23 July 2024 – Matching worries overtake View Data worries for schemes

In an article from pensions legal firm Sackers, on their recent webinar survey, schemes’ top dashboards worry is now matching (26%, up from 19% in 2022), overtaking being able to provide accurate DB pension data (25%, down from 40% in 2022).

19 July 2024 – PSIG comments on readiness

In a PensionsAge article, Chair of the Pension Scams Industry Group (PSIG) Margaret Snowdon says that data quality improvements across industry since 2019 mean data is now robust enough to support the delivery of pensions dashboards. She also says dashboards have a role in tackling pension scams, which “thrive in the shadows of confusion and misinformation”.

18 July 2024 – Aviva advocacy

In a LinkedIn post on the King’s Speech, Aviva Director of Workplace Savings and Retirement Emma Douglas reminds us dashboards still need to be delivered.

17 July 2024 – King’s Speech

The King’s Speech mentions a Pension Schemes Bill (see pp15-17 of the background briefing notes pdf) to include measures “preventing people from losing track of their pension pots through the consolidation of Defined Contribution individual deferred small

pension pots”. We all know dashboards need to be done prior to any small pots consolidation systems, so we best get on with dashboards!

P.S. Happy 10th birthday to this blog!

10 July 2024 – Double tweet / Double minister

Emma Reynolds MP tweets confirmation of her appointment as DWP Pensions Minister, then tweets again about being part of the HMT Ministerial team.

9 July 2024 – We must deliver

In a Citywire New Model Adviser article, ABI Director Yvonne Braun says:

“A new government offers a momentous opportunity to reset the pensions agenda [so] we must deliver pensions dashboards [as] the prize remains enormous [and] a culture change in pension engagement will be even more precious”.

8 July 2024 – Post-election priorities

In an interview with FT Adviser, dashboards are one of three priorities for the new government identified by Aviva Head of Savings and Retirement Alistair McQueen:

“they’re not a nice-to-have; they’re a must-have … they don’t have to be the perfect from day one … indeed, the old adage ‘perfection is the enemy of the good’ can apply to dashboards … there is no reason why they should not happen within this parliament”.

And in a Professional Pensions Opinion Piece, industry veteran John Moret puts forward a shortlist of five suggestions for the incoming government to consider, including (at No 2):

“Ensure dashboards have the resources and cross-industry support necessary to meet the timetables laid down … when implemented this project really will transform the pensions world with much higher levels of engagement across all age groups … the use of banking apps has grown enormously in a relatively short space of time and there is no reason why the same cannot be true of pensions API technology via commercial dashboards”.

5July 2024 – Labour must now deliver dashboards

Labour win the UK General Election, and commentators insist they must now get pensions dashboards done:

- AJ Bell director Tom Selby says in The Sun “it is crucial the new government presses ahead with the introduction of dashboards as planned”

- Nucleus director Andrew Tully says in FT Adviser “The new government need to make dashboards happen, make it soon and make it effective”, and

- People’s Partnership chief executive Patrick Heath-Lay says in The Independent “There are ‘day one’ challenges for new ministers … addressing key project documents requiring approval, and this must happen quickly”.

Meanwhile, a No 10 press release announces the appointment of new government ministers whose job it will be to ensure the delivery of dashboards.

27 June 2024 – Data connections focus

A Professional Paraplanner article quotes Origo CEO Anthony Rafferty saying that, since DWP published the staged timetable for data connections in March, “providers are keen to ensure they have a robust and secure connection to the pensions dashboards central digital architecture ahead of their onboarding schedule”.

24 June 2024 – TCS QPDS blog article

In a Finextra blog article, TCS Consultant Chandresh Pande explains how offering customers a commercial dashboard – legal name: Qualifying Pensions Dashboard Service (QPDS) – provides competitive advantage, enhances customer engagement, and supports new customer acquisition, concluding “the benefits that come with the QPDS badge far outshine & outweigh the evanescent drawbacks while pursuing it”.

