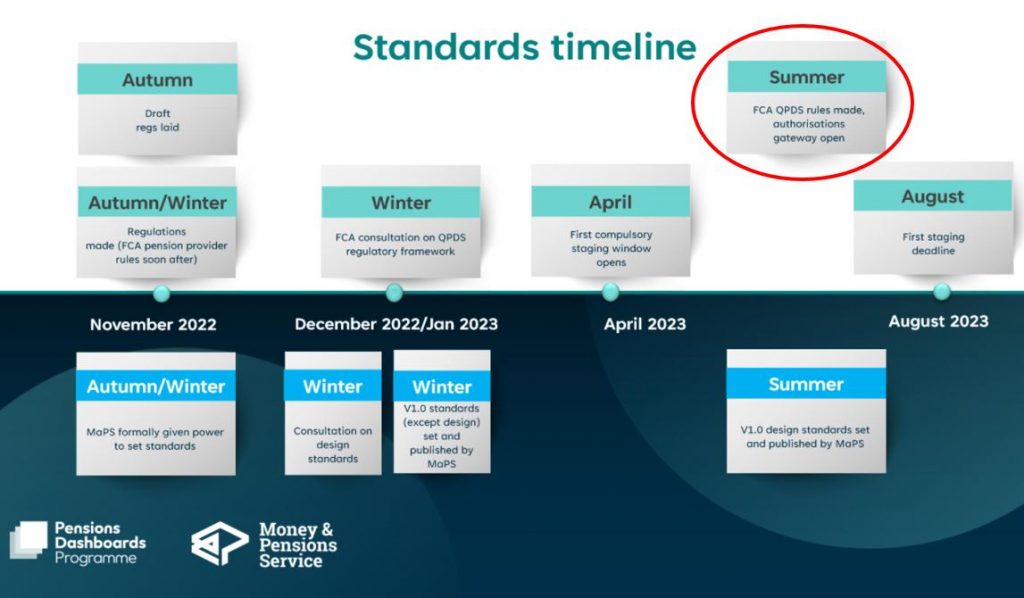

In a PDP webinar, it’s confirmed that applications to FCA for authorisation of Pensions Dashboard Service (PDS) firms will be accepted from Summer 2023. So, nascent dashboard providers wishing to be first to market have six months to prepare their FCA applications.

2 December 2022 – Impact blog

In an incredibly insightful blog article, the ABI’s Rob Yuille analyses DWP’s Pensions Dashboards Impact Assessment (IA) (published with the dashboards regulations), including a “juicy clue” on the point at which dashboards might be made publicly available: the Dashboards Available Point (or DAP) – a concept first devised by PDP in their April 2020 paper (para 47, p13).

1 December 2022 – PDS firm consultations

Two consultations on dashboards are launched:

- FCA: proposing rules on how Pensions Dashboard Service (PDS) firms must behave (press release, consultation page, consultation document), and

- PDP: proposing standards for how PDS firms must display pension information (press release, consultation page, consultation document)

24 November 2022 – TPR consultation launched

A press release from The Pensions Regulator (TPR) announces the launch of a 3-month consultation on how they propose to ensure schemes’ compliance with the dashboards duties, i.e. connecting to PDP’s Central Digital Architecture (CDA), receiving digital Find Requests and undertaking matching using their chosen match criteria, and, for found pensions, digitally returning prescribed pension information to users for them to view on their chosen dashboard.

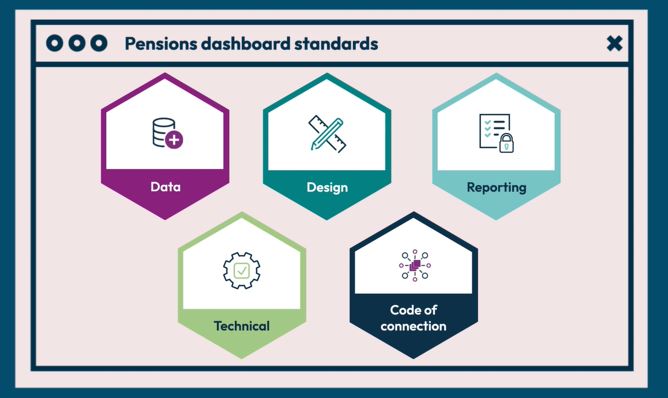

21 November 2022 – PDP standards published

In a press release, PDP announces the publication of its post-consultation standards, the first four with a handy list of changes included in the 21 November 2022 update:

- Data standards

- Technical standards

- Reporting standards

- Code of connection, incorporating Security, Service and Operational standards

- Early connection guidance, and

- Approach to governance of standards.

A summary of consultation responses is also available.

Explanatory webinars are on Monday 5 December (Data, reporting & technical) and Wednesday 7 December (Code of connection, early connection & governance). A further webinar on the upcoming Design standards consultation is on Thursday 8 December.

15 November 2022 – Regulations approved

Both Houses of Parliament approve the Pensions Dashboards Regulations 2022 (SI 1220) which were published in draft on 17 October (and subsequently made on 21 November 2022 and coming into force on 12 December 2022). The Commons Committee discussion lasted just 15 minutes (watch the video), whereas the Lords Chamber debate lasted over 100 minutes (see the full Hansard transcript – it’s a really important read).

10 November 2022 – Matching podcast

On a Hymans Robertson podcast, ITM’s Maurice Titley explains the findings from the large scale PensionFusion data matching research (see 8 September 2022 entry below).

8 November 2022 – ACA letter to new Minister

In published extracts from a letter to the new Pensions Minister Laura Trott, ACA Chair (LCP’s Steven Taylor) says the ACA questions whether proceeding too quickly with dashboards could be counter-productive and risk damaging the initiative. “We are worried that the complexities in delivering dashboards are currently being underestimated … now would be a good opportunity for the new Minister to pause and reflect on whether there should be further easements to the timetable that might better ensure strong outcomes are delivered”.

