16 December 2021 – 12 month blog and PLSA A-Z

Two dashboards updates today to round off the year:

- A blog article from PDP Principal Chris Curry on the last 12 months’ activity, summarising the significant progress made by the programme in 2021

- An A-Z Guide for industry from the PLSA, summarising the key issues which still require resolution for initial dashboards success.

15 December 2021 – First dashboard providers

PDP announces that the first four dashboards will be provided by: Aviva, Bud, Moneyhub and the Money & Pensions Service.

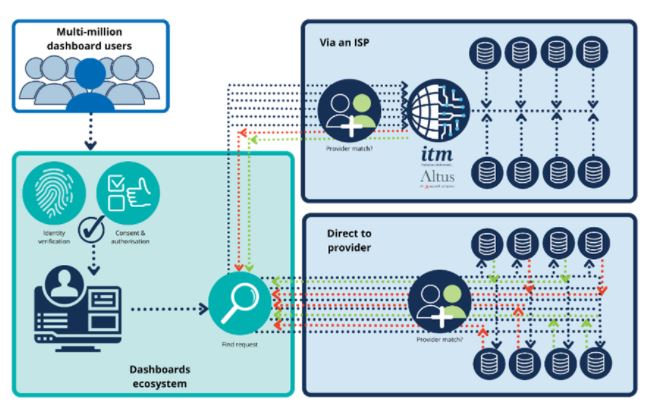

14 December 2021 – Why schemes need ISPs

ITM Head of Propositions Rob Dodson explains clearly in a Professional Pensions article why pension schemes might wish to contract with an Integrated Service Provider (ISP) in order to connect with the pensions dashboards ecosystem.

7 December 2021 – Data matching guidance

PASA publishes Guidance for schemes on data matching, supported by the PLSA and the ABI, as well as by PDP and TPR:

6 December 2021 – Another ISP

Following the Altus/ITM announcement on 23 November (below), Heywood Pension Technologies (HPT) announce they are also developing an Integrated Service Provider (ISP) solution, which they will offer to both existing and non-HPT customers.

30 November 2021 – EIOPA advice

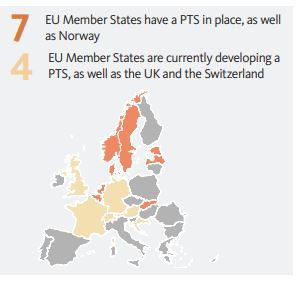

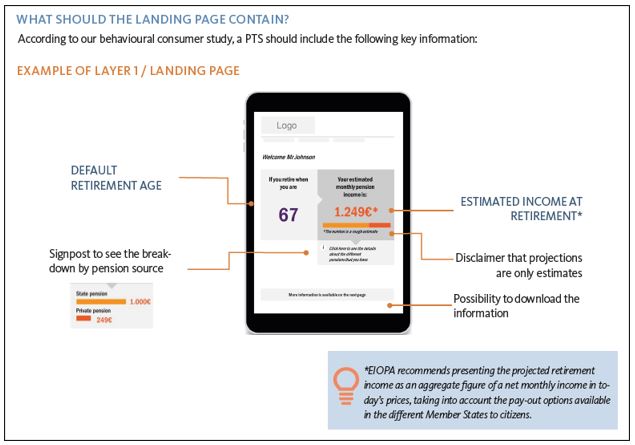

The European Insurance and Occupational Pensions Authority (EIOPA) publishes advice for the European Commission on best practice for the development (by EU Member States) of pensions dashboards – EIOPA call them national Pension Tracking Systems (PTSs).

Seven EU Member States already have a PTS (Belgium, Denmark, Estonia, Latvia, The Netherlands, Slovakia and Sweden) and four more are currently developing a PTS (Austria, Croatia, France and Germany). But 16 EU Member States, to whom this advice is mainly directed, do not currently have a PTS.

As the UK is no longer in the EU, EIOPA’s advice is not highly relevant for UK dashboards, but it is interesting nevertheless. Some examples of where the UK pensions system, and the approach the UK is taking on dashboards, are deviant from the best practice advocated by EIOPA are:

a) EIOPA recommend that the landing page for a PTS should only show one number, i.e. total monthly projected income at a single age (see their example below). This is never going to be possible in a UK context given the different pension ages which exist across schemes, and across different pension tranches within a single pension entitlement.

b) EIOPA’s report only mentions defined benefit (DB) pensions once, and does not advise how a mix of DB and DC pension incomes should be presented (at the different scheme / tranche pension ages mentioned above). But presenting comparable DB and DC incomes simply, and understandably, is one of the core aspects of the UK dashboards challenge.

c) EIOPA recommend that the provision of data to a PTS by schemes should be mandated by law but managed by an independent body. In the UK, however, the ongoing data requirements will be managed through Government regulation, which could prove problematic for the recommended iterative “step by step” development of dashboards.

