3 December 2018 – Pensions Minister launches consultation with PM support

A New Model Adviser article reports how Prime Minister Teresa May has told ITV:

“I welcome [today’s] commitment to make [pensions dashboards] a reality”.

Later, Guy Opperman MP, Minister for Pensions and Financial Inclusion, hosts a special event at Portcullis House, Westminster to report on the DWP’s feasibility study and launch a consultation on next steps, with a view to introducing new legislation in the 2019 Queen’s Speech.

29 November 2018 – Select Committee letter to the Minister

The Work and Pensions Select Committee hosts an informal meeting of industry representatives, after which the Chair Frank Field writes to the Pensions Minister reiterating again the importance of Government support in the key areas of compulsion legislation, identity verification, independent governance and appropriate regulation.

20 November 2018 – Support from the new Secretary of State

The Tax Incentivised Savings Association (TISA) tweets that Amber Rudd MP, the newly appointed Secretary of State for Work and Pensions, speaks very supportively of the pensions dashboard initiative at their Annual Conference.

19 November 2018 – Comments from a source close to the project

New Model Adviser reports a source familiar with the dashboard project as saying the DWP’s feasibility study will recommend compulsion, an industry levy and an implementation entity to govern the ecosystem for pensions dashboards.

13 November 2018 – IORP II Implementation Guidance

In their Principles and Guidance document for the implementation of IORP II’s benefit statement provisions, the European Insurance and Occupational Pensions Authority (EIOPA) recommends that pension schemes’ benefit statements should be aligned to national pensions dashboards.

7 November 2018 – Savers versus Spenders report

In their Savers versus Spenders report, Aviva find that 40% of employees aged 46 to 55 do not know how much they have saved for retirement and are therefore approaching retirement ‘blindfolded’.

30 & 31 October 2018 – Parliamentary discussion

Speaking for the Scottish National Party on the second day of the Budget debate, Aberdeen North MP Kirsty Blackman says she is pleased “the Government has made a commitment to the pensions dashboard, but they now need to legislate to compel companies to comply so that people can access information about their pensions and then get those pensions. That is important, and lots of people have been calling for it.”

The following day, in Prime Minister’s Questions, Labour MP for Bolton North East Sir David Crausby explains why the dashboard is such a good idea so asks why the Government is “backtracking on delivering the dashboard by putting the responsibility on the pensions industry? Does the Prime Minister really believe that the industry responsible for all that unclaimed money is best suited to taking control?” In response, the Prime Minister says she agrees “it is important people understand their pensions and what they are entitled to. That is why the DWP is working with the pensions industry on this issue. We are not just working with them; we have actually put some money forward as part of the project to ensure that that information is there and available to people.”

29 October 2018 – Budget confirmation

In the detailed Budget 2018 document published by HM Treasury, the Government confirms (on page 80) that the DWP will consult later this year on the detailed design of pensions dashboards and will work closely with the pensions industry and financial technology firms to make this a reality – with provision (on page 36) of £5m of extra funding in 2019/20 to help with this.

17 October 2018 – £20bn of lost pots

New research from the Pensions Policy Institute, sponsored by the ABI, highlights that there could be approximately £19.4bn of lost defined contribution pension pots in the UK – a major and growing issue that could be reduced by the introduction of pensions dashboard services.

15 October 2018 – Parliamentary answers

In response to oral questions in Parliament, the Pensions Minister Guy Opperman says that he and DWP colleagues are “in daily contact with industry figures as we prepare our feasibility report and plan for the roll-out of the dashboard”. He also wishes to “make it acutely clear that the Secretary of State and I, and all the members of the DWP team, are completely behind the pensions dashboard”.

10 October 2018 – Continued Ministerial support

Writing in Pensions expert, the Pensions Minister Guy Opperman reiterates that an industry-led dashboard, facilitated by government, will harness the best of industry innovation. He says that DWP will shortly report on the findings from the feasibility study, and move forward from there, over the coming weeks and months, in conjunction with industry, to establish to the right model, with government protection where necessary.