1 November 2022 – FCA consultation response

Following the 17 October DWP final regulations (requiring trust-based and public service pension schemes to connect to the dashboards ecosystem and make their data searchable), the FCA publishes its equivalent final COBS rules applying to contract-based pension schemes.

27 October 2022 – Lost and unaware research

The Pensions Policy Institute (PPI) publishes a 2022 Briefing Note update to their 2018 research on lost pensions. Over those 4 years, PPI estimates the number of lost pensions has increased by 73% from 1.62m to 2.80m with the value of those lost pensions increasing by 37% from £19.4bn to £26.6bn. On pensions dashboards, the PPI Briefing Note 134 says:

“There is industry consensus that pensions dashboards will have a positive impact by reuniting many savers with their lost pots, although with an administrative burden for providers caused by a surge in engagement. Some respondents expressed concern that dashboards would not have a lasting impact unless there was a sustained campaign.”

On the same day, new Scottish Widows research, reported in Pensions Age, finds: “nearly half of people have no idea how many pensions they have”. Dashboards will help here too!

26 October 2022 – PDP Progress Report

The Pensions Dashboards Programme (PDP) publishes its 6th six-monthly Progress Update Report alongside an accompanying webinar on 3 November with the Questions & Answers list published afterwards.

17 October 2022 – PDP connection blog

PDP publishes a blog article explaining that early data providers will be able to connect to the dashboards ecosystem from early 2023.

17 October 2022 – DWP Regulations, Mini consultation response and Deferral guidance

DWP publishes three things:

- Press release announcing that final draft affirmative dashboards regulations have been laid before Parliament, which will now be debated in, and hopefully approved by, Parliament

- Response to the mini consultation providing for 6 months’ notice of the DAP, with engagement on DAP criteria to come

- Guidance for schemes wishing to defer their connection to the ecosystem.

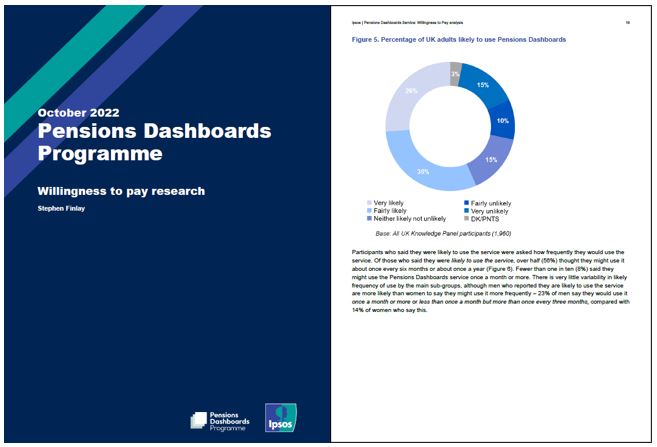

12 October 2022 – PDP “benefits” research

PDP publishes Willingness to pay research findings from Ipsos. Of course, users won’t pay to use dashboards, but asking nearly 2,000 people how much they would be willing to pay helps put a £ value on the benefits of pensions dashboards, which will help with the Impact Assessment accompanying the final dashboards Regulations from DWP due out soon.

7 October 2022 – FRC response and ABI hub

Very important FRC news release on the revised basis for DC pension projections, including a Feedback Statement and Impact Analysis, accompanying Technical Analysis, the new AS TM1 5.0 itself with AS TM 1 5.0 Guidance, and an explanatory podcast. ABI also launch a new hub on pensions dashboards for their members, introduced in an Evey Tang blog.

6 October 2022 – PDP myth busting

Two things from PDP’s Chris Curry:

- First of a series of Pensions Age guest articles, debunking dashboards myths, and

- A Bravura webinar (part of their series of five Pensions Dashboards Week webinars), in which Chris was joined by TPR’s Angela Bell, again debunking myths in a series of quickfire questions.

3 October 2022 – New Minister’s support

At a Conservative Party Conference fringe meeting, new Pensions Minister Alex Burghart pays tribute to the work done by his predecessor “to get pensions dashboards to the point where we’re now within touching distance” – watch from 14:30:

30 September 2022 – WPC Report

In the key conclusions of their Saving for later life report, the Work and Pensions Committee welcomes “the work being done to support savers, e.g. the development dashboards”.

21 September 2022 – TPR podcast

TPR publishes a 27-minute podcast (recorded in August) with PDP Principal Chris Curry and TPR Executive Director David Fairs making very clear what pension schemes need to be doing right now to prepare for pensions dashboards.

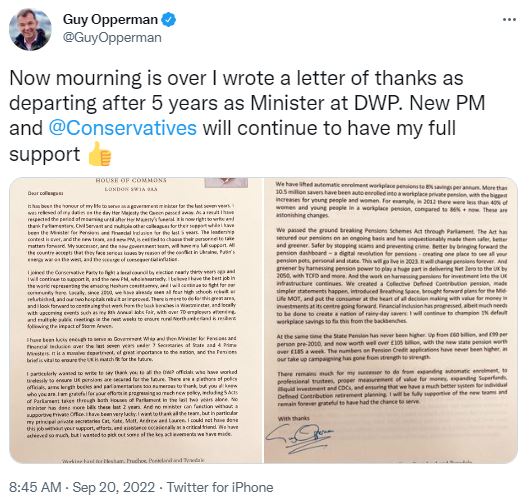

20 September 2022 – Ministerial change

Guy Opperman MP, the Pensions Minister, who has driven the legislative aspects of dashboards for the last five years, announces he was relieved of his Ministerial duties on 8 Sep. No replacement yet announced officially.