23 November 2021 – First ISP announced

In joint press releases, Altus and ITM announce they are joining forces to create the first Integrated Service Provider (ISP) service to connect with the dashboards ecosystem.

8 November 2021 – Committee quizzing

Quizzed by the Work and Pensions Committee about dashboards, the Pensions Minister Guy Opperman confirms (at 17:41:20) his vision that dashboards will “democratise pensions, increasing accessibility and greatly simplifying things, leading to greater comprehension and capability, and, in the longer term, consideration of costs & charges and consolidation”.

Earlier, though (at 16:23:30), he cautions that it is a “ginormous project – probably the biggest IT project being conducted by Government”.

1 November 2021 – MaPS Review

In his Departmental Review of MaPS for the Government, Tom McPhail calls for greater clarity over PDP’s costs, for both development and ongoing operations. Tom also reports that: “The PDP is a complex project; there are many ways in which it could fail”.

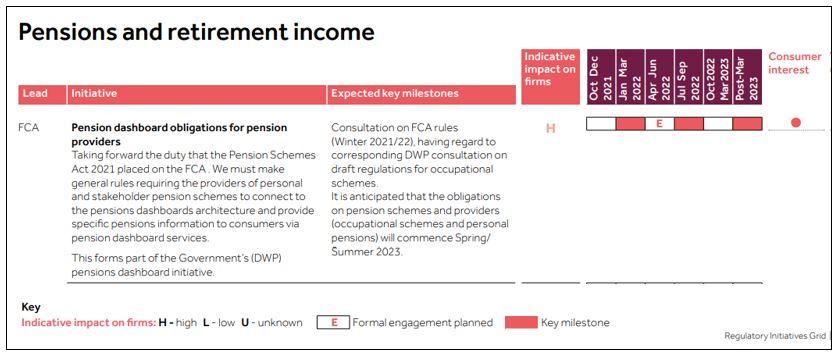

1 November 2021 – Regulatory Grid

In the 4th edition of its Regulatory Initiatives Grid the FCA confirms it plans to consult on dashboards rules in the first half of 2022.

26 October 2021 – 4th Progress Update

PDP publishes its fourth six-monthly Progress Update Report, as well as an introductory blog by Programme Director Richard James.

19 October 2021 – Simpler statements response

DWP responds to its consultation on simpler annual benefit statements (SABS).

In the antepenultimate paragraph (40), DWP says: “Several responses commented on the relationship between SABS and dashboards … Content to be displayed on dashboards will be informed by user testing [which] we anticipate will be broadly in line with that available on statements, recognising SABS and dashboards are not intended to duplicate each other”.

13 October 2021 – Staging CfI Summary

PDP publishes a summary of responses to their Call for Input on Staging.

11 October 2021 – Identity service procurement

PDP commences the procurement of an interim Identity Service provider.

5 October 2021 – Dashboard providers wanted

PDP opens a three-week window for organisations to apply to be one of up to three commercial alpha dashboard providers (alongside the MoneyHelper dashboard from MaPS), with a new dashboard providers hub providing supporting information.

30 September 2021 – Small pots update

In its comprehensive Initial Update Report, the PLSA / ABI Cross-Industry Small Pots Co-Ordination Group reviews synergies between the pensions dashboards and small pots initiatives. The report recommends:

a) co-ordination between PDP and the Small Pots Group to explore opportunities and challenges of closer alignment;

b) small pots data matching protocols should be aligned with the PASA Data Matching Convention (DMC) Guidance, whilst recognising small pot consolidation may require stricter matching criteria;

c) creation of dashboards ISP services should be mindful of small pots requirements, but

d) right now, resources should be focused on getting the core dashboards ecosystem up and running, rather than diverting attention to small pots requirements, with the caveat that Capgemini/Origo should be kept abreast of developments on small pots.

22 September 2021 – WPC session

At a Work and Pensions Committee oral evidence session, Chris Curry and Carolyn Jones from MaPS explain how the MoneyHelper dashboard will be just one component of the much more extensive Retirement Planning Hub being developed by MaPS. Watch from 11:14:30.

16 September 2021 – Consumer information

PDP launches a new Consumers area on its website, and Senior Policy Manager David Marjoribanks introduces the topic of consumer protection in a blog article.