He repeats too that we should not underestimate the size or complexity of the challenge.

9 October 2018 – Open Banking comparisons

Origo publish a detailed FAQ paper on the similarities and differences between Open Banking and “Open Pensions” (as a natural successor to pensions dashboard).

3 October 2018 – SFGB and Open letter demands

Writing in Money Marketing, People’s Pension Director of Policy and External Affairs Gregg McClymont argues that the risks for Government of signing off on a dashboard look heavy when compared to the rewards, meaning that dashboard governance must be handed to the new single financial guidance body.

Meanwhile, following up on their Don’t scrap the pensions dashboard petition, campaigning organisation 38 Degrees is asking UK citizens to sign an open letter to Secretary of State Esther McVey asking her to commit to a dashboard that:

- Legally requires all pension providers to sign up

- Includes the state pension

- Provides clear and neutral information about our pensions.

As at 3 October, over 50,000 people had signed the letter.

2 October 2018 – Pensions Bill 2019

Interviewed by New Model Adviser at the Conservative Party Conference, the Pensions Minister Guy Opperman suggests that dashboard legislation will be introduced in 2019. He says: “The hope is we will get in at the next Queen’s speech in the summer of next year. We will get a pension bill in which we will do pension dashboard and the legislation required in particular”.

1 October 2018 – Government commitment reiterated

In her speech to the Conservative Party Conference in Birmingham, Secretary of State for Work and Pensions Esther McVey reiterates the Government’s commitment to the pensions dashboard – watch here at 15:50. She states that “we will be giving people the opportunity to access their pension information through an industry-led pension dashboard building on the Government’s Check Your State Pension online service”.

26 September 2018 – Pensions Dashboard Summit

Conference organiser Finance Edge (FE) holds a Pensions Dashboard Summit of pensions industry leaders under Chatham House rules. Prior to the summit, FE published my latest infographic on the dashboard project’s status. Well known pensions blogger, Henry Tapper summarised his thoughts on the day in a blog post.

Separately, a House of Commons Library Briefing Paper on the dashboard was published on the Parliament UK website.

21 September 2018 – Government not confident to release pensions data

The Society of Pensions Professionals (SPP) Annual Conference is reported in a Pensions Age article. The People’s Pension Director of Policy and External Affairs Gregg McClymont is reported as saying “the government has issues over its confidence in releasing every single piece of pensions data in the UK”.

20 September 2018 – Nothing can stop us if everyone gets behind the idea

In a positive Professional Adviser article, Simplitium Head of Pensions Business Development Tom Hibbard writes that already some progressive and pioneering firms that have been involved in building and testing the dashboard prototype, and if everyone gets behind it, surely nothing can stop us?

19 September 2018 – The digital, data powered future

In an FT Adviser article, Experian’s Richard Howells describes the digital, data powered future. But he warns that their research shows an incomplete dashboard could lose half its audience and thus create an industry white elephant.

18 September 2018 – Meeting of 20 providers to discuss way forward

On Tuesday 18 September, 20 providers were reported as meeting to discuss a way forward for the dashboard initiative. The meeting was widely reported, including in a Professional Adviser article. The key reported points emerging included the importance of the government publishing its feasibility study as a matter of urgency, and the need for the government to legislate to ensure the whole industry is compelled to participate.

18 September 2018 – Central dashboard doesn’t mean one dashboard

In an ABI blog article, Matthew Burrell sets the record straight on some dashboard misconceptions, including that wanting there to be a government sponsored dashboard is not the same as wanting there to ONLY be a government sponsored dashboard.

14 September 2018 – Urgent and important

In a New Model Adviser article, Intelligent Pensions Technical Director Fiona Tait argues that dashboard is an exception to the Eisenhower principle in that it is both urgent and important. We should therefore do it now:

11 September 2018 – 24 pensions per couple

In an excellent Comment piece, Times Financial Editor Patrick Hosking is supportive of the dashboard initiative, reminding us that, in the future, the average couple will be trying to keep track of 24 different pension arrangements.

