Introduction

The Dutch pensions dashboard is Mijnpensioenoverzicht.nl (“My pension overview”).

On 22 June 2023, I had the absolute privilege of visiting the Mijnpensioenoverzicht team in The Hague at the end of my Pensions REDUX tour.

The core purpose of the tour was to learn more about mature pensions dashboards’ user experiences (UXs) and user interfaces (UIs).

So the main findings below focus on the high-level UX and UI before, whilst, and after using Mijnpensioenoverzicht.

The Dutch team were also very generous providing me with other insights, such as usage statistics, so I’ve included some of these findings below too.

Before reading on, for context please do have a look at the Background and 10 General Comments page.

After reading the findings below, feel free to get in touch with me if you’d like to talk about dashboards, discuss the findings, and what they might mean for forthcoming pensions dashboards in the UK.

What’s on this page?

UX before using Mijnpensioenoverzicht

UX whilst using Mijnpensioenoverzicht

UX after using Mijnpensioenoverzicht

Usage of Mijnpensioenoverzicht

Other information about Mijnpensioenoverzicht

UX before using Mijnpensioenoverzicht

Mijnpensioenoverzicht is a well-known online service in the Netherlands, run by an independent body created jointly by the Dutch equivalents of the UK’s PLSA, ABI and DWP.

Originally launched in 2011, the current refreshed user interface (which went live in May 2021) is the result of extensive research & development to give Dutch citizens the best possible information about their total pension position. Mijnpensioenoverzicht is now seen as first point of call for Dutch pension information.

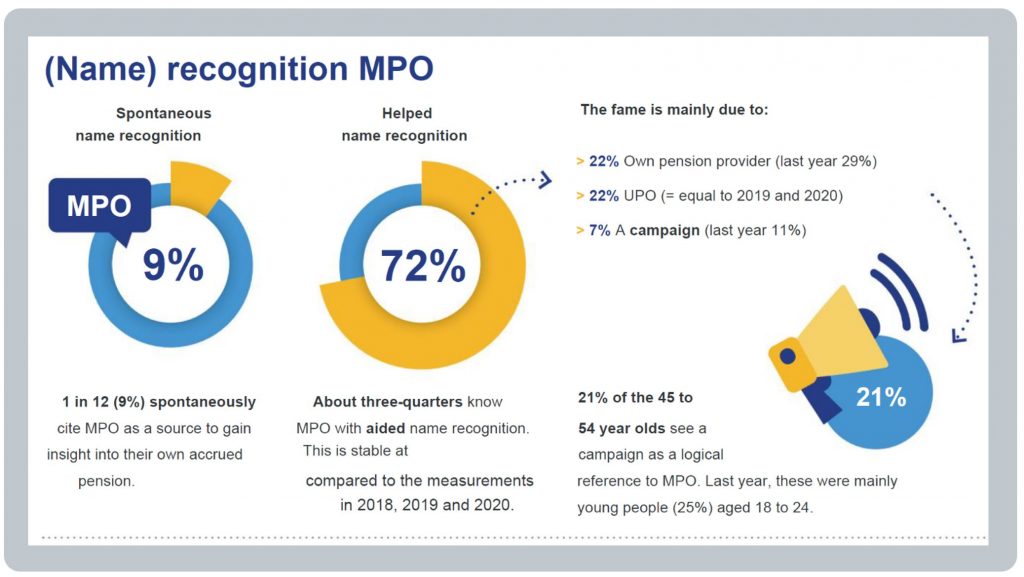

Brand awareness of Mijnpensioenoverzicht is high: in the 2021 annual awareness survey conducted by market research firm Motivaction, about three quarters (72%) of the c.1,500 research participants (aged 18 to 80) were aware of the service:

Awareness is created and maintained by pension providers and administrators, in particular via the communications they send out, such as annual statements (known as Uniform Pension Overview, or UPO) on which there is legal requirement to mention Mijnpensioenoverzicht.

Mijnpensioenoverzicht also runs online campaigns, for example through Google Ads, throughout the year.

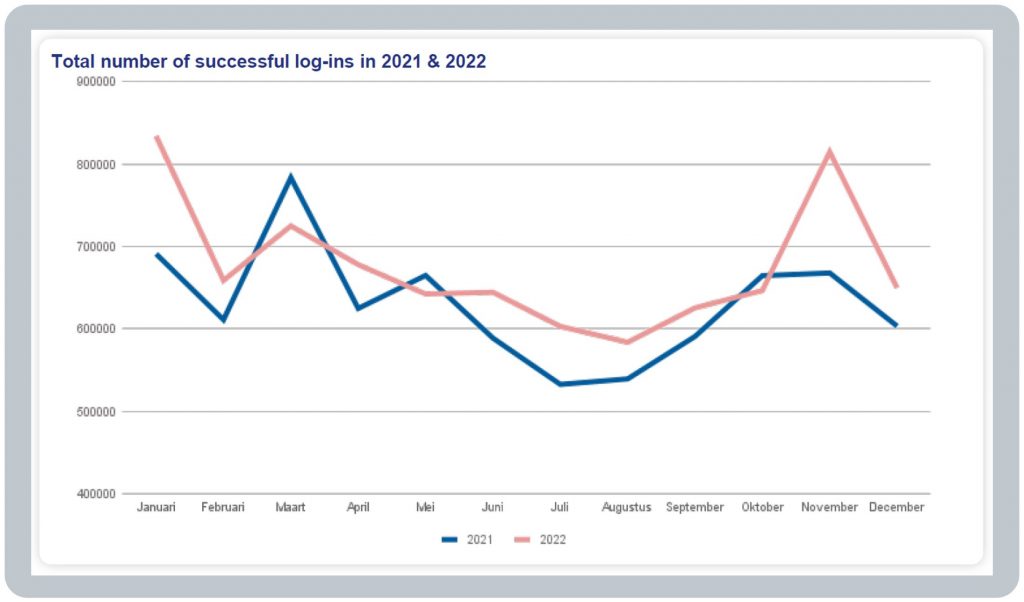

Also important is the annual Dutch nationwide pensions initiative known as Pension 3 Days, similar to the UK’s Pension Awareness Week, which promotes Mijnpensioenoverzicht.nl and creates a spike in usage of the service every November.