14 September 2021 – OB research report

An Open Banking (OB) research report published by challenger bank Zopa includes some important lessons for how dashboards should be promoted, designed and launched:

1) Total usage: Zopa surveyed 2,000 people in May and Aug 2021. They found that, since OB’s launch in 2018, 15% of adults said they had used OB at least once. With an UK adult population of nearly 53 million, 15% equates to c.8 million people.

2) Active usage: However, as of the start of 2021, only 3 million people are active OB users.

3) Market penetration: The relatively low active usage of OB is despite 73% of the adult population (c.38 million) using digital banking at least once a week. 3 million out of 38 million is about 8%.

Why this low uptake of OB amongst retail banking customers? Zopa’s Chief Commercial Officer Tim Waterman cites three reasons:

A. Lack of promotion: OB hasn’t been effectively promoted. Zopa’s survey found that 63% of people had never heard of Open Banking.

B. Security fears: Of those who have heard of OB, a significant proportion of consumers are wary of sharing data with third parties. 40% of Zopa’s survey participants said they were somewhat or completely uncomfortable with the concept of OB.

C. Lack of usefulness: Of those who have heard of OB, and who are comfortable with the data security arrangements, many found that early OB services are generally limited and low value, for example “viewing all my bank accounts in one place” (with relatively few people have multiple accounts with different banks, unlike their multiple pensions).

Learning from this, pensions dashboards need to be adequately promoted, allay security fears, and be positioned as providing a useful service from day one (i.e. finding a user’s pensions, hence the current significant industry effort on the Data Matching Convention (DMC) Guidance).

Ideally, by 2025 we need people to be saying: “I’ve heard of pensions dashboards; I’m not scared of them; and I think they’re really useful.”

14 September 2021 – PDP ecosystem group

PDP’s Helen Scriminger provides an excellent blog update on the activities of PDP’s newly formed Ecosystem Technical Working Group.