8 September 2018 – No shouts of hurrah yet

In her regular column, Times Personal Finance Editor Anne Ashworth refers to Tuesday’s Ministerial Statement which confirmed that dashboard will not be abandoned. However, she says “there can be no shouts of ‘hurrah!’ until a firm date is set for its implementation in its most detailed form — which is the wake-up call the nation needs”.

5 September 2018 – PM support but Gov.uk Verify threatened

According to an article from Times Political Editor Francis Elliott & Financial Editor Patrick Hosking, it was the Prime Minister Teresa May herself who requested the Secretary of State for Work and Pensions to press ahead with dashboard plans.

Meanwhile a Computer Weekly report states that the Government’s Infrastructure and Projects Authority (IPA) has recommended that the Gov.uk Verify identity assurance programme (which could be critical for dashboard services) should be terminated.

4 September 2018 – Government support

Later in the day on 4 September (the day that Parliament returned from its summer recess) a written statement from the Pensions Minister was published, accompanised by a DWP Press Office tweet from the Secretary of State. The announcements, widely reported in online and other media, confirmed that the Government would support the pensions industry with the delivery of pensions dashboard services, but did not provide any further detail on the nature of that support. The DWP feasibility report is still awaited.

4 September 2018 – Support every 38 seconds

By lunchtime on Tuesday 4 September, over 180,000 people had indicated that they want a dashboard by signing the Don’t scrap the pensions dashboard petition. This number had doubled from 90,000 on 26 July, so I tweeted that citizens had been signing the petition over the summer holiday period at the rate of one every 38 seconds.

3 September 2018 – Dashboard technical requirements

My Part 2 article on dashboard technical requirements is published on page 19 of the September 2018 edition of Pensions Aspects magazine from The Pensions Management Institute (PMI).

1 September 2018 – Why can’t we have the pensions dashboard?

In her regular column, Times Personal Finance Editor Anne Ashworth asks if the entirely unprincipled Wonga was able to exploit technology, why shouldn’t pension savers have the same access to the benefits of this resource? We should demand to know why we cannot have the pensions dashboard.

31 August 2018 – Industry to launch its own dashboard

In a second article in as many days, FT Pensions Correspondent Josephine Cumbo reports that the pensions industry is preparing to launch its own dashboard if the Government withdraws its support for the initiative.

30 August 2018 – 10 million could lose £15,000 each

Reporting in an FT article, Pensions Correspondent Josephine Cumbo refers to a 38 Degrees forecast that, on average, not having a pensions dashboard could cost 10 million UK citizens about £15,000 each in terms of lost pensions.

23 August 2018 – 2019 all but impossible

In an FT Opinion piece, BBC Radio 4 Money Box Presenter Paul Lewis outlines why the pensions dashboard is still stuck on the blocks and why the original target delivery date of 2019 will now be all but impossible to achieve. Paul also speaks about this to Claer Barrett on the FT Money Show.

22 August 2018 – “Think about all your pensions” message

In a Pensions Expert article, AHC Head of Client Services Karen Partridge, after describing how responsibility has now largely passed to the individual to manage an array of pension arrangements all maturing at different times, asks: how far have trustees adapted how they communicate in line with these changes?

She suggests it is time to look again at the pensions dashboard concept, especially given that trustees can only control what happens in their individual schemes. Trustees should prompt members to include pensions from all sources in their thinking, and this should be taken into account when developing scheme-specific technological solutions.

21 August 2018 – Industry should take back control

In a Money Marketing article, F&TRC Director Ian McKenna argues that Esther McVey is both brave and right to call time on [the Government’s involvement with] the pensions dashboard, but it should not be the end for the concept. The industry now has an opportunity to take back control and implement a practical and achievable roadmap.