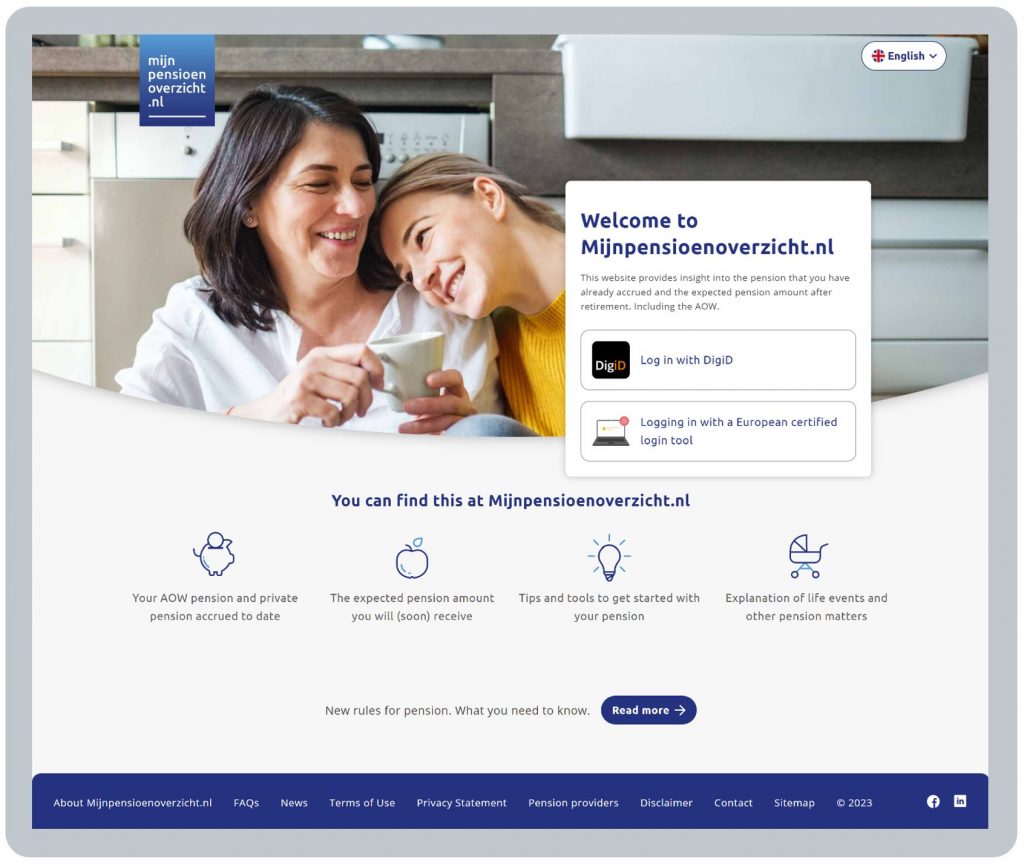

Arriving at the Mijnpensioenoverzicht.nl homepage, users can select to use the service in Dutch or English.

BLANK

What can you see before logging in?

Several design elements on the homepage combine to immediately starting growing users’ understanding, confidence and therefore trust in the service, and in pensions more generally:

- Name: the very name of the service (“My pension overview”) explains it is only an overview

- Imagery: homely imagery helps makes users feel comfortable and the service is relevant to them

- Simple function descriptions: really succinct descriptions how the service can help you, showing: your pensions accrued to date, and projected to retirement, tips to get started, and life event help

- About: a confidence-building explanatory video and other About details

- FAQs: an extensive list of Q&As

- Pension providers: an alphabetical list of participating pension providers’ contact details

- Contact: details for how to email or phone the Mijnpensioenoverzicht service desk with queries.

BLANK

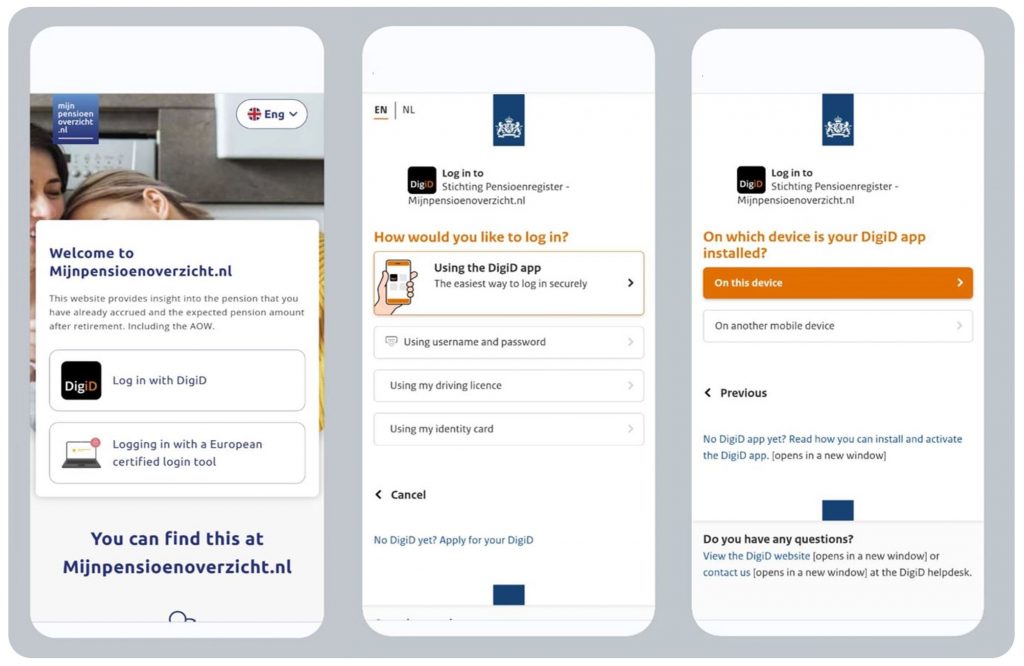

The homepage gives the user an option for which digital identity service to use to log in:

As explained in General Comment 5, there’s not much point covering Netherlands’ digital identity services in any detail here – they are what they are, and the UK’s identity service will be what it will be, i.e. there are no design choices to be made here by UK dashboard operators as they will all be required to use the same central identity service.

Matching Dutch citizens to their pensions

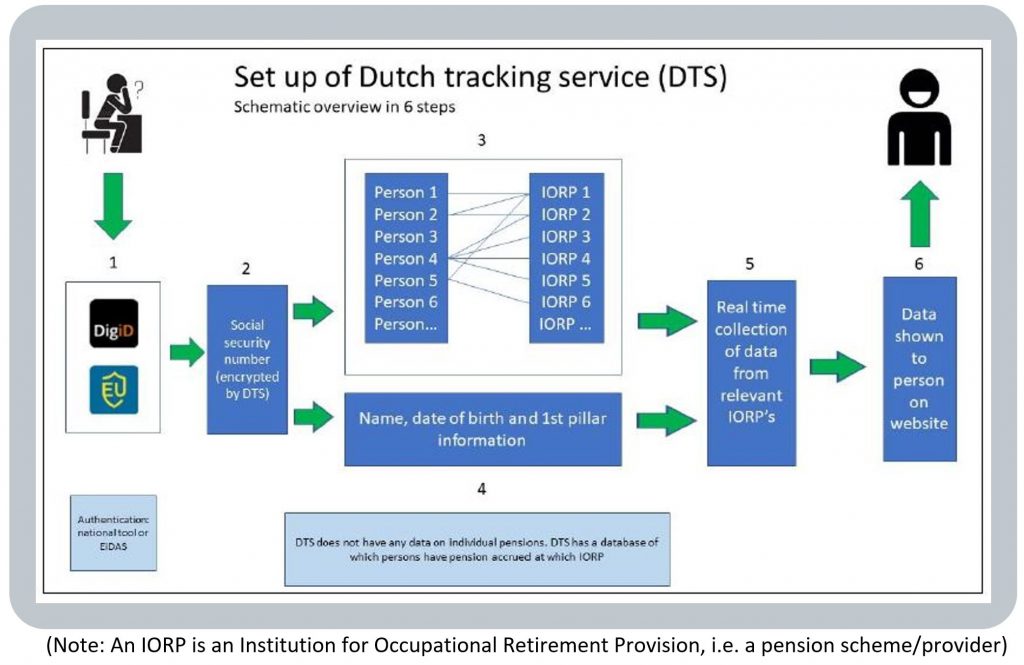

Mijnpensioenoverzicht uses a secure central database (box 3 in the process diagram below) which holds a record of the pension schemes and providers where each Dutch citizen has pensions.