A quick trawl of this blog shows the following key steps Guy took on dashboards:

- 19 October 2017 – Following the prototype dashboard project and associated report, Guy announces at the PLSA Annual Conference 2017 that DWP will conduct a feasibility study

- 3 December 2018 – Publishes a report on DWP’s feasibility study and a consultation on next steps

- 4 April 2019 – Responds to dashboards consultation confirming legislative compulsion will be introduced mandating pension schemes to make their data digitally available for dashboards

- 7 January 2020 – Introduces Pension Schemes Bill 2019-20 to Parliament including the dashboards legislative provisions

- 11 February 2021 – Achieves Royal Assent of Pension Schemes Act 2021

- 31 January 2022 – Consults on draft secondary legislation for pensions dashboards

- 14 July 2022 – Responds in detail on the secondary legislation consultation

15 September 2022 – Phoenix Insights research

Phoenix Insights’ Great Expectations research report, produced with Frontier Economics, finds that 6 million people don’t know what retirement income they’re expecting, and 12 million aren’t on track to achieve the retirement income they expect. The report says pensions dashboards will help people keep track of their total accumulated pensions, especially those in those in their 40s and 50s who may have accumulated multiple pensions and therefore find it harder to keep a sense of their overall future prospects.

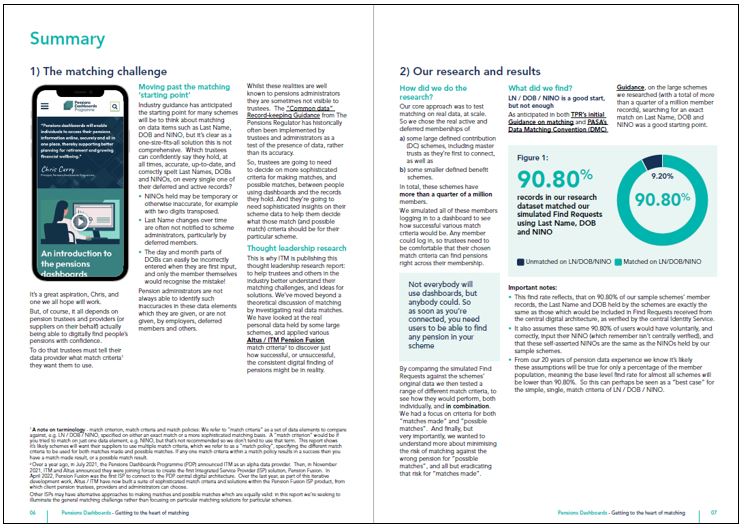

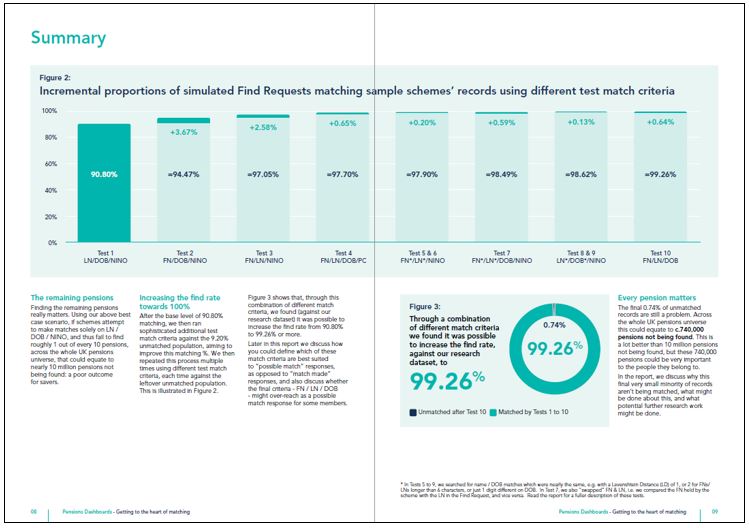

8 September 2022 – Matching research

Pension Fusion ISP supplier ITM/Altus publishes a detailed thought leadership research report on personal data matching for dashboards.

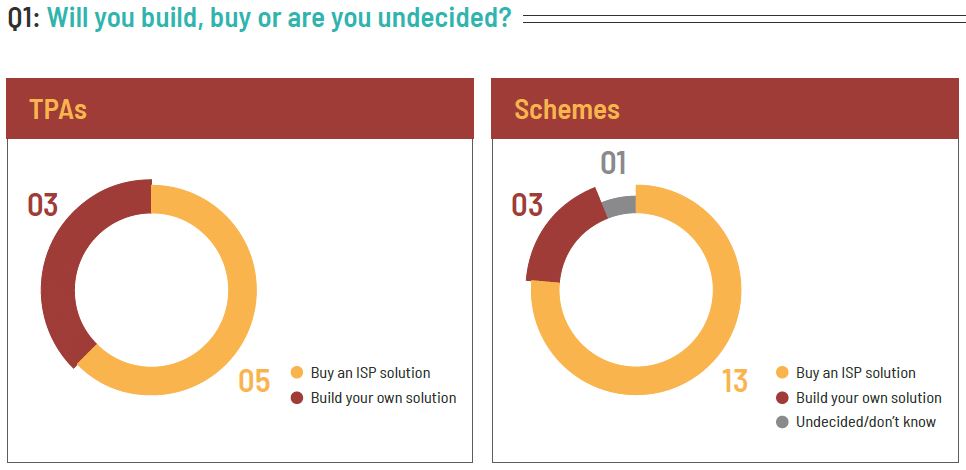

1 September 2022 – Bravura whitepaper

ISP provider Bravura/Delta publishes a research whitepaper on the dashboards readiness of pension administrators and schemes.

30 August 2022 – PDP Standards Consultation closes

As PDP’s consultation ends, some responses are put in the public domain:

- Pensions Administration Standards Association (PASA) response, focusing on the end-to-end impact of dashboards

- Pensions and Lifetime Saving Association (PLSA) response, repeating again the criticality of extensive user testing before standards are settled

- Society of Pension Professionals (SPP) response, saying “until [the proposed standards] are tried out using real data, it is not possible to say for certain whether they are the best solution”

- The Investing and Saving Alliance (TISA) response, suggesting if would be helpful, given dashboards span several bodies (DWP/FCA/FRC/PDP/TPR), if the proposals reflected this and provided a more holistic picture.