18 June 2024 – ABI manifesto

Page 7 of the ABI Industry Manifesto says “together, we can boost the nation’s savings … delivered through [amongst other things] continued commitment to proactive and collaborative initiatives by industry and government such as delivering pensions dashboards”.

11 June 2024 – WTW survey

An article from WTW on the results of their survey of pensions administrators explains how 4 in 5 administrators believe increased used of digital technology including dashboards is the key change they expect to have the biggest impact on pensions administration in the next 3 years.

10 June 2024 – SMF vision paper

A Social Market Foundation policy paper setting out a holistic vision for the future of pensions in Britain says “implementation of dashboards remains years away … [so] considering Britain to be a leader in financial services looks increasingly delusional. This will only change once the industry puts its customers first”.

7 June 2024 – People’s future vision

An article from The People’s Partnership outlines what it thinks the nation’s future political leaders can do to make retirement saving fairer for savers. Included in the People’s four key points is a call for “transparent and standardised value for money metrics, focused on the outcomes savers are likely to receive from pension saving, and covering the whole market”.

People’s then calls for pensions dashboards to feature these metrics “front and centre”. Great ambition, but definitely a “Version 2” requirement: first, we all need to collaboratively focus on getting core Find & Value basic “Version 1” dashboards working.

5 June 2024 – End of term report: 6½ out of 10

Many thanks to Pensions Expert for publishing my assessment of the government’s dashboards progress against the 10 asks made by industry in October 2017. Roll on the next government!

3 June 2024 – The “Martin Lewis effect” and Partial data connection

In an interview with Citywire New Model Adviser, LCP Partner and former Pensions Minister Steve Webb is quoted with a great headline grabbing line. It will be part of the work of the PDP User Testing and Planning Group, working collaboratively with dashboard operators and data providers to ensure the risk of system outages is minimised.

Meanwhile, an excellent Pensions Expert comment piece from ABI long-term savings policy adviser Emily Mae Collins explains the simplified process whereby contract-based pension providers won’t have to make all of their pension records digitally searchable at once, but should target for at least 80% to be connected by their staged connection guidance date.

29 May 2024 – LCP finding lost pensions paper

LCP Partner Steve Webb publishes a consumer-facing guide to finding lost pensions. In the “future” section, Steve says “It is reasonable to believe dashboards will be available to the public in the next five years or so”. That’s May 2029! I really hope it’s a lot sooner than that.

28 May 2024 – Times coverage on the DOC

Financial Editor at The Times, Patrick Hosking, publishes an article about the now seven member firms of the (Pensions) Dashboard Operators Coalition (DOC).

22 May 2024 – WPC Oral Evidence

In what turned out to be this Parliament’s final session of the Work and Pensions Committee, during a discussion on the communication of State Pension Age increases to WASPI campaigners, DWP Permanent Secretary Peter Schofield is asked Q104: “What lessons has the DWP learned from this whole affair?”

You can watch (11:40:00 to 11:41:20) or read Peter’s response again – containing some very important for lessons for dashboards:

“It goes back to the conversation about how we engage with customers. How do we make it easier for our customers to understand? We have an ability to go online … and give people the confidence of how they understand the nature of what their income will be in retirement and what they need to do to support that.

“These are things we are doing to try to make it easier for millions of people to know where they stand with their income in retirement and to make provision for that when they can in their working age. We have not talked about the pensions dashboards programme, but I know you are taking evidence next month* on that.”

[* The session Peter was referring to, scheduled for 12 June, at which I was due to give evidence myself, will of course not now take place, as, later in the day on Wed 22 May, the Prime Minister announced the fourth General Election during the lifetime of this blog. Let’s see what the electorate decide on Thu 4 July 2024.]

21 May 2024 – SPP LPM report

The Society of Pensions Professionals (SPP) new report “Just one pension?” on the Lifetime Provider Model (LPM) of pensions provision says “One way to address the issue of multiple pots would be to build on the existing policy of pensions dashboards … We do not need costly new infrastructure for the LPM when dashboards can achieve these outcomes”.