A key element that supports this central database, used to link users to their pensions, is Dutch citizens’ Social Security Number (SSN). This is a highly reliable unique identifier which is used by the Netherlands’ 200 pension schemes and providers, between them holding roughly 18 million pension entitlements.

Pension schemes and providers update the central database (box 3) quarterly. It’s important to know, as the diagram says, that this database “does not have any data on individual pensions”, rather “it is a database of which persons have pension accrued at which IORP”.

This makes retrieving pensions information efficient, as the dashboard only has to reach out to a user’s known schemes and providers (as opposed to having to send personal details to all schemes and providers as will happen in the UK).

Of course, in the UK, we won’t have such a central database. See General Comment 6 for more details on the dashboards data matching challenge in the UK.

BLANK

UX whilst using Mijnpensioenoverzicht

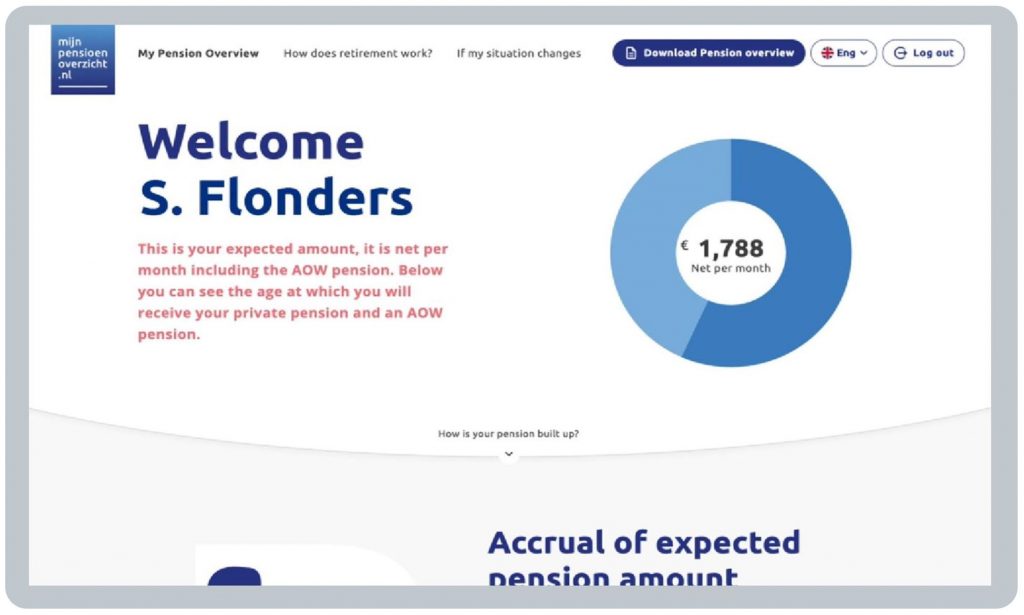

After logging in, the user sees this very clear and simple welcome page:

This initial page has been designed to be welcoming, and to immediately build understanding and confidence, by including:

- limited content, i.e. not flooding the user with content immediately

BLANK - welcoming the user by their name so they feel the system is both secure and relevant to them

BLANK - a single net MERIT figure, i.e. the monthly estimated retirement income total (MERIT) the user might receive, after tax, across all their different state (AOW) and workplace pensions. In S. Flonders’ example shown here, they might get €1,788 a month after tax – at current exchange rates that’s about £1,540 a month, or about £18,500 a year.

-

In the pie chart surrounding the net MERIT figure, the light and dark blue pie chart elements represent the proportions of the MERIT figure which are state and workplace pensions.

The key aim has been to show an easily understandable presentation of a net MERIT figure (which is the key piece of information about their total pensions most Dutch users most want to know).

BLANK

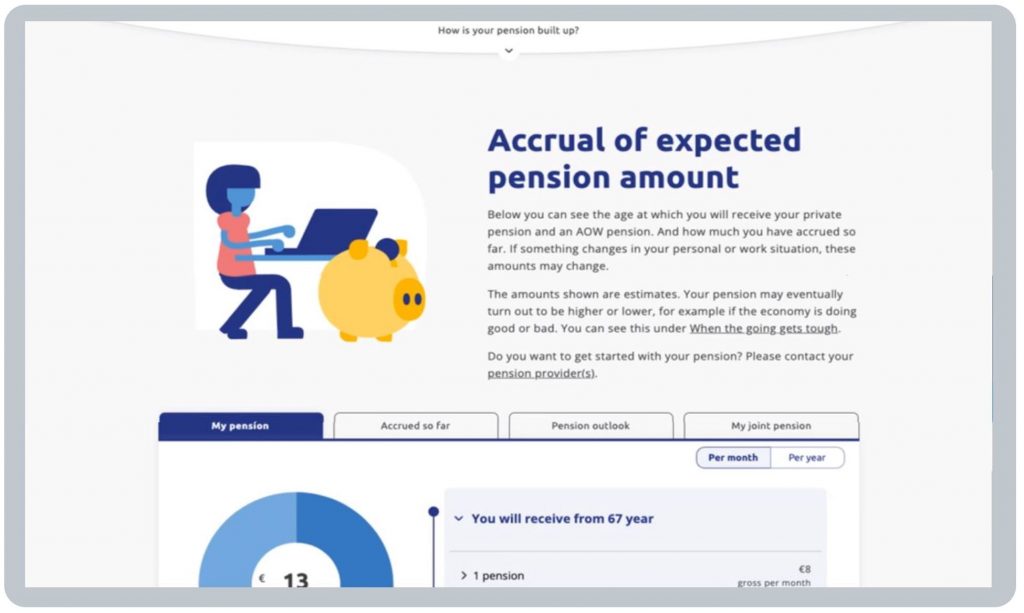

Scrolling down the landing page, a brief section of text clearly explains the figures shown are estimates:

Followed by the user’s different state and workplace pensions, payable from different ages:

- in list form (but not a graphical timeline, meaning users sometimes don’t notice payable dates)

BLANK - with a toggle option between showing future incomes as monthly or yearly amounts, and

BLANK - comparison against current earnings, to give a rough idea if that level of income will be enough.