6 September 2021 – Digital supplier appointed

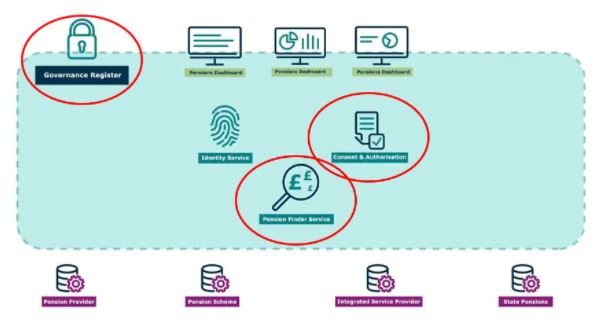

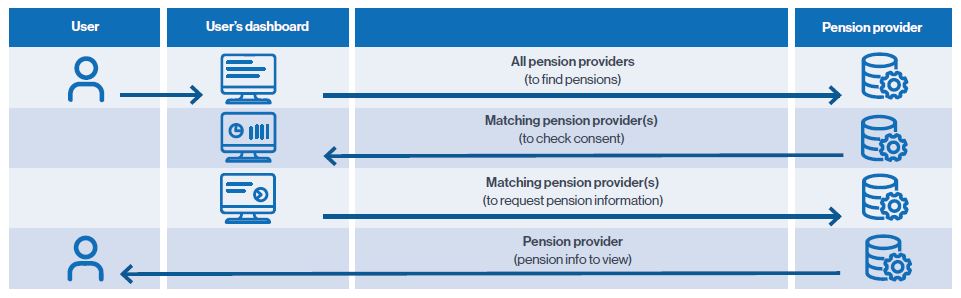

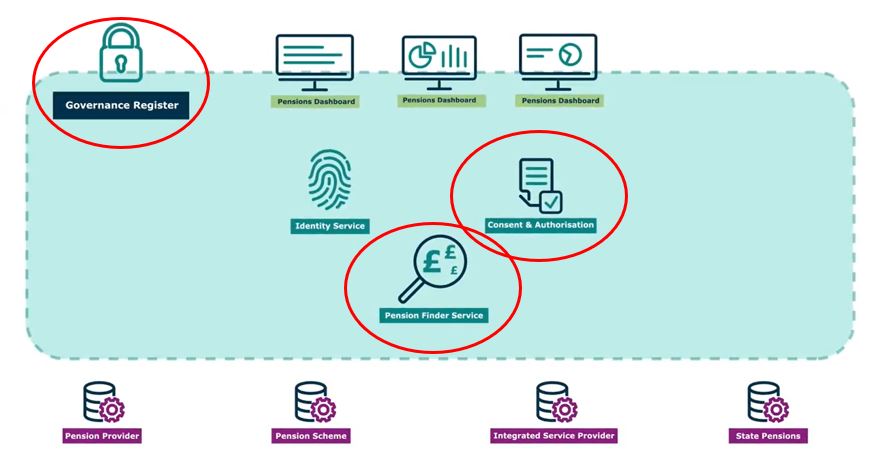

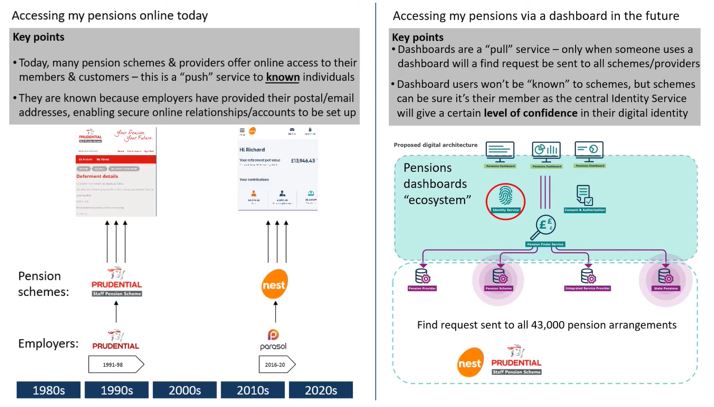

In media releases, PDP announces Capgemini working with Origo have been appointed to supply the central digital architecture of the pensions dashboards ecosystem (see red circles in the diagram below):

31 August 2021 – PMI confidence survey

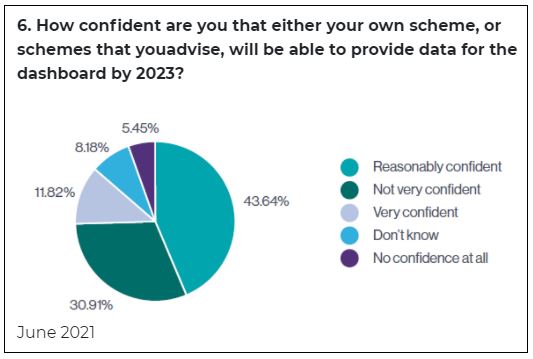

The Pensions Management Institute (PMI) publishes the June 2021 results of its twice-yearly Pulse Survey, completed by its members who are pensions professionals. Questions 6 and 5 were about pensions dashboards.

In response to Q6, 56% of respondents were very or reasonably confident the schemes they work with could provide the required data for dashboards by 2023:

Q5 was less useful as it asked how confident respondents are that pensions dashboards will be delivered by 2023. This isn’t the stated policy intention so the responses were less relevant.

For clarity, in its May 2021 Call for Input on Staging, PDP emphasised:

“It is important to distinguish between staging (from April 2023) and the point at which data becomes publicly accessible – i.e. when dashboards are launched to the public … It will be key to achieve a critical mass of pensions findable, before a viable pensions dashboards service can be launched to the public. We call this critical mass the ‘dashboards available point’ (DAP) – the point at which it will be reasonable to make dashboards publicly available. Dashboards will not be launched at the point the very first providers are staged. We anticipate compulsion duties will be in effect for many pension schemes and providers before dashboards go live. This will allow for thorough, ongoing scale and operational testing of the end-to-end service with live data in a controlled environment before the service is launched to the public. Our recommendations aim to achieve this public launch [the DAP] at the earliest possible date.”

However, no specific date for the DAP has currently been proposed (although a DAP in mid to late 2024 might provide a reasonable user experience for savers).

13 August 2021 – A national reluctance

In a very insightful Financial Reporter article, My Pension Expert Executive Chairman Andrew Megson highlights their recent research about consumers’ reluctance to engage with technology when thinking about retirement. Dashboards need to recognise this reluctance: they mustn’t just be simple to use, but must be presented so that people want to use them.

9 August 2021 – TPR lead recruitment

TPR advertises for a Business Lead role to “define the vision, objectives and critical success factors for delivering TPR’s regulatory approach to pensions dashboards”.