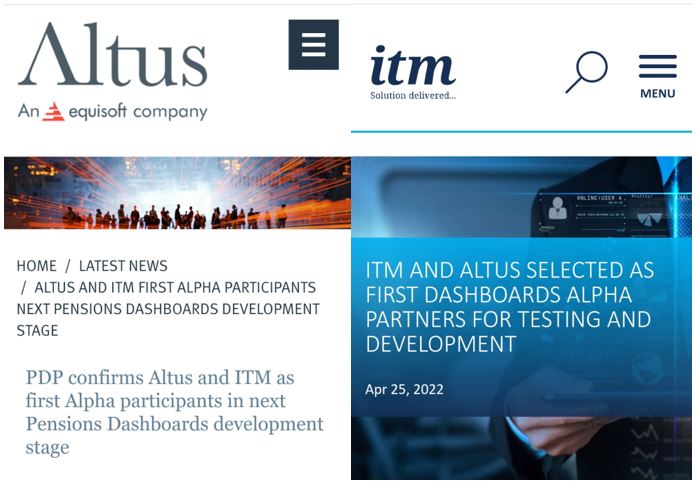

23 August (and 27 September) 2022 – ITM/Altus alpha video

PDP alpha data provider ITM/Altus share some alpha experiences with Chris Curry in a Part 1 PDP video, with the Part 2 PDP video published on 27 September.

23 August 2022 – Updated PASA DMC Guidance

PASA publishes an update to the December 2021 Data Matching Convention (DMC) Guidance:

1 August 2022 – Altus blog

Altus Managing Director Kevin Okell publishes one of the first blog articles to explain some of the challenges pension providers and administrators will have connecting to the central digital architecture of the pensions dashboards ecosystem.

1 August 2022 – PASA Values Guidance

The Pensions Administration Standards Association (PASA) issues its next piece of dashboards Guidance – an early checklist of the steps schemes should taking to prepare for returning pension values for display on pensions dashboards.

28 July 2022 – TPR webinar

Lucy and Angela from The Pensions Regulator host a high production value dashboards webinar with Paul from PDP and Joe from DWP. Well worth a watch.

21 July 2022 – Standards webinars

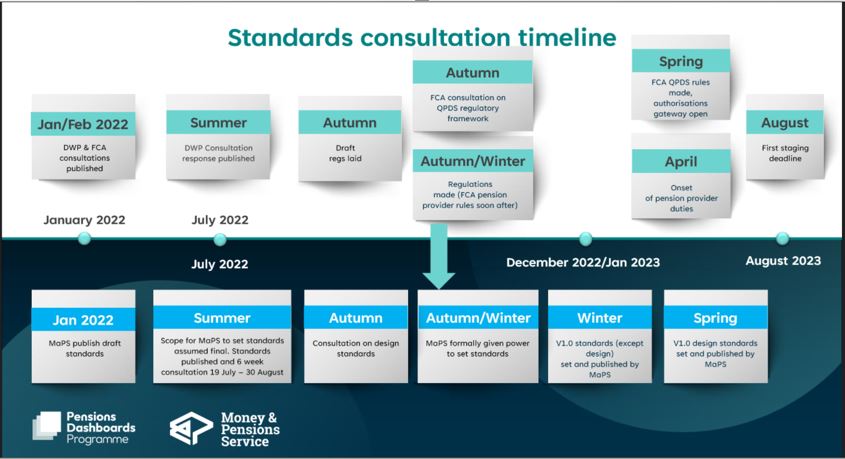

PDP Principal Chris Curry and Director Richard James host a general webinar explaining the 19 July Standards consultation (including a handy forward look timeline right through to the summer of 2023), followed up by two subsequent specific PDP webinars on the connection standards, and the data, design & reporting standards.

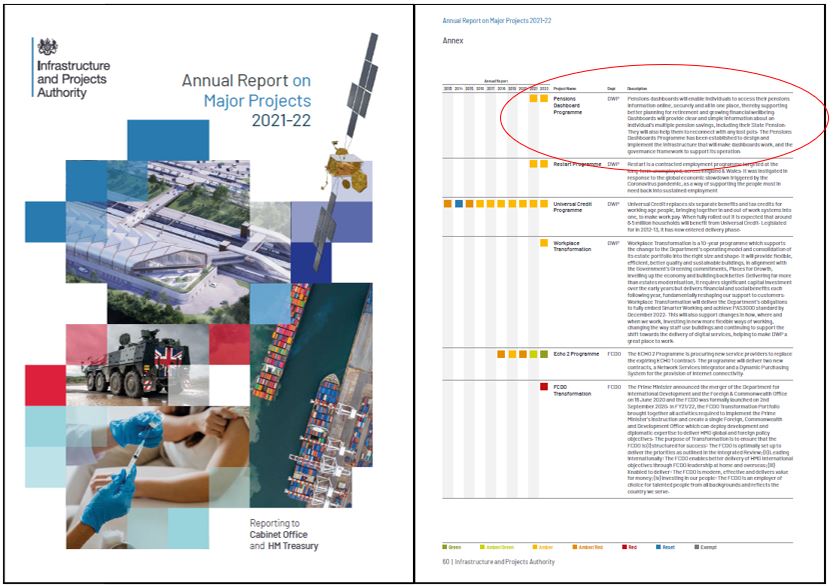

20 July 2022 – Status remains Amber

The joint Cabinet Office / HM Treasury Infrastructure and Projects Authority (IPA) publishes its 2021/22 Annual Report on the 235 Major Projects right across Government. PDP appears for the second year, remaining at status Amber. Remember, though, this is now a year out of date as it was the result of the IPA Review of PDP in July 2021, as described in PDP’s October 2021 Progress Update Report.

19 July 2022 – PDP Standards consultations

PDP launches major 6-week consultation on Data, Reporting, Technical and Connection Standards and a Call for Input on Design Standards. Closing date is Tuesday 30 August.