20 May 2024 – New Coalition firms

A PensionsAge article reports the (Pensions) Dashboard Operators Coalition ((P)DOC) now has seven member firms: Aviva, Just Group, L&G, Mintago, Moneyhub, Scottish Widows (which is part of Lloyds Banking Group) and Standard Life (part of Phoenix Group).

12 May 2024 – Sunday Times coverage

Coverage in the general, as opposed to specialist, media of Friday’s NAO report (see 10 May below) continues in an article in The Sunday Times.

11 May 2024 – BBC Radio 4 Money Box

Nearly seven years since the prototype dashboard was covered on BBC Radio 4 Money Box in August 2017, today the show covers yesterday’s NAO report.

10 May 2024 – NAO Report

The National Audit Office (NAO) publishes the report on its investigation into the PDP Reset, receiving considerable media coverage, for example in The Times. Lack of digital skills and ineffective governance were to blame. The review only looked at the PDP Central Digital Architecture (CDA), ignoring dashboards and data. The report says DWP and MaPS expect to consider if PDP is ready to leave Reset during May.

8 May 2024 – FCA consultation closes

FCA’s further consultation CP24/4 on the proposed rules for Pensions Dashboard Service (PDS) firms closes, with various responses made available in the public domain:

- ABI response, asking the FCA to map out and test the end-to-end customer journey

- AJ Bell response, urging the FCA to return to the drawing board to redesign the rules

- Financial Services Consumer Panel response, strongly encouraging the FCA to review firms’ testing that their PDS adheres to Consumer Duty principles and / or to engage in its own testing

- Moneyhub response, emphasising the importance of post-launch changes

- Pensions and Lifetime Savings Association (PLSA) response, stressing the criticality of consumer testing

- Society of Pension Professionals (SPP) response, saying the proposed choices menu must be expanded at the outset or within a relatively short period of time

- The Investing and Saving Alliance (TISA) response, outlining the need for streamlined, intuitive, engaging dashboards journeys also extending seamlessly to off-dashboard services.

7 May 2024 – Size of QPDS market

Corporate Adviser publishes the 2024 edition of its annual Master Trust and GPP Report finding that all MT and GPP providers say they are planning to offer a commercial dashboard, except for Fidelity and WTW LifeSight (maybe not) and SEI (definitely not).

1 May 2024 – Updated Data Standards

In a blog article, PDP announces the publication of updated Data Standards, defining the data elements which pensions schemes and providers must supply and which dashboard operators must display.

30 April 2024 – New national ISP framework

The National LGPS Frameworks team publishes a new Framework for use by pension service pension schemes to let ISP and data services contracts.

25 April 2024 – 9th PDP Progress Report

PDP publishes its 9th six-monthly Progress Update Report.

24 April 2024 – FCA waiver and Equisoft dashboard

FCA publishes a waiver application process enabling firms to connect to the dashboards ecosystem from their staging date in guidance even where they are unable to connect all of their data from that date.