16 August 2018 – We can’t let Britain’s savers down

Royal London Chief Executive Phil Loney speaks in the business slot on the BBC Radio 4 Today Programme about their 2018 Interim Results. Asked (at 1:23:00) about current sources of uncertainty, Phil identifies Brexit and Government policy on pensions, in particular the pensions dashboard. He says “there are still some big holes in Government policy and the pensions dashboard is a really important requirement for people to save effectively and get value for money. We hear rumours that the Government might not now be willing to back it because it doesn’t want to take on another big initiative – we can’t let Britain’s savers down: we’ve got to find the legislative time to address these issues“. Royal London also headline this issue in their LSE Results Announcement.

15 August 2018 – Dashboard was always destined for disaster

In a Money Marketing article, Thameside Financial Planning Director Tom Kean argues that the dashboard initiative was always going to falter due to complexity, cost and consumer lack of demand. He says that putting together an amalgamated interpretation of a person’s pension assets takes qualifications, years of experience, and lots of time – it simply isn’t possible to do this with a dashboard with the range of pensions out there.

13 August 2018 – Calls for a rapid DWP response

Two well known industry commentators (John Lawson and Henry Tapper) both call for a rapid feasibility response from the DWP. In a Money Marketing article, John says if the dashboard is to be a success it absolutely needs government involvement, with the ideal situation being for government, regulators and industry to work together. In a blog article, Henry says dashboard services should be both “high integrity” and “high impact”, best achieved by a public private partnership.

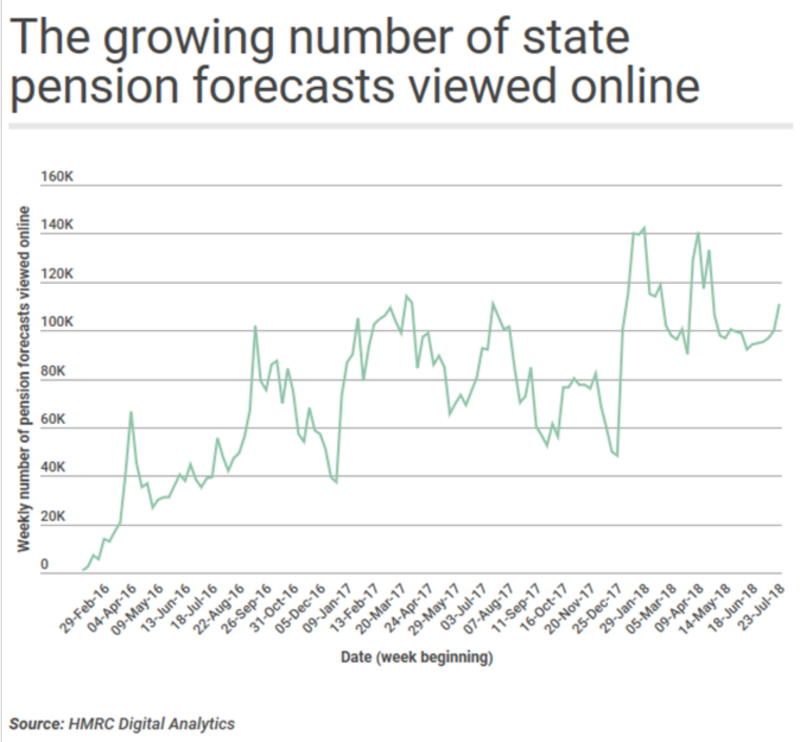

10 August 2018 – Demand for online pension data

Further evidence that there is strong, and growing, demand amongst UK citizens to see their pensions information online: Professional Pensions reports the results of their Freedom on Information request which revealed the number of views of online state pension forecasts grew by 36% in a year – from 3.3m in 2016/17 to 4.5m in 2017/18.

8 August 2018 – Petition debate in Parliament

As the number of signatures in support of 38 Degrees’ “Don’t scrap the pensions dashboard” petition reaches 130,000, a Retirement Planner article explains that the topic can now be considered for debate in Parliament (having passed the 100,000 signatures threshold).