18 July 2022 – DAP consultation closing tomorrow

With DWP’s further consultation on the Dashboards Available Point (DAP) closing tomorrow, various organisations are putting their responses in the public domain:

- Association of Consulting Actuaries (ACA) response, calling for 9 months’ notice or 6 if a strong indication of the DAP is given 12 months in advance and a staggered launch to avoid a big bang.

- Pensions Administration Standards Association (PASA) response, setting out how, rather than being considered in isolation, dashboards are part of a much wider interconnected pension system, requiring a greater strategic plan to ensure all parts of industry can work successfully together to plan the live launch of dashboards. This should include: indicative DAP now with regular updates, soft launch, and at least 6 months’ notice before a full, promoted, DAP.

- Pensions and Lifetime Savings Association (PLSA) response, saying a 6 month formal notice period within a 12 month planning timeline is required to ensure schemes can prepare and test systems ahead of a full dashboards launch, and threshold criteria on coverage, matching and understanding.

- Sackers response, strongly supporting PLSA’s threshold criteria.

- Society of Pension Professionals (SPP) response, calling for 12 months’ indicative notice of the DAP, 6 months’ definitive notice, with incremental DAPs before a full, promoted, DAP.

- Which? response, outlining the Consumers’ Association’s belief that the Government should publicly outline its expectations for when dashboards should be launched to consumers at the earliest opportunity.

15 July 2022 – PDP Standards trailer

PDP trails its consultation on dashboards standards coming the following Tuesday. The consultation will run for six weeks to the day after the August Bank Holiday weekend, including three webinars. Standards and guidance being consulted on include: Data, Technical, Reporting, Early connection and Code of Connection (covering Security, Service, Testing and Operational Standards). There will also be a Call for Input on Design Standards.

14 July 2022 – DWP consultation response

DWP publishes its detailed response to the consultation on draft dashboards regulations from January, as well as a really helpful Summary of key policies, including changes made since the consultation in January.

12 July 2022 – Heywood alpha video

PDP Principal Chris Curry chats with Heywood’s Chris Connelly in a 3 minute 45 second video about Heywood’s alpha experience. Heywood also publish a detailed blog update on their Integrated Service Provider (ISP) solution to connect schemes to the dashboards ecosystem.

7 July 2022 – Dashboards must, and will, happen

The seemingly forever challenged dashboards initiative suffers an inevitable delay as the Pensions Minister Guy Opperman MP resigns, just one hour before the Prime Minister.

But on the same day, TISA/EY publish a research report finding again what we all know: “people want dashboards”, and PDP posts a guest blog from Moneyhub showing they’re happening.

Dashboards really must, and will, happen. As the Minister said at his final Work and Pensions Committee appearance the previous day, in the mid-2020s when dashboards are up and running, “many of the problems we’re discussing today will be solved in a massive way”.

4 July 2022 – Data, matching & expectations

PASA launches Guidance for schemes on how to improve personal data accuracy; ITM announces research into matching criteria (for schemes whose personal data isn’t accurate), and Money Marketing publishes an extended article on dashboards balancing expectations with the challenges ahead.

30 June 2022 – Another ISP

In a press release, Origo announce their intention to launch an Integrated Service Provider (ISP) product in September. The other five ISPs announced so far are Altus/ITM, Bravura, Civica, Heywood and Procentia.

28 June 2022 – DAP consultation

DWP launches s a further 3-week consultation on the draft dashboards regulations, on the Dashboards Available Point (DAP) and on information sharing between MaPS and TPR.

23 June 2022 – Busy day on dashboards!

Various announcements today:

- A press release from Moneyhub confirms they are the first commercial dashboard to connect to the “front end” of the central digital architecture (CDA)

- A press release from Heywood confirms they have connected their Integrated Service Provider (ISP) solution to the “back end” of the CDA

- A research report from TPR finds only half (53%) of administrators questioned agreed they would be able to deal with the administrative demands placed on them by dashboards

- Following a Corporate Adviser (CA) roundtable, CA publishes two detailed articles, on provider readiness and customer primacy, plus a 16-page supplement

- The Spring 2022 report from the ABI / PLSA Small Pots Co-Ordination Group says reusing elements of the dashboards initiative (such as standards for personal data matching) will be key to resolving the huge & growing problem of small defined contribution (DC) pension pots.

22 June 2022 – TPR guidance and ABI blog

The Pensions Regulator (TPR) publishes guidance for pension trustees to help them prepare for connecting their schemes to the pensions dashboards ecosystem. Meanwhile, ABI’s Evey Tang posts an excellent blog article on the multiverse of DC pension projections.

21 June 2022 – ABI policy report

In its major 10-year policy recommendations report, What will the next decade bring?, the ABI says industry should “continue to champion dashboards including tools that help customers to understand their retirement planning”.

13 June 2022 – TPR Corporate Plan

The Pensions Regulator (TPR) publishes its two-year Corporate Plan (2022-2024), including launching “a programme of education, highlighting the steps schemes need to take to meet their dashboard duties, including what data to prepare”.

12 June 2022 – Ministerial profile

A major Sunday Times Money profile of the, now longest-serving, Pensions Minister, describes dashboards as “the most noticeable of the big changes to our pensions system”.

7 June 2022 – TPR / FCA consumer journey

In their feedback statement on their joint Call for Input on the pensions consumer journey, TPR and FCA say dashboards “could enhance consumers’ ability and willingness to engage with their pensions at various stages of the consumer journey”.

6 June 2022 – When will dashboards launch?

In a short video LinkedIn post, PDP Principal Chris Curry says that dashboards will be made available to the public only once “it’s safe and secure for people to use the service”.

3 June 2022 – Projection challenges

In an FT Opinion piece, LCP’s Steve Webb describes some of the challenges with the FRC’s proposals for standardising defined contribution (DC) pension projections.