BLANK

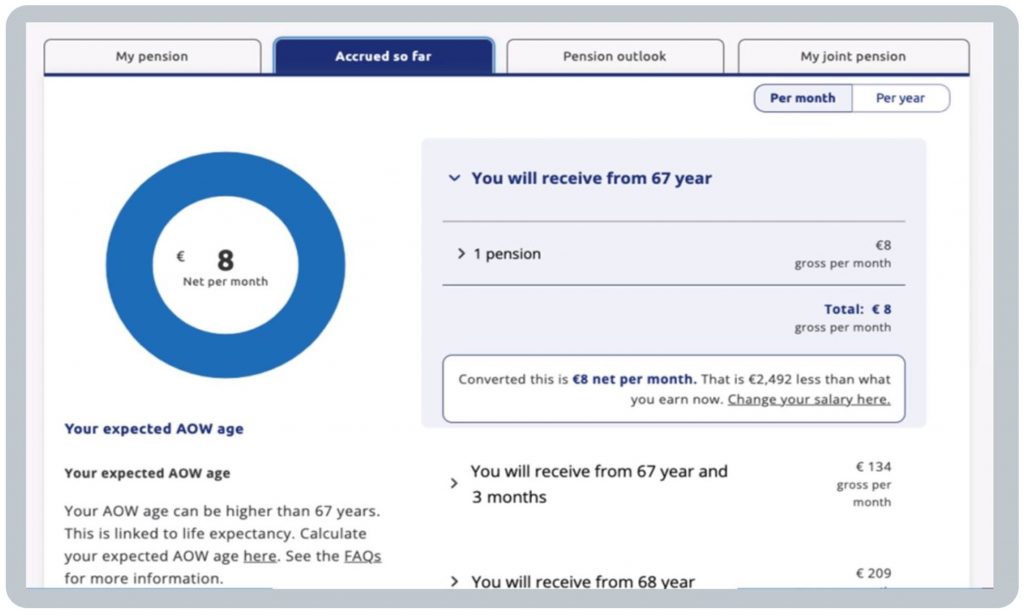

The “Accrued so far” tab shows pension incomes built up so far:

BLANK

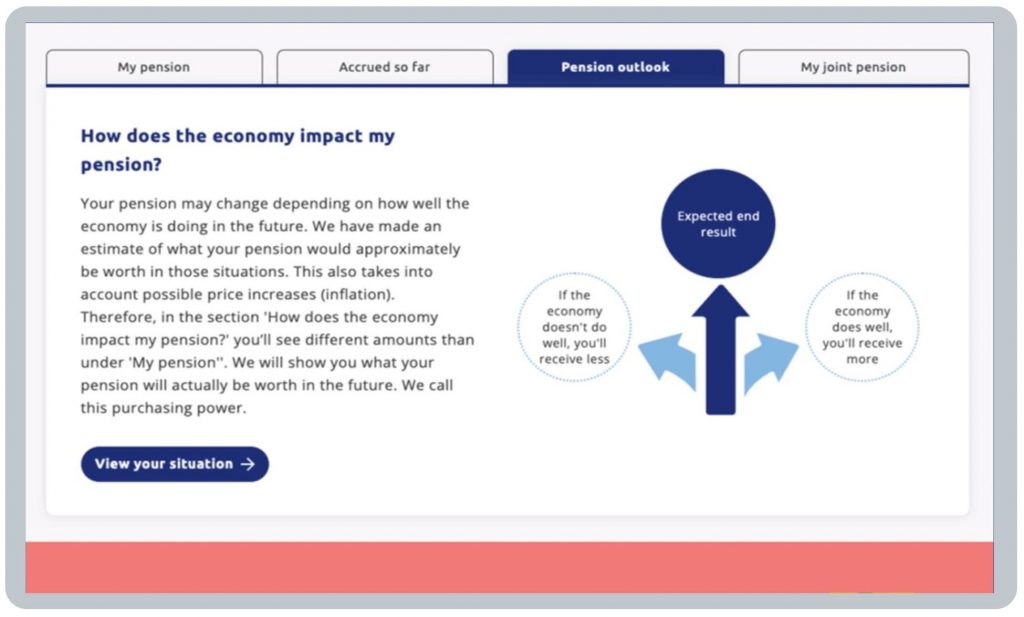

Then, for those users who are interested, the “Pension outlook” tab has a “How does the economy impact my pension?” section, explaining why the retirement income on “My pension” can only be an estimate based on assumptions, about things like price increases (inflation), which may turn out differently over time than currently assumed today:

BLANK

UX after using Mijnpensioenoverzicht

Many users’ core interest in their overall pension position can be boiled down to three simple questions:

- What have I got?

- Is it enough for me to live on in retirement?

- What can I do?

In the Netherlands, the core focus of Mijnpensioenoverzicht.nl is to help Dutch answer question 1. Users can see clearly what net total pension income they might get, across their different pensions.

BLANK

To help with the second question (“Is it enough?”), Mijnpensioenoverzicht displays the difference (in net Euros a month) between the user’s estimated net total month income and their monthly earnings today.

Thinking about adequacy of “household-wide” pension income, Mijnpensioenoverzicht also allows two spouses’ or partners’ to log in jointly so they can see their total household pension income.

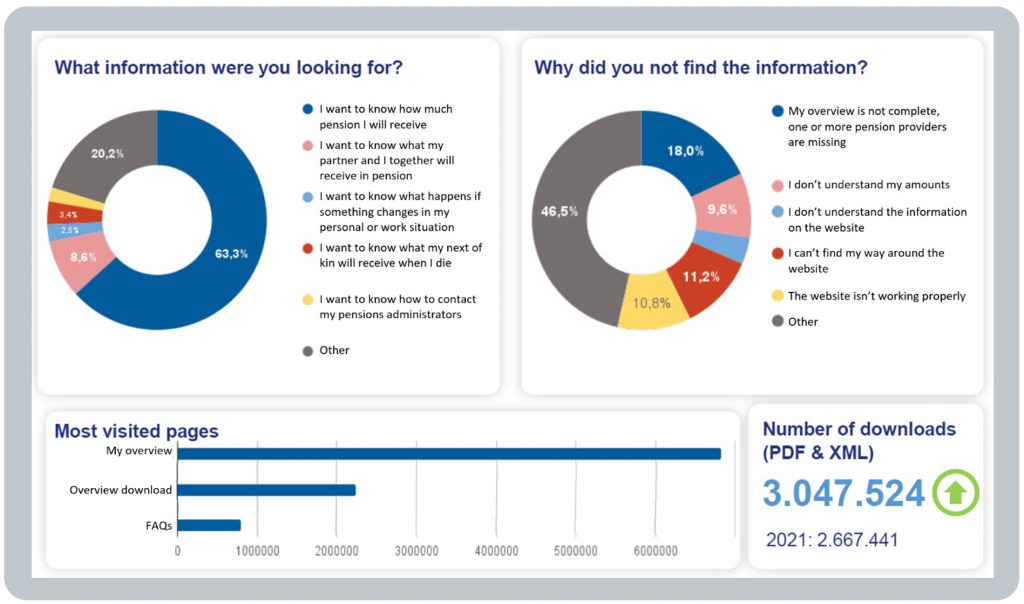

Mijnpensioenoverzicht.nl also allows users to download their pension overview information for future reference if they wish – many millions do this:

Downloads are also used as part of the evidence financial institutions require for other financial products, e.g. mortgage applications, so this is a major motivation for younger people to use Mijnpensioenoverzicht.

BLANK

In terms of the third question (“What can I do?”), Mijnpensioenoverzicht is focused on being impartial, so it lets users address this more subjective question themselves afterwards.

For example, after using Mijnpensioenoverzicht, Dutch citizens may take steps to:

- understand what pension income they may need in retirement

- learn more about pensions generally to give wider context

- speak with their pension providers, or an adviser, or others who can help

- take appropriate steps to improve their pension position if they wish.

BLANK

To get users started with this onward pensions learning and understanding, Mijnpensioenoverzicht.nl offers helpful content for users, for example:

- practical information and handy tips to learn more about how retirement works, and

- information on what might happen if their situation changes, such as marriage or disability.