1 August 2018 – Simpler statement research

Quietroom publish the Ignition House research on simpler annual statements. While it finds people liked the first page of the simpler defined contribution (DC) statement, it did also show that people don’t generally understand what a DC pension pot is, nor have much idea how to relate its value to a monthly income they might receive in retirement.

This is where the IFoA’s recommendation (from April 2018 below) will be very helpful, i.e. thinking about taking 3½ per cent of your pot each year as a sustainable income from age 65.

25 July 2018 – Complete misalignment with younger generations

In a powerful article, City A.M. Features Writer Katherine Denham sets out why dashboard is one of the most common sense ideas to come out of Government, and why it would be crazy to ditch it. She ends by saying: “If the dashboard is indeed sent to the scrapheap, it will be another example of the Tory party’s complete misalignment with the views and values of younger generations“.

24 July 2018 – Lords question

In House of Lords Oral Questions (on the final day of Parliamentary business before the House rises for summer recess), Labour Lord McKenzie of Luton asks “What progress has the Government made towards establishing an online pensions dashboard?“

In response, Baroness Buscombe, DWP Parliamentary Under-Secretary of State, confirms that the Government is “currently exploring the many complex issues associated with developing a pensions dashboard: our feasibility work is nearing completion and we will report to Parliament in due course“. Parliament returns on Tuesday 4 September.

In answering a supplementary question, the Baroness states that “we are working through the options around scheme participation: the decision whether to compel participation depends on a number of issues, such as the functionality, delivery model and governance of the dashboard. We will set out the Government’s view in due course”.

23 July 2018 – Mainstream coverage and petition update

The rumoured scrapping of the pensions dashboard initiative is covered in articles in the mainstream Sunday press including the Sunday Express and the Mail on Sunday.

Meanwhile, over its initial weekend, 38 Degrees’ “Don’t scrap the pensions dashboard” petition secures 80,000 signatures, and the number continues to increase.

18 July 2018 – No decision yet made

At a hearing of the Work and Pensions Committee, the Pensions Minister Guy Opperman is questioned about the previous day’s report in The Times but states that no decision has been made about how pension dashboard services should be delivered. He reiterates the Chancellor of the Exchequer’s enthusiasm in 2016 for dashboard services, but says the DWP’s feasibility work is a perfectly legitimate consideration of how the service should be provided and the way ahead. Once decisions have been made, they will be communicated: the Minister hopes this will be fairly soon, certainly this year.

Meanwhile, numerous organisations publish statements in support of the dashboard initiative, including the ABI and the PLSA who say that:

ABI – It is vital the Government stands by its promises: the pensions industry is committed but we need Government involvement to ensure the system works fairly for everyone.

PLSA – It’s vital the Government sticks to its word: the industry is strongly behind this initiative and we fully expect the Government to continue leading on the dashboard.

And the campaign website 38 Degrees launches a campaign addressed to the Secretary of State: “Don’t scrap the pensions dashboard“.

17 July 2018 – DWP’s position

DWP’s long awaited feasibility report, “for release shortly”, is due to build on the initial industry-led pensions dashboard work and to establish a path towards delivery.

However, an article in The Times, reports that the Secretary for State for Work and Pensions Esther McVey is said, by sources, to believe that the pensions dashboard service should not be provided by the state, with an announcement due after the start of Parliament’s summer recess on Tuesday 24 July.

5 July 2018 – Income target should be included

In their major Hitting the Target report, the PLSA recommend (amongst several other key measures) that new retirement income targets should be displayed on pensions dashboards, and that there should be at least one high-profile dashboard hosted by a major public body, such as the single financial guidance body.

3 July 2018 – Government and multiple dashboards

A Professional Adviser article reports how the ABI Head of Retirement Policy Rob Yuille called at a recent conference for there to be both a government dashboard and multiple commercial dashboards.

2 July 2018 – Data littered with errors

In a Daily Telegraph article, Experian is reported to have found that one in eight pension records have the wrong address attached to them in one large pensions database.