1 June 2022 – PDP / Heywood webinar

PDP host a webinar with Heywood Pension Technologies, with the recording and slides available on the PDP website, and a follow up summary blog published on 30 June.

27 May 2022 – Multiple benefits

In a Pensions Expert comment piece, Buck’s Wayne Gibson argues that dashboards could have multiple benefits for the pensions industry.

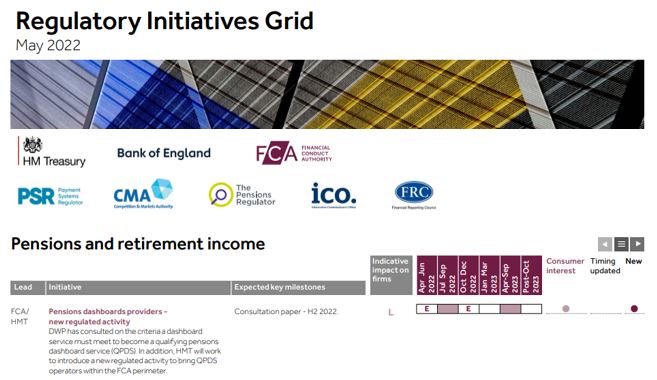

25 May 2022 – FCA regulatory grid

In the latest update to its Regulatory Initiatives Grid, FCA confirms it intends to consult on dashboards rules in Q4 2022, with the milestone of finalised rules for Qualifying Pensions Dashboard Services (QPDS) falling sometime in the six months from Apr to Sep 2023.

24 May 2022 – Elizabeth Line lessons

In a blog article, which also appeared in Professional Pensions, PLSA Director of Policy and Advocacy Nigel Peaple explains the difference between dashboards ‘connection’ and ‘launch’, emphasising the need for extensive testing in-between, and drawing upon key lessons from Crossrail.

19 May 2022 – How to become a dashboard

PDP and FCA host a webinar explaining what organisations need to do to become a dashboard provider, with the presentation slides also being made available afterwards, and a follow up summary blog published on 30 June.

16 May 2002 – Which dashboard will be best?

In a thought-provoking Money Marketing article, Michael Klimes quotes LCP Partner (and former-Pensions Minister) Steve Webb saying over the next two years it’s likely the public will be bombarded with advertisements, alongside much media coverage and speculation, about who has the best dashboard.

15 May 2002 – The PFS works!

PDP confirms in a LinkedIn post that they have successfully tested the central Pensions Finder Service (PFS) built by Origo.

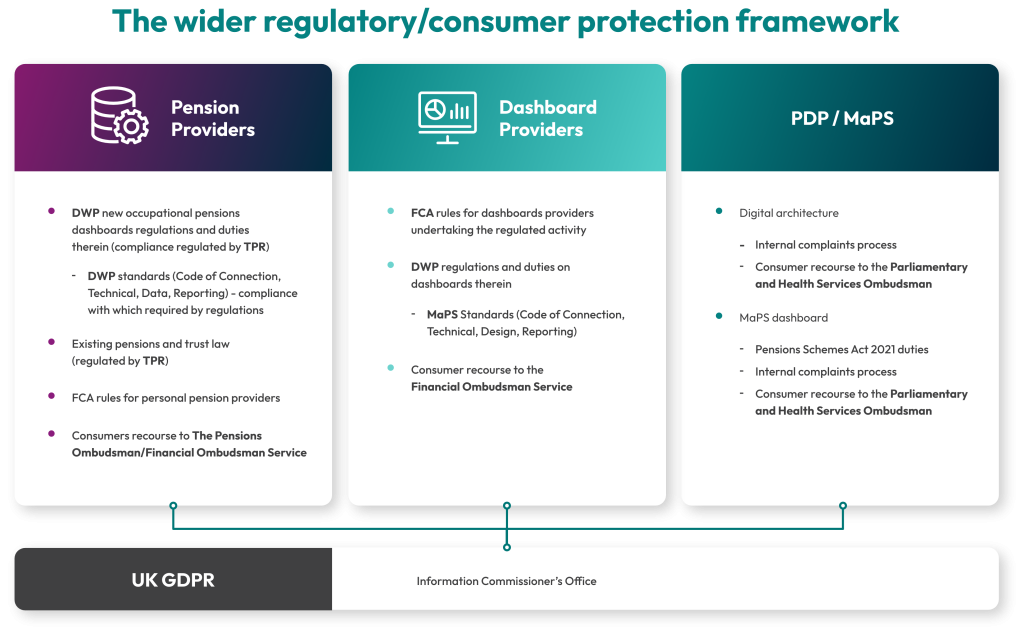

11 May 2022 – Consumer protection blog

PDP Head of Policy David Reid blogs about the consumer protection landscape for dashboards.

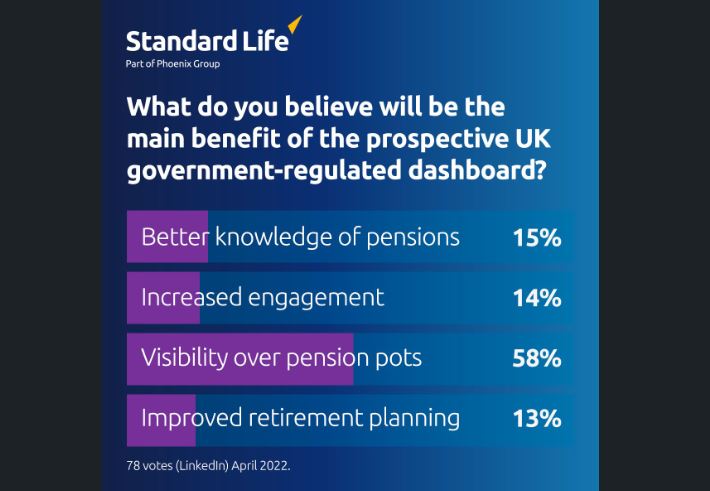

10 May 2022 – Standard Life survey and blog

Standard Life publish the results of their LinkedIn survey which found pensions visibility is expected to be the main benefit of pensions dashboards. Supporting this is Standard Life’s blog on lessons from Sweden and the roll out of the Swedish dashboard, MinPension.se.