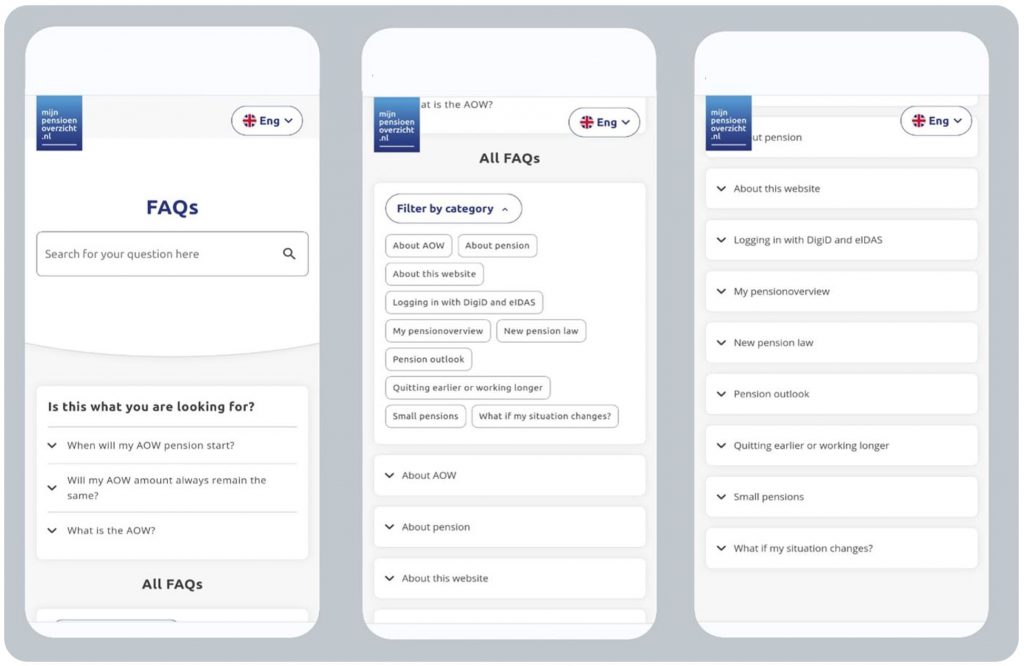

A user can also learn much by visiting the extensive FAQs section for which they don’t need to be logged in:

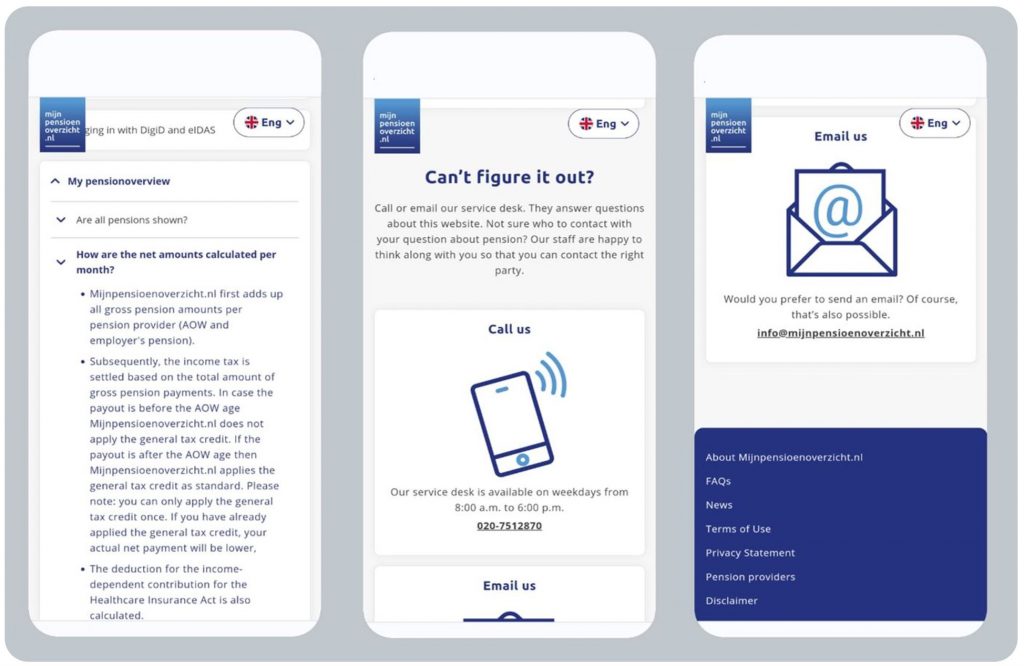

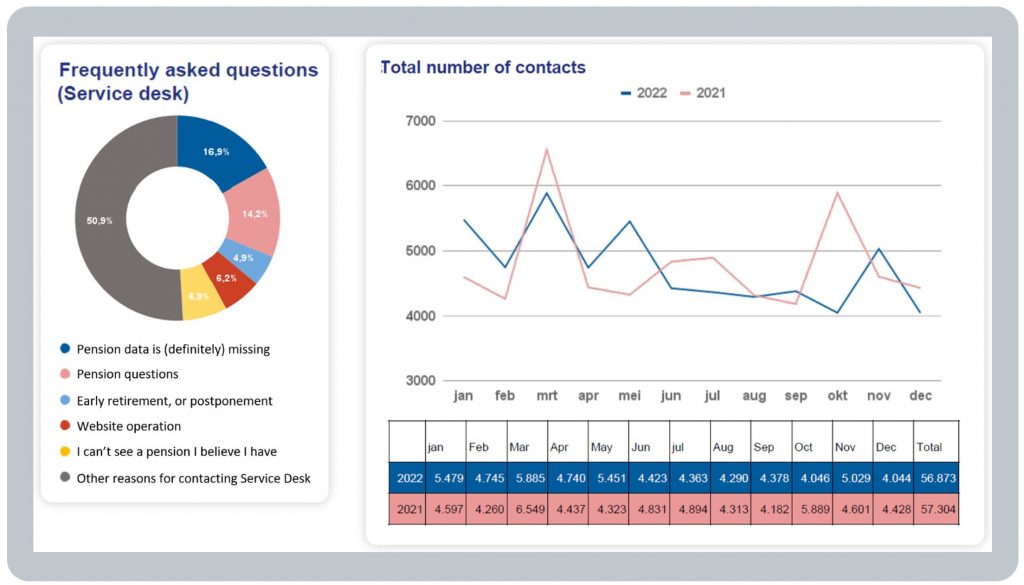

Or they can phone or email any questions to the Mijnpensioenoverzicht service desk, who may direct the user to contact their pension provider(s), or other parties, depending on the right place for their query:

BLANK

Taking action

As discussed in General Comment 7, the extent to which users actually make changes to their pension position after using Mijnpensioenoverzicht.nl is not explicitly visible to the Mijnpensioenoverzicht.nl team. This is because Mijnpensioenoverzicht deliberately focuses on offering an impartial “Find and View” service which primarily seeks to empower consumers, helping them to be better informed, so they are able to make better decisions.