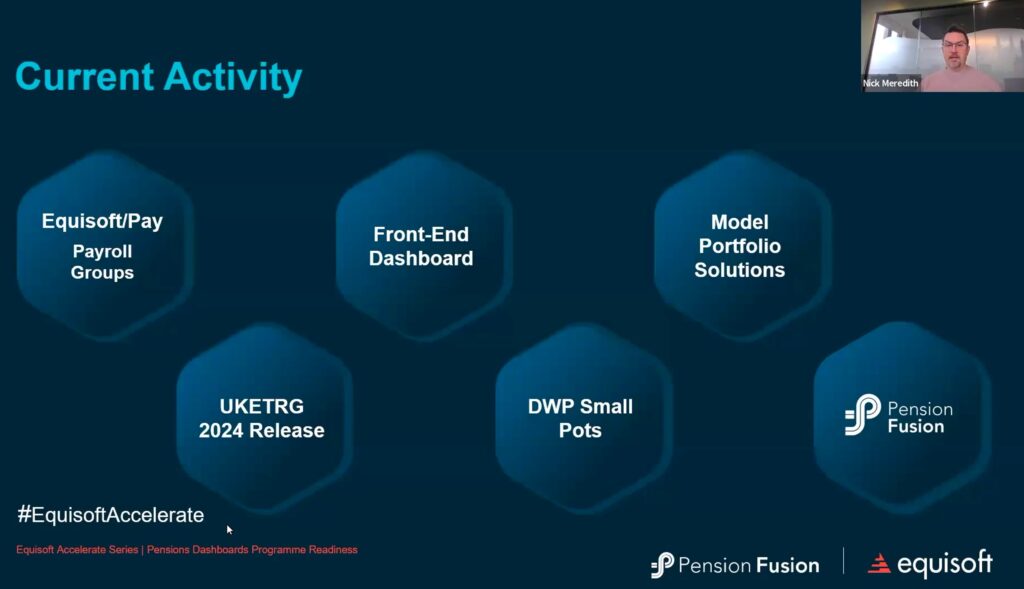

Meanwhile, in a client webinar, Nick Meredith at Integrated Service Provider (ISP) equisoft announces they will also provide a front-end dashboard for clients. Watch from 7:30-9:30.

19 April 2024 – Small pots policy paper

LCP publishes a policy paper recommending an improved version of ‘pot follows member’ utilising elements of the pensions dashboards ecosystem.

17 April 2024 – New SRO appointment

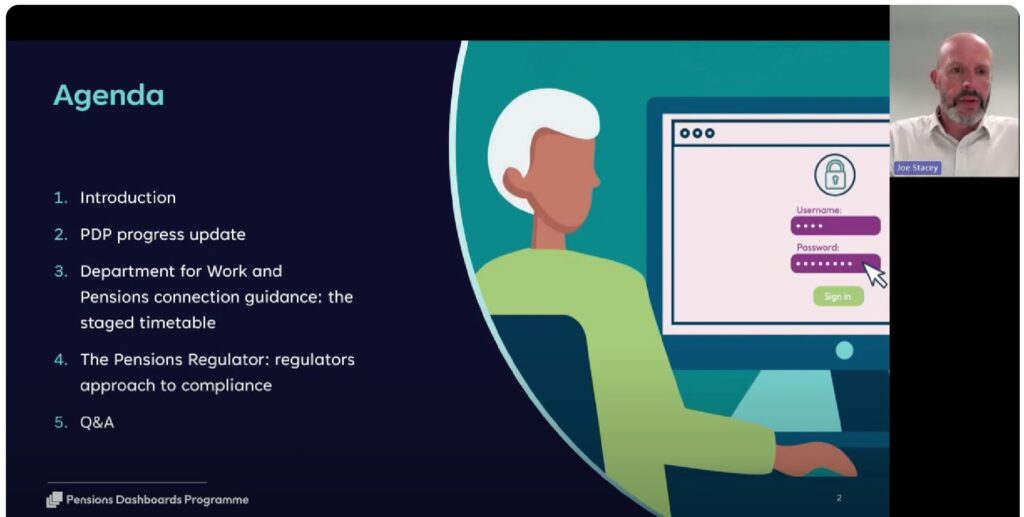

In a press release, PDP announces its new Senior Responsible Owner is Iain Patterson, with Chris Curry remaining as PDP’s lead on industry engagement. On the same day, PDP also hosts a webinar with DWP and TPR to help schemes prepare to connect their data.

12 April 2024 – Accrued income guidance

DWP publishes guidance for pension schemes and providers on how to calculate the estimated income which might be provided by a consumer’s defined contribution (DC) pension built up so far.

9 April 2024 – PDP blog on connection

In a blog article, PDP Principal Chris Curry provides an update on the Connection Guidance for schemes and providers published by the DWP on 25 March.

