Blog started: 18 July 2014

Last updated: 11 March 2026

“I defy anyone not to be excited about dashboards after speaking to Richard!”

Nick Reeve, Editor of Pensions Expert, after Wiltshire Pension Fund’s dashboards seminar (Mar 2026)

“Richard Smith was brilliant!”

Mitesh Sheth MBE, Review of SG Pensions Enterprise’s DC Growth & Retirement Summit (Oct 2025)

“Richard is interesting and kind [with] some strong views on the consumer testing of dashboards”

Henry Tapper, Blog article (Sep 2025)

“I don’t know if Richard Smith is the UK’s dashboards expert, but he’s certainly a strong contender”

Tom McPhail, The lang cat podcast (Dec 2023)

Quick links to latest content

Latest updates, latest videos, independent research on five continental dashboards, how to get in touch

My real retirement story: August 2025 onwards

Series of occasional blog articles about my practical experience of, and feelings around, actually retiring (partially), bringing some of my pensions into payment

Dashboards Nine-Nine: August 2024 to April 2025

Series of monthly Pensions Expert case study articles about each of my own pension providers’ preparations, and also exploring key consumer understanding topics.

What’s this website blog all about?

Hi there – Thanks for coming to this blog all about pensions dashboards. It’s a repository I’ve been maintaining for the last 11 years of all the key information published about dashboards in the UK, ever since the idea was first suggested in July 2014 (or actually December 2002).

Here’s a short video of me, in March 2025, explaining the concept to MPs, on the Work and Pensions Committee Chair Debbie Abraham MP’s Instagram:

As of February 2026, the blog includes links to over 740 announcements, updates, key reports, commentaries, and so on from Government bodies, regulators, and many other different parties: a truly wide ranging history of ideas and views (some older links may no longer work).

Seeing all your pensions in one place is a really simple concept to understand. But actually developing the multi-party technological ecosystem to achieve that safely, and understandably for the user, is pretty tricky. There’s a lot to think about: have a look at the Videos page for some simple, digestible explanations.

There’s also information about the pensions dashboards other countries have developed, with some important lessons for the UK (recognising key country differences, of course). New in 2023 was my detailed research on the user experiences (UXs) offered by five continental European dashboards.

More details on me are on the About page. I started this blog for myself, but folk tell me they find it a really helpful body of ideas, so I hope you do too.

Cheers, Richard Smith.

Background

If we’re employed, most of us are now fortunate to be building up money for our retirement through our work. But because lots of us have several jobs during our lives, we end up with multiple bits of pension savings in many different places.

This makes it very hard, almost impossible sometimes, to understand your total pension picture. In fact, only 1 in 5 people understand what they’ve already got to give them confidence they’re on track to have enough money in retirement.

The 80% of UK adults who aren’t sure about this is 30 million people!* It’s a big deal.

Because of this problem, consumer groups, the pensions industry, the Government and many others all think it would be a great idea to develop online “pensions dashboard” services, where people can see all of their different UK pensions, securely, together.

This issue isn’t unique to the UK: it exists in many developed countries. Several countries are years ahead of us and have already developed online pensions dashboard services for their people (for example, in Scandinavia, the Low Countries, Israel and Australia).

Denmark’s dashboard (PensionsInfo.dk) is the oldest – it’s been running for 25 years so is now pretty sophisticated (they’ve even recently launched a demo version in English):

And the 14-year-old dashboard in The Netherlands (Mijnpensioenoverzicht.nl) – or My Pension Overview, known as MPO – is now the top place Dutch people go for information about their pensions, preferring it over their scheme-specific statements because it shows what they want to know: total pension income.

Brief history of dashboards in the UK

In late 2014, the Financial Conduct Authority (FCA) recommended a pensions dashboard should be developed, and in the 2016 Budget, the Government said it would ensure industry launched one. Industry then developed a prototype dashboard in 2017:

The prototype project, though, highlighted a range of really complex issues on which Government would need to opine. So in 2018, the Department for Work and Pensions (DWP) conducted a feasibility study examining the tricky issues involved, then ran a public consultation. In April 2019, the Government presented a Command Paper to Parliament, committing to make dashboards happen:

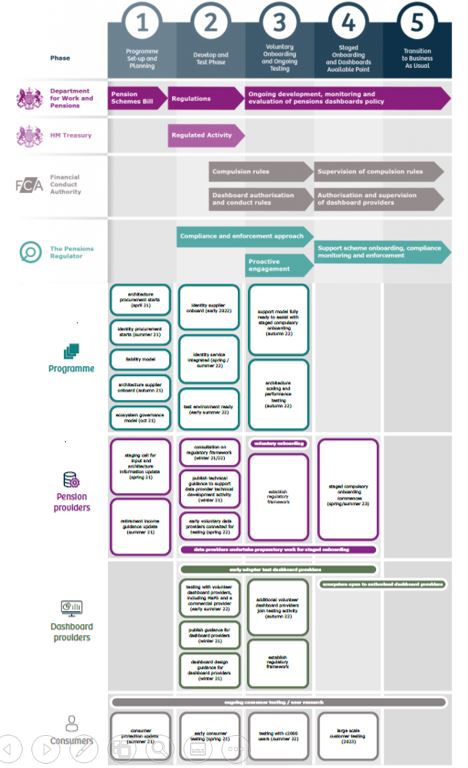

Since then, the Government has brought forward the necessary primary legislation in the Pension Schemes Act 2021 which became law on 11 February 2021, and the detailed secondary legislation in the Pensions Dashboards Regulations 2022 made 21 November 2022.

The Government has also set up a Pensions Dashboards Programme (PDP) run by the Money & Pensions Service (MaPS). PDP is working hard with a wide range of government and industry delivery partners to make pensions dashboards a reality. As part of this, during 2020, I was very fortunate to be able to help PDP develop the dashboards data standards.

The work to develop pensions dashboards is a very significant undertaking, now recognised as one of the most important and complex projects currently underway in the UK.

As of 2024, the programme plan and overall timeline were reset. In April 2025, the first pension schemes and providers started connecting to the ecosystem, and live consumer testing of the government’s MoneyHelper Pensions Dashboard (MHPD) started in October 2025.

Public launch of the MHPD will depend on the success of the MHPD consumer testing. Ministers have committed to giving 6 months notice of the launch.

Pensions dashboards are coming to the UK in the 2020s. It’s a big task, but, working together, Government and industry are going to deliver something really wonderful for the UK.

See Full history of events for more details.

So what’s DashboardIdeas.co.uk for?

Developing and maintaining dashboard services for the whole UK will be fiendishly tricky. There are lots of issues to resolve requiring clever thinking and collaboration.

I hope this website, serving as a repository for knowledge, thoughts and ideas on all aspects of pensions dashboards, can help inform debate, and support all those contributing to the dashboards initiative.

See the About page for more details on why I’ve created this blog and brief background on me.

Many thanks for reading.

Cheers, Richard Smith

11 March 2026

* In May 2018, the Pensions and Lifetime Savings Association (PLSA) commissioned Populus Data Solutions to undertake an omnibus poll of c.1,500 UK individuals aged 18 to 65 to examine attitudes towards saving for retirement. The poll found that 8 out of 10 people aren’t sure they’re saving the right amount for retirement, because they lack knowledge about what pensions they’ve already built up. At a national level, using the latest ONS figures available at the time, the non-retired UK population aged 18-65 was 38.0 million, 80% being 30.4 million.