BLANK

Usage of Mijnpensioenoverzicht

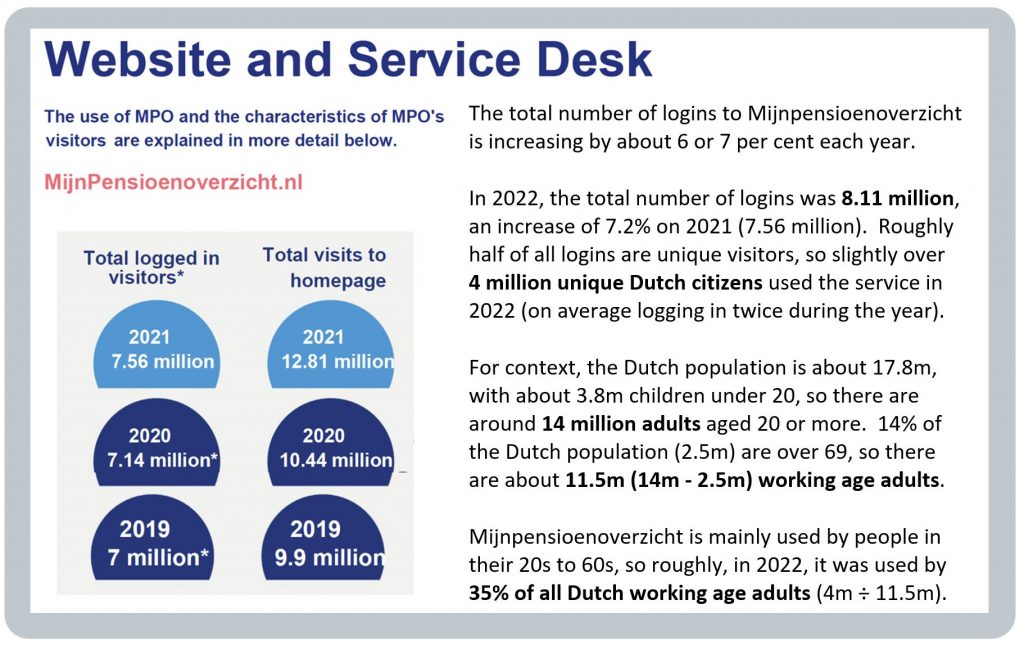

The Mijnpensioenoverzicht team publish Annual Reports on their website with very useful usage statistics:

BLANK

Some highlights are below:

BLANK

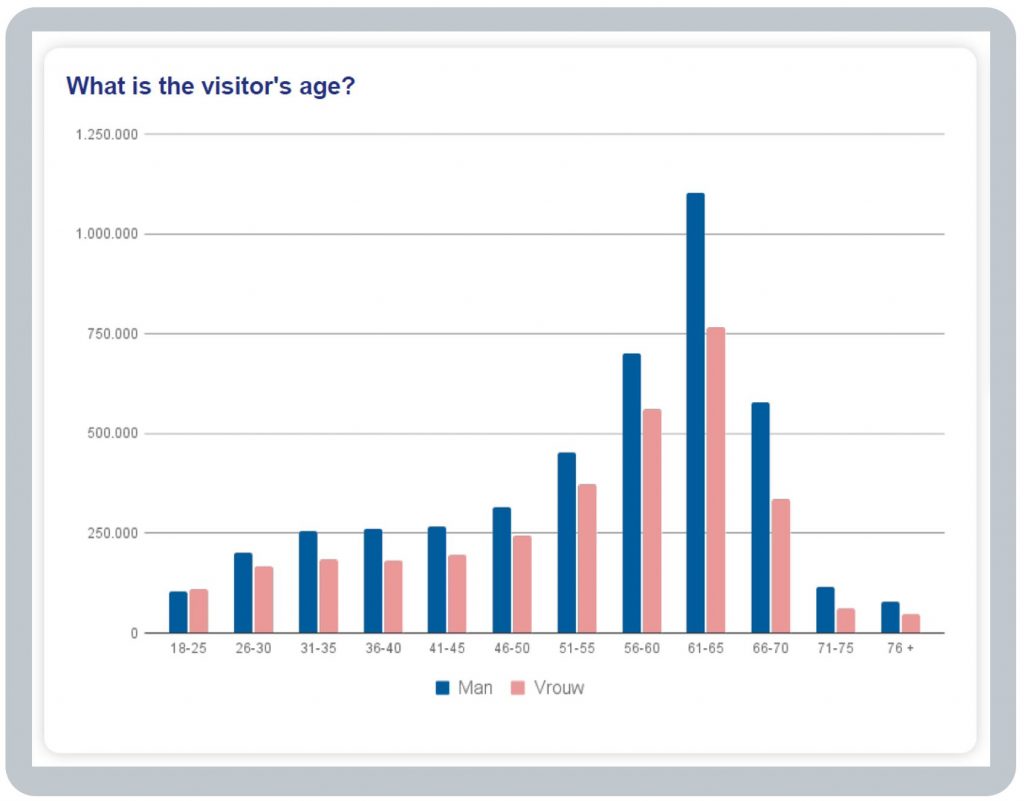

Number of logins increases with age, clearly shown in the graph below. For example, consider users aged 31-35 compared to those aged 61-65. During 2022, there were:

- less than half a million visits by users aged 31-35 (c.0.25m men (“Man”) (blue columns) and c.0.20m women (“Vrouw”) (pink columns)) compared to

- nearly 2 million visits by users aged 61-65 (c.1.10m men and c.0.75m women).

In all age bands (except the 18-25s), men consistently use the dashboard more than women, on a roughly 60 / 40 split across the user population as a whole.

BLANK

Most people just want to see an overview of the Total Monthly Income (TMI) they might get in retirement (see General Comment 2).

Downloading their pension overview data is also popular (users made over 3 million downloads during 2022).

Users are also surveyed on what information they were looking for:

BLANK

Usage varies through the year: it spikes in The New Year / Spring and again in November (as a result of “Pension 3 Days” – see UX before using Mijnpensioenoverzicht above):

BLANK

These spikes in usage are also reflected in contacts made to the Mijnpensioenoverzicht Service Desk (the number of contacts reduced from 2021 to 2022, with about 1.5% of users making contact, i.e. c.57,000 contacts ÷ c.4 million unique users):

BLANK

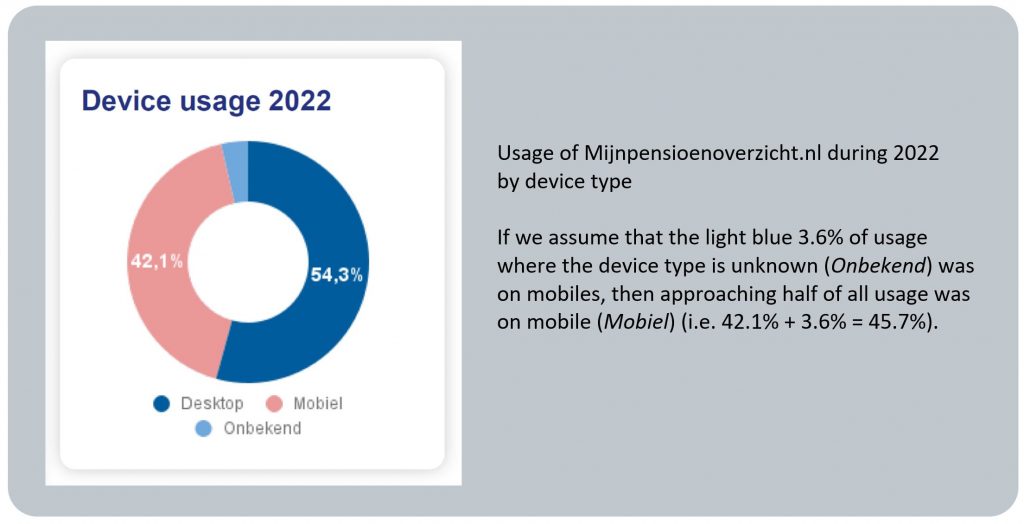

Finally, nearly half (around 46%) of the usage of the Mijnpensioenoverzicht.nl website is on mobile devices:

BLANK

Other information about Mijnpensioenoverzicht

The core purpose of my research tour in June 2023 was to learn more about mature pensions dashboards’ user experiences (UXs) and user interfaces (UIs). However, the Dutch team were also very generous providing me with various other insights about the Dutch dashboard, which I’ve summarised below.