4 April 2024 – New Government ID Check app

The Government Digital Service (GDS) publishes a blog article about the accessibility of their new GOV.UK ID Check app, a key part of the GOV.UK One Login service. One Login will be the dashboards ecosystem’s central Identity Service (according to UKAuthority.com although there’s been no confirmation of this from MaPS PDP yet). See the 11 October 2023 entry on the 2023 page of this blog for more details about GOV.UK One Login.

27 March 2024 – Further FCA PDS rules consultation

Following its 1 Dec 2022 consultation on rules for how Pensions Dashboard Service (PDS) firms must behave, the FCA publishes a further consultation paper CP24/4:

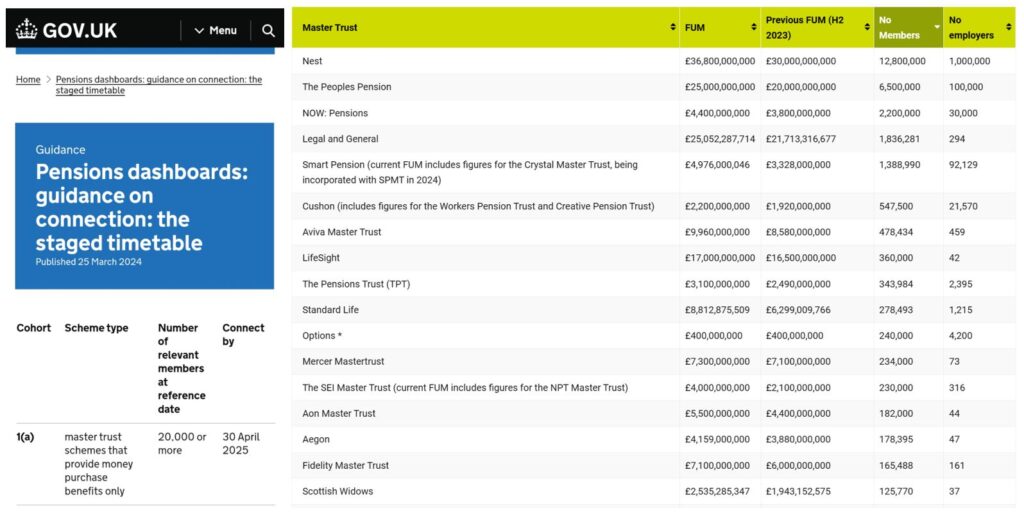

25 March 2024 – Dashboard Operators Coalition and Staged Connection Guidance

Two really important announcements today:

- Dashboard Operators Coalition is launched, kicked off by Just Group, L&G, Moneyhub, and Standard Life, part of Phoenix Group

- Staged connection guidance for schemes published by DWP, announced in the nick of time in a Written Ministerial Statement the day before Parliament recess.

In a LinkedIn post, I summarised this as follows:

“In just 13 months (30 April 2025), 28 million pension entitlements* will be connected to the dashboards ecosystem: good job we’ll have many dashboards to test the consumer experience of using a dashboard”.

* According to the latest Master Trust League Table from Go Pensions (H1 2024)

21 March 2024 – New PDP Advisory Group members

In a press release, PDP announces the names of eight people joining their new advisory group, joining the existing 10 members of the previous steering group.

19 March 2024 – PDP answers to 3 questions

In a blog post, PDP Principal Chris Curry answers questions on consumer consent, timescales for View Data returns, and AVCs.

13 March 2024 – FCA support and risk mitigation

In a speech on the future of pensions, FCA Chief Exec Nikhil Rathi reiterates the FCA’s support for dashboards but also says the FCA is alert to dashboards potentially increasing the risks of scams so the FCA wants to work with the industry on measures to mitigate those risks.

1 March 2024 – Good Housekeeping magazine

This blog likes to keep abreast of pensions dashboards mentions in the wider media, i.e. not just the specialist pensions, financial services and technology media.

Following dashboards’ mention on BBC R4 Woman’s Hour at the start of 2023, this year they get a mention in the March 2024 issue of Good Housekeeping magazine.