6 August 2021 – Three alpha articles

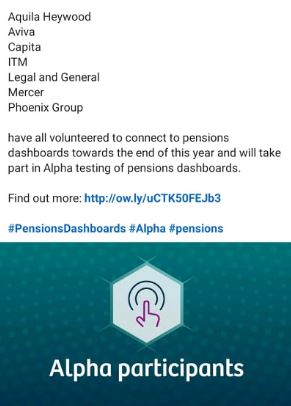

3 of the seven 7 data providers publish updates:

- Aquila Heywood Managing Director Colin Lewis blogs about some recent data quality research they’ve done

- Capita Pensions Director (Data, Remediation & Projects) Paul Capel talks in a LinkedIn video post about the dashboards’ “essential wake-up call”

- Legal & General Co-Head of DC Stuart Murphy argues in a Pensions & Investments comment piece the only way to engage members is to communicate with them in a manner that best suits their needs.

4 August 2021 – Interim ID procurement

PDP confirms in a short update that, in October 2021, it will procure an interim (two-year) digital identity service to tide over the programme until the UK Digital Identity and Attributes Trust Framework is in place.

29 July 2021 – Two new research reports

PDP and MaPS each publish complementary qualitative research reports (by Ipsos MORI and PwC Research respectively), explained in a blog from MaPS Head of Pensions Policy and Strategy Carolyn Jones.

29 July 2021 – Data Matching Conventions

Click the Tweet below for the full press release

28 July 2021 – Seven alpha data providers

PDP Head of Onboarding Paul Noone blogs about onboarding data providers to the dashboards ecosystem and announces the names of the seven data providers who will be first to connect:

Aquila Heywood said (on LinkedIn): “We are delighted to announce our alpha provider involvement with the PDP. As key contributors to the testing phase, we are looking forward to building a strong foundation for the delivery of the solution to our customers.”

Capita Pension Solutions said (on Twitter): “At Capita, we are delighted to be supporting PDP in the initial Alpha test phase.”

Maurice Titley, ITM Chief Innovation Officer said (in Professional Pensions): “We are proud to be supporting the PDP as an alpha, testing and refining early connections and, hopefully, making the process that bit easier for others who follow.”

Emma Byron, Legal & General Retirement Solutions Managing Director said (in Money Marketing): “We are delighted to be part of the PDP working with the industry to build the foundations of a thriving dashboards ecosystem.”

Andy Curran, Phoenix Group UK & Europe CEO of Savings and Retirement said (in FT Adviser): “What’s under the bonnet is vital to success and getting the right specification is key. We intend to play a key collaborative role and it’s essential our industry works together in moving the project forward.”

21 July 2021 – WPC follow up session

In a follow up to their 16 June oral evidence session, the Work and Pensions Committee (WPC) heard from seven witnesses from Aon, AJ Bell, B&CE (The People’s Pension), Just Group, LCP, Legal & General and Scottish Widows.

The Committee asked about dashboards at 10:33:15 and 11:30:15. Responses mentioned:

a) the importance of dashboards’ place in the market, reuniting people with their pensions and helping them have knowledge of what their pensions are

b) the completeness (or near completeness) of dashboards coverage for both a good user experience and to not unbalance the market

c) understanding whether users are more engaged by seeing on dashboards pensions they already know about or pensions they have forgotten about

d) the need for older DB and DC pensions to be included and, eventually, pensions in payment

e) clear contact information for each pension

f) the consumer protections and safeguarding features required to prevent unintended harms and bad decisions

g) the fact that dashboards will develop over time, but we have to put the basics in place first

h) the teething problems which will need to be overcome, but that we have to get going to start addressing these teething problems

i) the comparability and consistency of information across different pensions to minimise user confusion, aiming for as much consistency as possible (rather than a wide variety of different dates and assumptions across different pensions)

j) the need to work slowly to properly understand what behaviours dashboards generate, recognising “it’s a big jump from knowing what you’ve got to knowing what you’ve got to do with what you’ve got”.

15 July 2021 – Amber Status

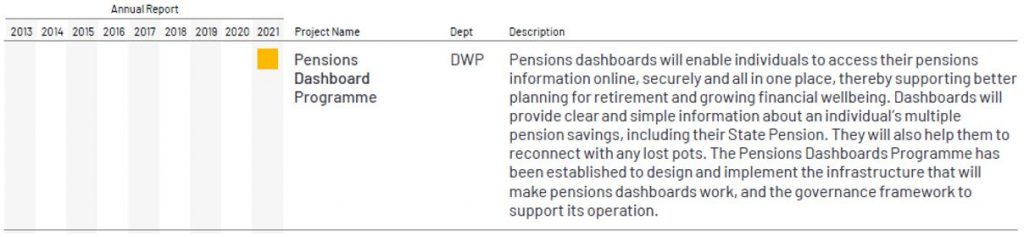

The Cabinet Office / HM Treasury Infrastructure and Projects Authority (IPA) publishes its 2021 Annual Report on the Government Major Projects Portfolio (GMPP) (currently 184 projects), including, for the first time, the Pensions Dashboards Programme (PDP) (with a Delivery Confidence Assessment (DCA) of Amber and an end date of March 2025).