This “Other information” section covers some summary points on the:

- history of Mijnpensioenoverzicht

- governance of Mijnpensioenoverzicht

- vision for Mijnpensioenoverzicht.

BLANK

History of Mijnpensioenoverzicht

In 2008, a new non-statutory body, but with a legal duty from the Dutch Government, was created called Stichting Pensioenregister (SPR) (the Pension Register Foundation). SPR was given the statutory duty to provide the Dutch pensions dashboard. There’s more information about SPR under Governance below.

BLANK

During 2009/10, three “koploper” (“front-runner”) pension providers helped to get the overall end-to-end Mijnpensioenoverzicht system working, including the critical data flows from the pensions industry.

Together with the Sociale Verzekeringsbank (Social Insurance Bank) – the Dutch equivalent of the DWP – which provides the Dutch state pension (the AOW), the three koplopers were:

- Arcadis – a very old Dutch pension scheme (formed in 1924), now part of consolidator Het

- AZL – a major pension administration and actuarial consulting firm, and

- Delta Lloyd – a major Dutch insurance company, then owned by Aviva, now part of NN Group.

Mijnpensioenoverzicht was then launched in 2011 when compulsion legislation came into force on all Dutch pension schemes and providers to make their data digitally available for retrieval by the dashboard.

BLANK

Over the last decade or so, Mijnpensioenoverzicht has become the place where Dutch citizens go in the first instance to find out about their pensions.

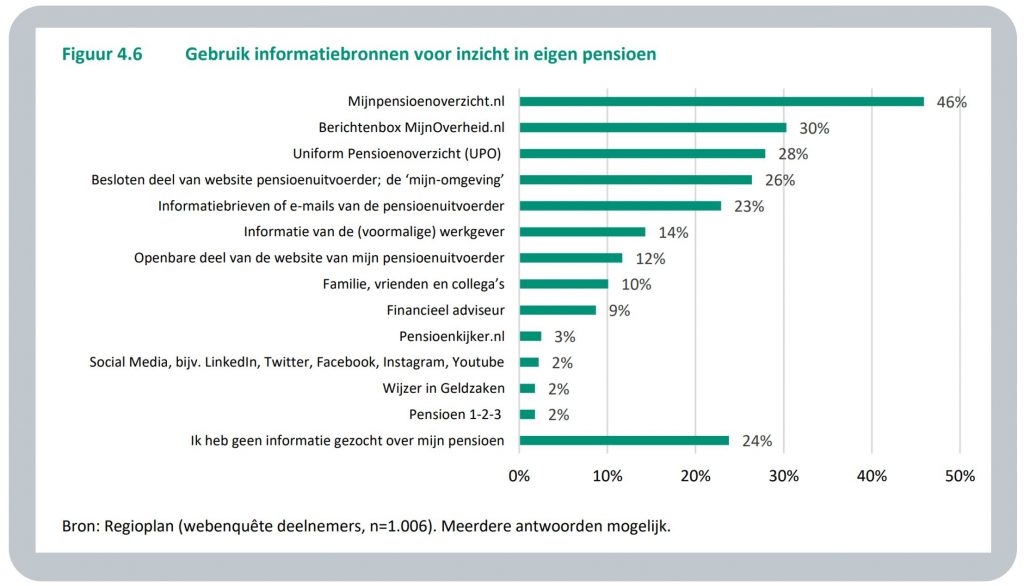

This was evidenced in 2019 when the Dutch Government commissioned a major research project, undertaken by research agency Regioplan, into the effectiveness of all Dutch pension communications, including Mijnpensioenoverzicht.

Regioplan surveyed over 1,000 Dutch citizens, and their October 2019 research report was presented by letter to the Dutch Parliament in January 2020 by the Minister for Social Affairs and Employment.

The Minister highlighted the key research finding that Dutch citizens want, quite reasonably, to see their estimated total monthly income (TMI) at retirement age, net of tax.

The graph below shows the results of Regioplan’s survey question to research participants:

“Which different information sources do you use to gain insight into your pension?”

The top green bar shows that almost half of the research participants (46%) said they use Mijnpensioenoverzicht.

By contrast, the third green bar shows that only just over a quarter (28%) said they look at their standard annual statements (Uniform Pensioenoverzicht (UPO)) from their different pension schemes and providers.

Dutch people now use Mijnpensioenoverzicht because it is the only information source which meets their key need of seeing their total pension income (which, obviously, individual scheme statements cannot do). Also, the calculation of income tax can only be done when the total income amount is known across all of a citizen’s different pensions, so only Mijnpensioenoverzicht can show their net total monthly income.

For interest, the next four top responses mentioned by Regioplan’s research participants were:

- MyGovernment message inbox (mentioned by 30% of respondents: second from top)

- My pension providers’ secure portals (requiring log in) (26% of respondents: 4th bar)

- “I haven’t looked for information about my pension” (24% of respondents: bottom)

- Letters or emails from my pension providers (23% of respondents: 5th from top bar).

BLANK

Governance of Mijnpensioenoverzicht

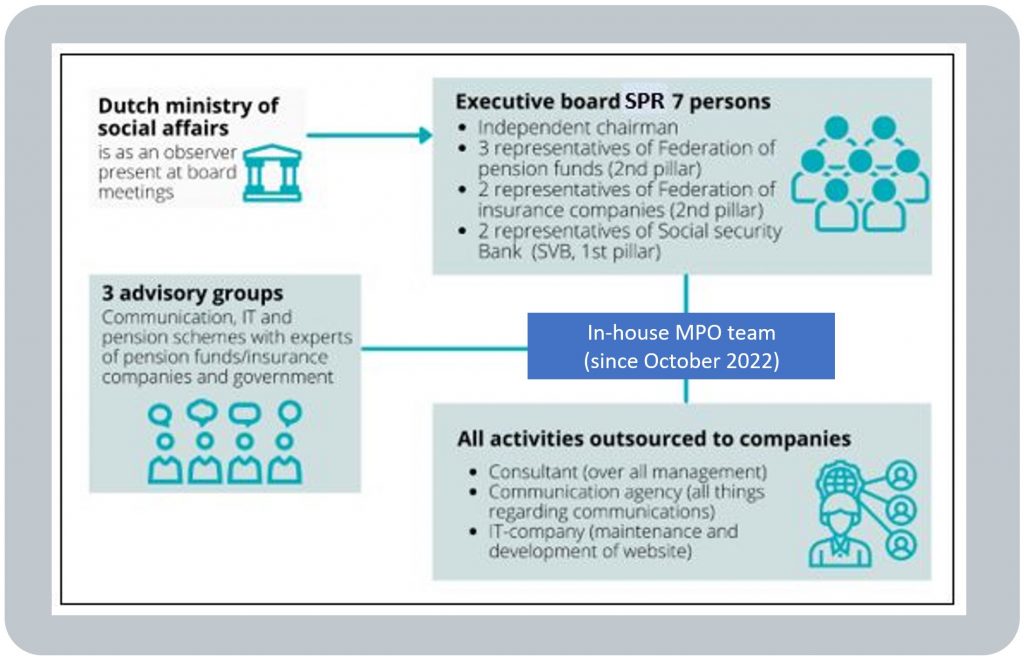

Mijnpensioenoverzicht.nl is managed by the independent body Stichting Pensioenregister (SPR) (the Pension Register Foundation). SPR is a partnership between:

- Pensioen Federatie (Pension Federation) – equivalent of the UK’s PLSA

- Verbond van Verzekeraars (Association of Insurers) – ABI equivalent

- Sociale Verzekeringsbank (SVB) (Social Insurance Bank) – DWP equivalent for State Pension.