29 June 2018 – Better to wait and get it right

In a BusinessNewsWales article, Quantum Advisory Partner Stuart Price argues that it’s important not to rush the dashboard development and risk making a mistake; the right thing to do is take the appropriate time to ensure we get it right first time.

22 June 2018 – Feasibility study for release shortly

In the response to the Work and Pensions Committee’s Report on Pension freedoms (published on 5 April – see below), the Government confirms that the DWP’s feasibility study is for release shortly.

18 June 2018 – Majority consumer support for single dashboard

The People’s Pension publish a press release summarising their research findings that seven out of 10 UK workers with a private or workplace pension want a single pensions dashboard to help them keep track of their savings, with nearly half admitting that they don’t know how much they’ve saved for their retirement.

18 June 2018 – Getting it right first time

In a Professional Pensions article, Stephanie Baxter discusses the increasing argument that the dashboard’s launch should be delayed in order to get it right the first time around. However, if there is a delay beyond 2019, it should not too long as savers are crying out for the dashboard.

14-15 June 2018 – Dashboard challenges

Two Money Marketing articles set out two key challenges dashboard will face:

- Aberdeen Standard Investments Head of Retirement Gregg McClymont argues that citizens are just too disengaged from pensions for the dashboard to succeed

- Pensions Policy Institute Director Chris Curry highlights their recent analysis that only a quarter of citizens understand how much state pension they will get thus undermining effective retirement planning.

12 June 2018 – Scale testing complete

Following their scale analysis paper in April (see below), Origo publish a press release announcing that they have successfully scale tested their dashboard infrastructure for the anticipated usage by 15 million active consumers.

8 June 2018 – Automatic enrolment providers keen to engage

In their Engagement Deficit report, ShareAction find that, subject to further future clarification, nine of the largest automatic enrolment pension providers intend to supply member data to the proposed pensions dashboard.

6-8 June 2018 – Pre-feasibility industry views

Ahead of the publication of DWP’s feasibility report due this month, various commentators publish views about dashboard. One key point on which all parties agree is participation by schemes and providers must be mandatory. However, there’s a major point of disagreement over whether there should be a single or multiple dashboards:

- Retirement report: In a suite of recommendations accompanying their 14th annual Retirement Report, Scottish Widows state that people will lose confidence in the dashboard if some schemes or plans are missing, so the priority for the dashboard’s first phase of delivery should be for it be fully populated with all defined benefit, defined contribution, public sector and state pensions.

- Industry survey: In the results of an industry survey, TISA also finds overwhelming support for mandatory pension provider participation to ensure full coverage, but with nearly three quarters of respondents preferring a multiple dashboard solution over a single dashboard.

- Press articles: In a Professional Adviser article, Space Managing Partner Marilyn Cole writes that we need really firm commitments from all government departments and regulators to get all pension information on to the dashboard and not just the pensions for the younger defined contribution and auto-enrolled generation. And finally, in a Pensions Expert article, Andy Tarrant (Head of Policy and Government Relations at The People’s Pension), writes in support of a single, public-good dashboard, as called for by the Work and Pensions Committee but at odds with the TISA findings above.