9 May 2022 – Third ISP announces

Following Altus/ITM and Heywood, Procentia is the third organisation to announce an ISP service, called Smart ISP (or, for existing clients, Smart ISP+).

6 May 2022 – FRC consultation closes

The FRC consultation (on changes to the AS TM 1 basis for projecting DC pensions into the future) closes, although FRC subsequently extended the deadline to the end of May. Responses put in the public domain include:

- Association of Consulting Actuaries (ACA) response

- Pensions Administration Standards Association (PASA) response

- Pensions and Lifetime Savings Association (PLSA) response

- Society of Pension Professionals (SPP) response

Subsequently, on their website, FRC publishes 37 responses it received.

Several public media releases express concern about the FRC’s proposals, including from the ACA, Aegon, AJ Bell & LCP. On the core volatility proposal (consultation Question 3), of the 32 responses which expressed an opinion, roughly 13% were supportive, 40% had reservations, whilst 47% did not support the FRC’s proposal.

29 April 2022 – Chris Curry blog

PDP Principal Chris Curry blogs about progress on the programme, following up on the fifth six-monthly PDP Progress Update Report (Oct 21 – Apr 22) launched with a webinar with TPR earlier this week.

27 April 2022 – Government response to WPC

The House of Common Work and Pensions Committee (WPC) publishes the Government response to WPC’s report published on 18 January 2022 (scroll back to January for this).

Amongst other things the Government response stated that: “It is important to establish trust in dashboards as they are introduced. We have taken the position that they will start with a basic level of information, with the potential to include more detail or functionality as our understanding of consumer needs develop. We have been clear throughout that in order to develop a digital service that is safe, useful and relevant to consumers, future enhancements to dashboards functionality should not be decided before the initial offer has been tested with users and any behavioural effects are understood. This means that transactions will not be possible on the initial version of dashboards”.

27 April 2022 – Webinar heaven

At one point this morning, there were three online events running where you could hear about pensions dashboards:

- PDP ran a webinar with TPR promoting their 5th 6-month Progress Update Report

- Standard Life ran a webinar with Anders Lundström, CEO of minPension.se as part of their Thinking Forward joint research initiative with OECD

- The Work and Pensions Committee heard oral evidence from various leading pensions industry figures as part of their enquiry into Saving for later life.

A key lesson from Anders’ experience creating and operating the Swedish dashboard over the last 18 years is the early need to manage expectations. Expectation management was done rather well in Parliament by Will Sandbrook, Nest Insight’s Managing Director of Strategy & Analytics:

“We [Nest] are really supportive of the dashboards programme. Dashboards could be really powerful for people, but that power may not extend, for quite a lot of people, to actual changes in behaviour … Dashboards have the capacity to be enormously helpful for people in understanding where they stand … absolutely a necessary pre-condition for people to do more … but there have to also be safeguards in the system for those who don’t.”

25 April 2022 – Altus/ITM first to connect

Altus and ITM press releases confirm that their joint-ISP solution Pension Fusion has been chosen by PDP to be the first data provider to connect to the dashboards ecosystem.

13 April 2022 – Pre-Easter roundup

PLSA publishes a list of 30 FAQs with answers on the PLSA Pensions Dashboards Hub. The FAQs were raised by the audience at the PLSA Pensions Dashboards Webinar which included a demonstration of the potential Moneyhub alpha dashboard. The webinar and FAQs refer to the 2-page PLSA Pensions Dashboards Pension Scheme Checklist summarising the actions schemes must take to prepare for dashboards.

8 April 2022 – FCA consultation responses

The FCA consultation on new rules requiring contract-based pension providers to connect to the dashboards ecosystem closes. Responses put in the public domain include:

- Pensions Administration Standards Association (PASA) response

- Pensions and Lifetime Savings Association (PLSA) response

- The Investing and Saving Alliance (TISA) response

4 April 2022 – Programme Director blog

In a blog article, PDP Director Richard James looks back at his first year on the programme, highlighting the useful PLSA scheme checklist.

1 April 2022 – Alpha product offerings

With exactly one year to go until the start of staging, two of the ten alpha partners to PDP announce their potential product offerings:

- Altus | ITM in the data / Integrated Service Provider (ISP) space, and

- Moneyhub in the potential dashboard provider space.

Week ending Sunday 13 March 2022 – Final week of DWP consultation

As we enter the final week of the DWP’s six-week consultation on the draft dashboards regulations, various organisations are publishing their responses:

- ACA response – calling for another round of consultation on the draft regulations due to gaps and lack of clarity found in the initial draft regulations.

- APPT response – broadly supportive of many of the consultation proposals.

- ICO response, i.e. from the Information Commissioner’s Office focusing on data protection.

- LCP response – making four main points: that dashboards shouldn’t be inhibited from providing value add services (such as modelling); the risk of a consolidation ‘dash for cash’; the dangers of a ‘big bang’ dashboards launch (see PASA’s response below); and the urgency of the development of an ISP market.

- LGA response – saying that LGPS funds should connect from April 2025 rather than April 2024.

- PASA response – highlighting the importance of the liability model and the need for multiple, incremental launches of dashboards at multiple Dashboards Available Points (or DAPs).

- PLSA response – setting out, amongst other things, the three key tests which must be passed before dashboards are launched.

- Sackers response – highlighting the ambitious timeline, DB complexities and liability.

- SPP response – flagging liability, design standards and compliance enforcement as some of the key issues.

- TISA response – calling for greater alignment between dashboards and the provision of guidance and advice.

21 February 2022 – Intellica audit solution

Pensions data specialists Intellica announce their PyxisPD data audit solution to help schemes audit their dashboards data readiness.