13 July 2021 – EIOPA best practice

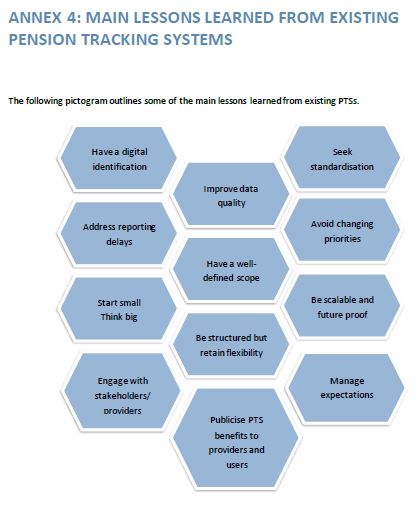

The European Insurance and Occupational Pensions Authority (EIOPA) consults on best practice advice to EU Member States about how to set up national pension tracking services (PTSs), i.e. what we’re calling pensions dashboards here in the UK (what EIOPA calls pensions dashboards is something else, which is confusing). The final advice is due to go to the European Commission in December 2021.

The detailed consultation includes a handy pictogram of top tips from the other countries which have developed PTSs (below).

9 July 2021 – Staging CfI responses

The PDP Call for Input (CfI) on staging closes and some organisations make public their responses (and / or media releases summarising their responses), including:

- Hymans Robertson, advocating Find first

- LCP, advocating both Find first and launching for older workers first

- Local Government Association and Local Government Pensions Committee

- Pensions Administration Standards Association (PASA), including a case study and advocating Find first (supported by industry survey results)

- Pensions and Lifetime Savings Association (PLSA), recommending PASA’s Find first approach

- Sackers, highlighting administration and integrated service provider (ISP) issues

- Society of Pension Professionals (SPP), advocating Find find to test matching

- The Investing and Saving Alliance (TISA), highlighting that timescales for readiness will be taken out of providers’ hands where they are reliant on technology partners

6 July 2021 – Admin and comms impacts

Holly Roach’s extended Professional Adviser article looks (in more detail than has been done before) at the radical impacts dashboards will have on both pensions administration and member communications. A great read!

5 July 2021 – Small pots linkages

The PLSA publishes a small pots thought leadership report, authored by Altus and ITM, including ideas on how dashboards solutions should be developed with a view to helping with small pots matching and consolidation.

2 July 2021 – Eversheds Speedbrief

With the dashboards initiative picking up pace, various pension firms (such as administrators, consultants, laywers and software providers) are publishing material for their clients. One example is an Eversheds Sutherland Speedbrief, describing dashboards in a nutshell and looking at what trustees should be focusing on now.

1 July 2021 – PLSA Viewpoint

The Summer 2021 issue of Viewpoint (the official journal of the PLSA) includes my dashboards advocacy to schemes to get ready to “connect, compare and convey”.

29 June 2021 – More joined-up approach?

In an Actuarial Post article, Aegon Head of Pensions Kate Smith calls for a “more joined-up approach [on pensions policy making] across government, regulators and the PDP”. One idea to support this would be to delay the implementation of Simpler Annual Benefit Statements by a year to April 2023.

18 June 2021 – BBC You & Yours

PDP Principal Chris Curry talks dashboards with Peter White on BBC Radio 4’s You & Yours. Click the image below to listen (it’s 3½ minutes, starting at 25:30). Peter says at the end: “I suspect we’ll be talking about this some more!”

16 June 2021 – W&P Committee session

At a Work and Pensions Committee Oral Evidence session, Stroud MP Siobhan Baillie asks representatives from the ABI, ACA, PLSA & SPP for an update on dashboards. Click the images below to watch for 5 minutes from 11:31:45 (or 12:08:10 as the session ran late) – everyone is very optimistic!

Points made include: the scale of the programme, digital identity, getting the basics up and running first, the importance of Finding pensions, estimated retirement income challenges, increasing trustee interest, and the possibility of a launch from 2023.

10 June 2021 – Identity responses

In a blog article, PDP Senior Product Owner for identity Jon Pocock, summarises the responses received to February’s Call for Input on the central identity service. Next steps include adding more details about the identity approach to the PDP data providers hub, and, by the end of the summer, publishing details of PDP’s work on how liability will be apportioned across the digital architecture, including the central identity service.