Maybe this reflects SEI’s research finding (see the 23 March 2023 entry on the 2023 page) that it’s Gen X women who most want to use pensions dashboards?

29 February 2024 – Ministerial urging

An FT adviser article reports how the Pensions Minister, in his speech to the PLSA Investment Conference in Edinburgh today, urges all pension schemes and providers to get their data ready ahead of connection to the pensions dashboards ecosystem, adding:

“Don’t wait for me to come knocking at your door. I may seem cuddly now but trust me if I have to come to your door when it comes to dashboards, you will not enjoy the experience.”

19 February 2024 – New FCA Regulated Activity

UK consumers move a step closer to seeing all their pensions together on their favourite banking, pension or money management app on their phone as “Operating a pensions dashboard service” becomes a new FCA Regulated Activity, into force in two weeks (with an accompanying Explanatory Memorandum).

13 February 2024 – The lang cat industry research, PDP CDA blog, and HoL debate

The lang cat, together with The People’s Partnership, publishes an industry research report from 24 anonymised 1-to-1 interviews, carried out in the summer of 2023, with recognised pension policy and/or technical experts. On dashboards, “the general consensus is that dashboards should and will happen … [with] three clear messages:

- State Pension must be included

- a strong call not to try to deliver too much at the outset: industry would much prefer a live minimum viable product, followed by incremental improvements, rather than attempting to deliver fully armed & operational dashboards from day 1

- dashboards should be delivered ahead of any implementation work on small pots [solutions]”.

Meanwhile, a new blog article from PDP Principal Chris Curry explains the Central Digital Archictecture (CDA) of the pensions dashboards ecosystem.

And finally, there’s a fantastically well-informed House of Lords debate on the HM Treasury Statutory Instrument making “Operating a pensions dashboard service” a new FCA-regulated activity, between the Government Parliamentary Secretary Baroness Vere, Labour’s Lord Livermore and LibDem’s Lord Sharkey:

- watch on Parliament TV here (from 17:46:28)

- read the Hansard transcript here.

9 February 2024 – Five advantages of QPDSs

Corporate Adviser Editor John Greenwood kindly publishes my independent article explaining the numerous reasons why commercial dashboards (QPDSs) have strong cross-party support.

8 February 2024 – Ministerial delivery focus

A Professional Adviser article reports on Minister for Pensions Paul Maynard’s comments, at the lang cat’s Regenerate 2024 conference, that dashboards remain a key DWP priority.

Watch Tom McPhail’s interview with the Minister on the lang cat’s YouTube channel: comments on dashboards are 13:00-13:40, 19:00-21:00, and 34:00-37:00, including Paul’s observation “what is very clear is the interdependency of all these ideas that are in flight”.

2 February 2024 – DWP deferral guidance

DWP updates its guidance to schemes on applying to defer their connection to the PDP Central Digital Architecture (CDA). Applications must be submitted by 8 August 2024.

29 January 2024 – HMT Regulated Activity Debate

At the Delegated Legislation Committee debate on HMT’s legislative amendment making “Operating a pensions dashboard service” an FCA-regulated activity, Shadow Economic Secretary to the Treasury Tulip Siddiq MP is very supportive – watch/read again below.

It’s very helpful for industry to have certainty around QPDSs whatever the outcome of the upcoming General Election. Tulip’s statements included:

- Labour support any initiative that helps people manage their finances and save for later life.

- These changes [i.e. QPDSs] are long overdue.

- To reach their potential, dashboards must be incorporated into services people already use.

- When will the FCA publish its final [QPDS] rules?

- Does the Government expect commercial dashboards and the MoneyHelper dashboard to be available at the same time?

- Will dashboards rely on other Government plans, such as the new GOV.UK One Login service?

- Some commercial dashboards will present other financial data alongside pensions which is one of the main benefits to consumers: to see all their finances in one place.