14 February 2022 – FRC consultation

The Financial Reporting Council (FRC) publishes a consultation on a revised basis for calculating projected future defined contribution pension incomes which will appear on dashboards.

11 February 2022 – FCA consultation

In parallel with the 31 January DWP consultation (which covers trust-based and public service pension schemes), the FCA launches a consultation covering contract-based pension providers.

7 February 2022 – Digidentity contract

A PDP press release announces the appointment of Digidentity as the programme’s interim identity service provider.

4 February 2022 – Capita/Intellica service

Working in parnership with Intellica, Capita announce their new service to analyse pension schemes’ data readiness to meet the new dashboards legal requirements on schemes.

3 February 2022 – Programme Director and ABI blogs

In a blog article, PDP Director Richard James describes how PDP will work with:

- the four dashboard providers Aviva, Bud, MoneyHelper and Moneyhub,

- the central digital architecture supplier Capgemini, with Origo, and the interim digital identity provider, and

- the seven data providers Aviva, Capita, Heywood, ITM/Altus, Legal & General, Mercer and Phoenix Group

to build the alpha pensions dashboards ecosystem in just a few (i.e. five) months’ time.

Meanwhile, ABI’s Evey Tang wonders exactly what dashboards are in an excellent blog article.

31 January 2022 – DWP regulations and PDP outline standards

DWP launches a major consultation on draft regulations and PDP publishes five draft or outline standards documents to support the consultation (on data, design, reporting, technical and connection). DWP / PDP subsequently run four webinars to help explain the consultation: Webinar 1 Overview, Webinar 2 on Dashboards, Webinar 3 on Schemes and Webinar 4 on Pensions Values.

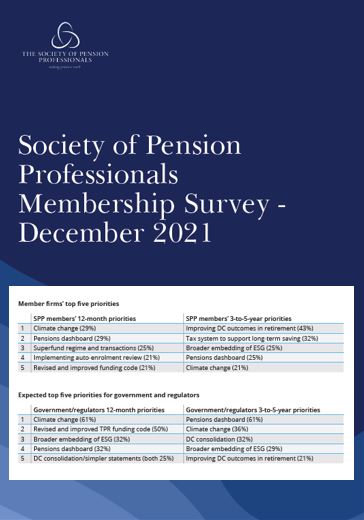

27 January 2022 – SPP Member Survey

The Society of Pension Professionals (SPP) publishes a short report on its regular survey of its members (carried out in December 2021).

The survey found that dashboards will be pensions professionals’ top priority in 2022, alongside climate change issues. They felt climate would also be Government’s and regulators’ top 2022 priority. So it was odd that they felt dashboards would only be Government’s priority number 4. Does this suggest industry feels it is taking dashboards more seriously than Government?

Some survey comments were:

“Dashboards are the game-changing pensions development. That said, the industry needs to be listened to … we will need a lot of energy to both argue our case and position the industry for any negative outcomes if the Government does not listen. There are serious technical challenges in delivering dashboards, and a proper partnership between government and industry is needed.”

25 January 2022 – Ipsos Mori research (Pt 2)

Building on their Part 1 report published in July 2021, PDP publishes the Ipsos Mori Part 2 research report, alongside a blog article from Rita Patel, and background materials.

19 January 2022 – ABI Research Reports

The ABI publishes two research reports:

- One, by BritainThinks, from consumers’ perspectives;

- The other, by ABI itself, from interviews with industry stakeholders.

The gap in expectations could not be clearer. For example: BritainThinks found “consumers expect the ‘basics’ [such as completeness of data] to be nailed”, but ABI found “data will only be returned once matching data is accurate and matching standards are reasonably designed”.

It’s clear that a major part of dashboards success will be managing savers’ expectations.

18 January 2022 – WPC Report

The Work and Pensions Committee (WPC) publishes a report on the pension freedoms, also looking at dashboards. The Committee believes the dashboards policy has the potential to be highly influential, as long as the implementation is resourced properly:

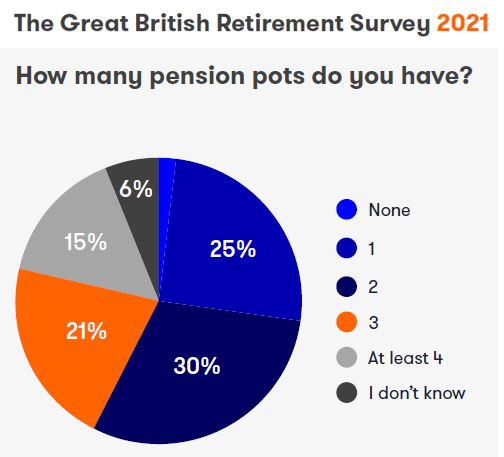

12 January 2022 – GB Retirement Survey

interactive investor (ii) publishes the Great British Retirement Survey 2021. In Spring 2021, 10,000 online respondents were asked how many pensions they have. Of the non-retired respondents, only a quarter said they have one pension; the rest said they have more than one, or don’t know. The ii report says that dashboards “cannot come soon enough”.

11 January 2022 – Dashboards blog

In a blog article, PDP Director Richard James explains how PDP will develop the market for dashboard providers during 2022.

10 January 2022 – Romantic in its simplicity

In a wonderful film-related blog article, LCP Consultant Ella Holloway describes the PASA DMC Guidance, including why good matches aren’t just made in West London bookshops!

10 January 2022 – Capita preparations

In a LinkedIn article, Capita Director of Pensions Policy Anish Rav outlines what they are doing to help their clients prepare for dashboards.

3 January 2022 – Early retirement complications

A Pensions expert article refers to a PMI survey about the upcoming changes to Normal Minimum Pension Age (NMPA). Surveying 2,000 individuals at the end of 2021, the PMI found that only 4% knew that the current NMPA is 55, let alone that it is increasing to 57. The extent to which dashboards need to make clear, and understandable, what the NMPA is for each pension needs to be thoroughly tested with savers during 2022.