7 June 2021 – “Find my pensions” first?

The Pensions Administration Standards Association (PASA) launches a 10-minute industry-wide survey on dashboards: https://www.surveymonkey.co.uk/r/SYR332Z.

In an accompanying explanatory Professional Pensions article, PASA Chair Kim Gubler sets out PASA’s view that dashboards should be launched soon, but with an initial primary service to Find the pensions of people using dashboards.

LCP Partner and former Pensions Minister Steve Webb tweets his support:

A few days later, in a Pensions Expert podcast on 10 June (starts at 15:00), Steve’s colleague LCP Partner Francesca Bailey tells Benjamin Mercer she thinks PDP should focus on getting “Find” working first by 2025. Pensions Management Institute (PMI) President Lesley Alexander concurs.

The following week, on 15 June, immediate past President of The Society of Pensions Professionals, and PLSA Policy Board member, Paul McGlone also advocates “Find first” in a Pensions Age guest comment article.

7 June 2021 – MoneyHelper beta launch

The Money & Pensions Service (MaPS) launches the beta version of its consumer-facing MoneyHelper website, with a full launch targeted for the end of June. When the MaPS pensions dashboard is launched, it will be the MoneyHelper pensions dashboard – launching this consumer brand is the start:

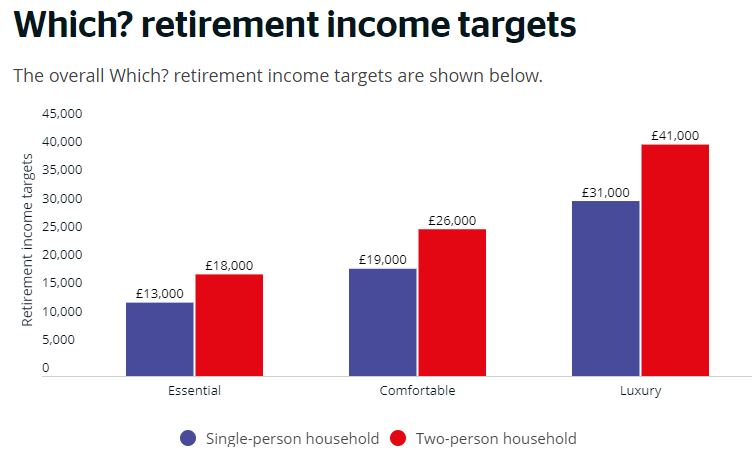

2 June 2021 – New retirement income targets

In a news story, promoting their new retirement income targets, Which? Money Editor Jenny Ross repeats calls for the Government to “move swiftly to introduce long-awaited pensions dashboards”.

1 June 2021 – Rapid Evidence Report

The PDP publishes the Behavioural Insights Team (BIT)’s rapid evidence assessment (REA) report reviewing existing domestic and international literature on pensions dashboards. The report looked to highlight what works in increasing people’s awareness of their pensions via dashboards and to identify priority evidence gaps in the existing literature.

In a Pensions Age article on BIT’s report the following week (10 June), Sophie Smith highlights BIT’s call for continued testing and development once dashboards are live to ensure their continued effectiveness: PDP, BIT says, should avoid a ‘set and forget’ approach.

28 May 2021 – PDP / Industry bridge role

The PDP advertises for what will be an absolutely crucial role on the programme providing a critical communication “bridge” between Government and industry on dashboards. The role is called Industry Relationship Manager and the closing date for applications is Thursday 17 June 2021.

27 May 2021 – Staging Call for Input

The PDP launches a critically important Call for Input (CfI) on the staged compulsory provision of pension scheme data for dashboards. The CfI is supported by a new Data providers hub, with information on data standards and the dashboards digital architecture, as well as a blog article and press release.

Meanwhile, you can watch my third dashboards video with my ideas on what will be the best way to rollout dashboards in the UK.

19 May 2021 – TPR 3-year Corporate Plan

The Pensions Regulator (TPR) publishes its three-year Corporate Plan 2021-24, including its plans to engage proactively with the pensions industry as it prepares to comply with the dashboards legislative framework. TPR sees the development of dashboards as “an opportunity to engage with industry to drive up data standards and build a focus on the work of administrators and administration software providers”.

17 May 2021 – Simpler DC statements consultation

The DWP launches a six-week consultation on proposals to introduce mandatory simpler annual benefit statements for defined contribution (DC) pension arrangements from April 2022. The announcement states that “These changes build on plans for the pension dashboard” but it is not explained what that actually means.