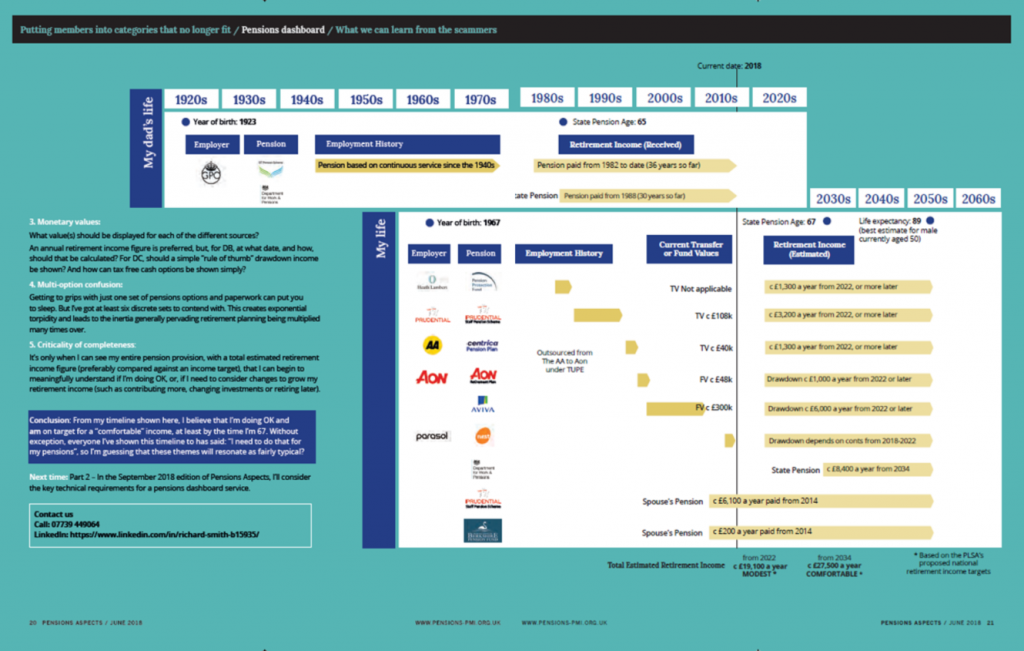

1 June 2018 – Dashboard case study

My personal case study is published on page 18 of the June 2018 edition of Pensions Aspects magazine from The Pensions Management Institute (PMI) (screenshot below).

22 May 2018 – Support from new ACA Chair

The Association of Consulting Actuaries (ACA) elects Jenny Condron as its first female Chair. In a press release commenting on her election, Jenny highlights the importance of the pensions dashboard initiative: “If we can make headway supporting initiatives like the dashboard, then we’ll achieve a great deal”.

21 May 2018 – Parliamentary questions

Adam Afriyie and Jeremy Quin, Conservative Members of Parliament for Windsor and Horsham respectively, ask the Pensions Minister some questions about the pensions dashboard in Parliament. As well as congratulating Prince Harry and Meghan Markle on their wedding at the weekend, the Minister confirms his view that a properly constituted dashboard, developed in collaboration between the FinTech industry and Government, can help nudge people to save more and deliver great progress for everyone in the UK.

15 May 2018 – A user-managed solution

In an extended press release, Origo Managing Director Anthony Rafferty and Chief Architect Kenneth May describe how the relatively new User-Managed Access (UMA) open security standard could allow dashboard users to control who can access their pensions data and for how long. This, they argue, would create a better user experience which would enable consumers to become better engaged with their pensions.

8 May 2018 – An extremely useful tool

In its final report, A New Generational Contract, the Resolution Foundation’s Intergenerational Commission states (albeit on page 187, 85% of the way through the report) that the pensions dashboard will provide an extremely useful tool for individuals to track their various pension pots and their value. The report goes on to say, however, that individuals would be better served if it were also easier to consolidate pots.

26 April 2018 – Alignment to MOT and revised communications

The ABI five point plan, launched at their Retirement Interventions and Innovation Event in London, states that pensions dashboard content should be integrated with the Mid-life MOT. Dashboard services should also be aligned to a revised suite of tailored and phased pension communications which are given to citizens throughout their lives.

25 April 2028 – IFoA sustainable DC income

In a press release and associated policy briefing, the Institute and Faculty of Actuaries (IFoA) recommends that people can sustainably withdraw 3½ per cent of their DC pension pot as a income from age 65 and not run out of money. In a dashboard user’s mind, this is going to be the best way for them to think about connecting their current DC pension pot value(s) to the income(s) they might generate in retirement (ignoring future contributions and investment returns).