Read again here: Draft Financial Services and Markets Act 2000 (Hansard – UK Parliament)

Watch again here: https://lnkd.in/efFVkFbv

25 January 2024 – PDP advisory group

PDP publishes an open invitation for individuals to apply to be part of its (new?) advisory group, giving them 12 working days to apply by 12 February.

17 January 2024 – PDP webinar

PDP hosts a webinar for data providers with speakers from DWP, PASA, the LGA and TPR:

16 January 2024 – New dashboard providers group

In a blog article, PDP announces that in 2024 it “plans to set up a connection working group for potential dashboard providers, once FCA rules have been finalised”. The blog also covers the other, previously announced, ways PDP is engaging with industry.

10 January 2024 – Important WPC update

At a routine (non-inquiry) oral evidence session of the Work and Pensions Committee (WPC) – about the DWP Annual Report and Accounts 2022/23 – Committee member Nigel Mills MP asks about dashboards progress (see Questions 47-51 of 70 in the session transcript).

There were positive responses from the three very senior DWP officials on the session panel:

- Peter Schofield: Permanent Secretary of the Department for Work and Pensions (DWP)

- Katie Farrington: DWP Director General for Disability, Health and Pensions

- Neil Couling: DWP Director General for Change and Resilience, also Senior Responsible Owner for Universal Credit and DWP lead on fraud and error.

Key points made by Peter, Katie and Neil:

Reason for reset: Peter said DWP agreed with the (former) MaPS Chair to put the programme into reset because they needed to take stock. The technology was right but the impact of the sheer scale of the connections that needed to be made was more than people really understood. They needed to go through a proper process of looking again at the programme.

Reset is progressing: Katie said the programme continues in reset, but is making quite good progress with the team having increasing confidence about delivery. One of DWP’s own programme directors is now leading this forward (this is Simon McKinnon, former DWP Director General for Digital – see 12 July 2023 entry on the 2023 page of this blog).

Reset confidence: Peter said Simon is giving him a huge amount of assurance that, technologically, the programme is absolutely doable, but “it is the scale of the connections that need to be done, with 3,000 pension providers, that is the thing. That is a question of time. It is a question of engagement with the industry, of course, but it is a question of time rather than a question of doability”. Neil added: “the programme is in a much better position than it was six months ago, which caused us to put it into reset, so [we are giving ourselves] the time, [to] test, go small, then go bigger later; that is the way to run major programmes, in my view”.

Guidance on staging dates for data connections: Katie confirmed this is expected “in the spring”.

Moving the programme out of reset: Together, Peter, Katie, MaPS Chair Sara Weller, and new MaPS CEO Oliver Morley (starts on 1 Feb) form the programme reset “executive” and they will make a decision about when to move the programme forward out of reset.

Infrastructure and Projects Authority (IPA) rating: The previous IPA assessment of the programme as Red (see 20 July on the 2023 page) will be reassessed when the programme comes out of reset.

Interdependencies: In addition to the independency on the pensions industry to connect their data, Katie also mentioned the interdependency on Capgemini, which is providing the IT platform (but she didn’t mention the third critical dependency on the new GOV.UK One Login Service – see 11 October on the 2023 page). These interdependencies will continue to be monitored and the risks managed, “but the assessment that we have had is that it is deliverable”.

Dashboards Available Point (DAP): DWP will work with the industry and MaPS to determine when the DAP can be, but it “could well be quite a lot sooner than October 2026 [with] six months’ notice before that—so perhaps not so very far away”.

Watch the session here (the 6½ minutes in question is from 11:10:15 to 11:16:45).

9 January 2024 – NAO investigation

The National Audit Office (NAO) announces its investigation into PDP, scheduled to take place during “Spring 2024”.

1 January 2024 – Penalty act comes into force

The 10th year of this blog starts with a minor legislative change:

The Pensions Dashboards (Prohibition of Indemnification) Act 2023 which makes it a criminal offence for pension scheme trustees to use scheme assets to reimburse themselves for any penalties imposed under the dashboards regulations (see the 9 February 2023 entry on the 2023 page), comes into force from 1 January 2024.