The SPR Board has an independent Chair, with three members from the Pension Federation, and two members each from the Association of Insurers and the Social Insurance Bank.

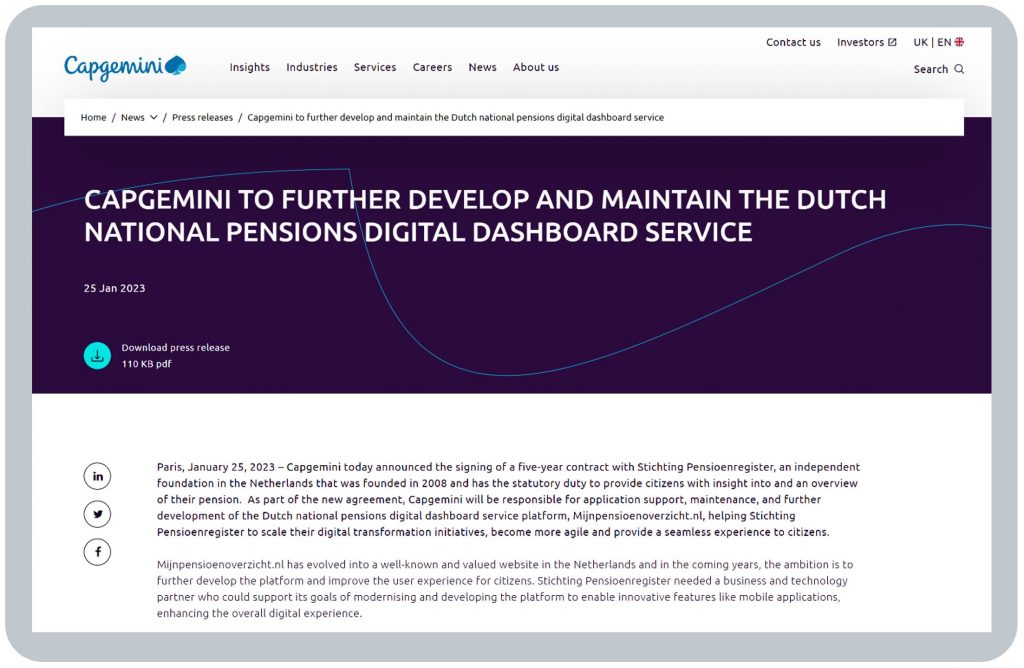

For the first decade of operations, the SPR Board outsourced all aspect of the dashboard’s operations to third parties. But from October 2022, a new administrative office of SPR has been established. This small teams of in-house experts will lead the delivery of Mijnpensioenoverzicht’s vision over the coming years.

As part of this renewed governance and operating model from 2022, the outsourcing of the core technology provision of Mijnpensioenoverzicht was reviewed. In January 2023, Capgemini announced they had been appointed to maintain and further develop Mijnpensioenoverzicht for the next five years:

Data standards

Part of the reason the dashboard, and the necessary data flows, could be set up relatively quickly in 2009/10, was because earlier in the 2000s legislation had required all schemes to issue standardised annual statements (known as the Uniform Pensioenoverzicht, or UPO).

UPOs included a standard calculation basis for projecting future pension incomes. The standard UPO information became the basis for the data to be sent to Mijnpensioenoverzicht from 2011. This means there is consistency, both across different pension providers, and between the amounts individuals see on Mijnpensioenoverzicht and the amounts they see on their scheme-specific UPO statements.

Data standards maintenance

Mijnpensioenoverzicht’s data requirements are defined in data standards governed by SPR, under delegated authority from the Secretary of State.

So the standards aren’t in legislation, which is helpful as they change from time to time, to both enhance the Mijnpensioenoverzicht user experience (UX) and to keep pace with wider pensions regulations.

The standards are governed in accordance with SPR’s internal governance structure, illustrated below:

Vision for Mijnpensioenoverzicht

SPR publishes it mission, vision and core values on its website.

Stichting Pensioenregister (SPR), as an independent and non-commercial foundation with a statutory task, fulfills a social need.

It increases the knowledge of as many Dutch citizens as possible about their accrued and estimated future total pension income, to motivate and enable them to make better financial choices for the future.

SPR’s Mijnpensioenoverzicht.nl service presents information in a clear, understandable and digital way, but also actively refers citizens to their pension providers for further information, reminding users of their own responsibility when it comes to making conscious choices about their income for retirement.

In delivering this aim, the Mijnpensioenoverzicht service has five core values through which it seeks to be:

- Understandable

- Trustworthy

- Efficient

- Together

- Directed by the citizen (i.e. with citizens always kept at the heart of the service).

On the last value, Mijnpensioenoverzicht seeks to continuously respond to the needs of citizens through ongoing consumer research, a consumer panel, and in particular testing with consumers.

BLANK

In February 2023, SPR published its five-year vision 2023-2027:

Key elements of this future vision over the next few years include:

- Sharing data: Once the necessary statutory provisions have been made, there will opportunities for a citizen’s total pension data (retrieved by Mijnpensioenoverzicht) to be accessible via the secure portals of citizens’ pension providers (i.e. similar to Norway – see General Comment 8).

BLANKThe aim is to enable pension providers to give their customers greater insight into their pensions and offer them better guidance on their choices. In the UK, our “Day 1” model is to have both the Government’s MoneyHelper dashboard and a number of FCA-regulated commercial dashboards.

- Investigating an app version: In addition to the core Mijnpensioenoverzicht.nl website, SPR will look at the possibilities of an app. If it’s found to add value for citizens, an app may be introduced.

BLANK - Modernising the platform: The Mijnpensioenoverzicht.nl platform is 14 years old, originally built by Atos, further developed by Cognizant, and now managed by Capgemini. Major maintenance will be undertaken over the coming years to keep up with the speed of technological & regulatory change, the expectation of modern web design, and the trends of “digital government” and “open data”.

BLANK

So even though, after well over a decade of live operation, Mijnpensioenoverzicht has now become a highly sophisticated service for Dutch citizens, it is still being continually developed (as reflected in my LinkedIn post after I met the Dutch team). See also General Comment 10 for more on the importance of continual iteration of pensions dashboards.

BLANK

BLANK

Page content verified by the Mijnpensioenoverzicht.nl team on 1 September 2023