18 April 2018 – 15 million dashboard users?

The financial press reports on a recent analysis paper published by Origo which found that pensions dashboard services will be attractive to approximately 13-15 million people.

5 April 2018 – Work and Pensions Committee report

The House of Commons Work and Pensions Committee publishes its Report on Pension freedoms. The report states that the case for a publicly-hosted pensions dashboard is clear cut. The case for multiple dashboards hosted by providers is far less convincing and would add complexity to a problem crying out for simplicity. The report goes on to recommend that the Government should mandate all pension providers to provide the necessary information to a single dashboard operated by the new single financial guidance body, over a phased implementation period to be agreed.

4 April 2018 – Feasibility report expected in due course

A DWP spokesperson is reported in New Model Adviser as saying that the update on its feasibility work, originally planned to be published in March 2018, will now be published “in due course”. The report is due to build on the findings of the initial industry-led work and will seek to establish a path towards delivery of pensions dashboard services.

26/27 March 2018 – Self-employed TechSprint

A two-day innovation event is run at Aviva’s Digital Garage in Hoxton exploring ideas for making retirement saving more accessible for Britain’s 5 million self-employed people. The TechSprint challenges teams of experts to develop practical interventions, focusing on the roles that technology, pensions dashboard and open banking could play in helping the self-employed build later life financial resilience. Of nine competing teams, the overall winners propose using open banking to smooth out irregularities in self-employment income while also earmarking rainy day savings and long term savings.

1 March 2018 – Vision for dashboard uses

In an extensive Professional Adviser article, Dunstan Thomas Retirement Strategy Director Adrian Boulding sets out a vision of the multiple potential uses of pensions dashboard services in the fullness of time.

28 February 2018 – Raconteur special report

Writing in a Raconteur special report on workplace pensions, mallowstreet Chief Executive Stuart Breyer argues that the ways in which the industry facilitates retirement saving (including pension dashboards) need to be easy, simple, personalised, intuitive and rewarding.

27 February 2018 – Scottish political endorsement

Delivering a keynote speech at the ABI Annual Conference, First Minister of Scotland Nicola Sturgeon endorses the “hugely beneficial impact” of the pensions dashboard initiative, in particular mentioning the role played by Edinburgh-based Fintech Origo.

20 February 2018 – How to make it work for consumers

Which? publishes an extensive policy report, authored by independent consultant Dominic Lindley, setting out a suite of 12 recommendations for taking forward the pensions dashboard initiative, most importantly: comprehensive coverage, consistent display of pension information and control of dashboard providers.

9 February 2018 – If we build it, will they come?

In a New Model Adviser article, Copia Capital’s Malcolm Small envisions a future world where pensions are discussed at dinner parties. He concludes, though, that it remains uncertain whether pensions dashboard services will finally engage UK consumers, but, if we don’t build the dashboard, we’ll never know.

7 February 2018 – Origo comment on CSFI report

Flagging the recent Dependency Trap report from the Centre for the Study of Financial Innovation (CSFI), the new Origo Managing Director Anthony Rafferty comments, in an Actuarial Post article, that it’s important to get the dashboard basics right (for example, robust identification and pension finder services) so that firm foundations are laid on which dashboard services can be developed.

6 February 2018 – Open banking: the pre-cursor to open pensions

In two separate articles, Experian’s Richard Howells and Dunstan Thomas’ Adrian Boulding set out how open banking, which went live in January, is the pre-cursor to a new world of “open pensions” in which pensions dashboard services will dramatically enhance consumers’ retirement experiences as well as providing significant opportunities for product providers and advisers.

17 January 2018 – Infographic of “Big DB”

Using data from Pension Funds Online, Professional Pensions Editor Jonathan Stapleton uses Infogram to publish an online infographic of the UK’s 20 biggest funded DB schemes. With total assets between them of approximately half a trillion pounds, these 20 schemes would make an excellent set of early dashboard volunteers. In particular, between them, they utilise all the major defined benefit administration systems (from which data would need to released for display on dashboards).