14 May 2021 – Slippage maybe?

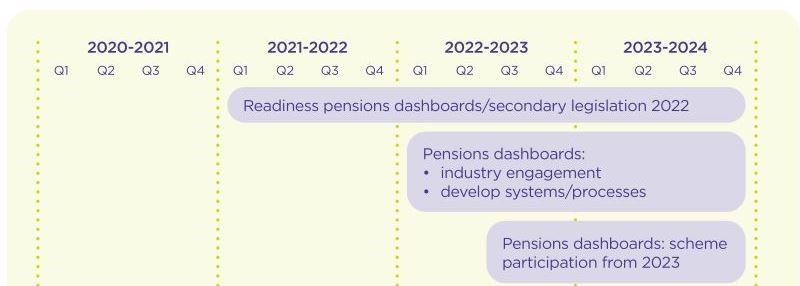

Managing Editor Oliver Smith out-nerds me in an AltFi article with a forensic analsyis of PDP’s May 2021 timelines compared to the original published in October 2020, detecting (from the underlying detail) potential slippage and the critical importance now being placed on 2022.

13 May 2021 – PDP publication package

The Pensions Dashboard Programme (PDP) publishes a suite of materials comprising:

- A press release summary update

- A blog article from new Programme Director Richard James

- A 3rd biannual Progress Update Report

- A 3rd explanatory video, this time focusing on delivery partners

- Three different levels of timeline:

- An updated Programme phases timeline with near term deliverables

- A new Programme timeline with deliverables through to 2024

- A new Data providers timeline outlining what schemes must do when.

7 May 2021 – Six PMI magazine articles!

The May 2021 edition of the PMI Pensions Aspects magazine contains six articles that mention pensions dashboards. Two are from:

- PDP Principal Chris Curry discussing the differences between pensions dashboards and open banking (including the diagram below), and

- LCP Partner (and former Pensions Minister) Steve Webb explaining the issues schemes will face when attempting to match personal data to enable pensions to be found.

26 April 2021 – Upcoming PLSA webinar

The Pensions and Lifetime Savings Association (PLSA) announces a forthcoming Policy Insights Webinar on dashboards on 10 June. Alongside PDP Principal Chris Curry and PLSA Director of Policy Nigel Peaple, I will be speaking, in my new role as PLSA Pensions Dashboards Consultant.

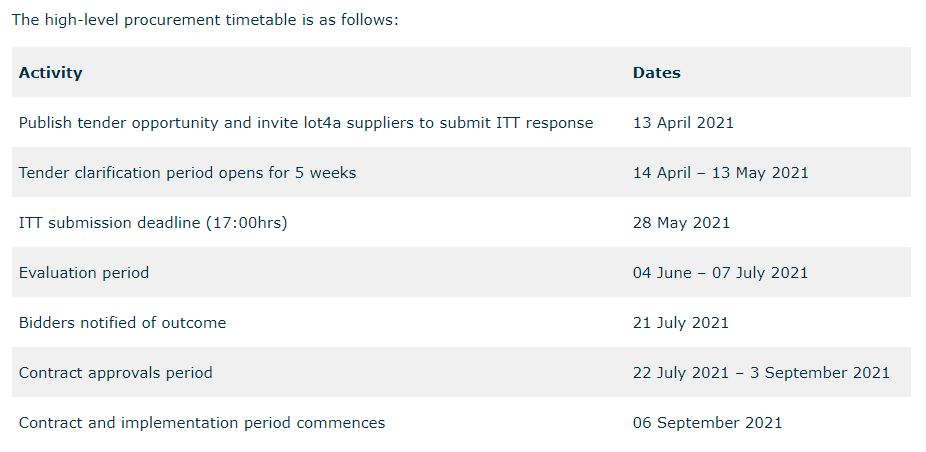

13 April 2021 – Launch of procurement

Publishing an invitation to tender, the PDP launches the process to procure a supplier of the pensions dashboards ecosystem digital architecture. This includes the following technology components: Governance Register, Consent & Authorisation service, Pension Finder Service (there will be a separate procurement process for the Identity Service):

The PDP’s procurement timeline is ambitious, aiming to have appointed a digital supplier within five months, by the start of September:

1 April 2021 – Programme Director starts

The PDP tweets that new Programme Director Richard James starts today (scroll down to the 22 February entry for more details on Richard).

26 March 2021 – FCA on open finance

The FCA publishes a feedback statement on its Open Finance Call for Input, which ran from December 2019 to October 2020. As open finance develops, the FCA wants to help ensure that the needs of consumers are considered from the outset, with systems and standards designed with the consumer in mind. One of the ways the FCA will do this is by sharing lessons from the development of pensions dashboards.

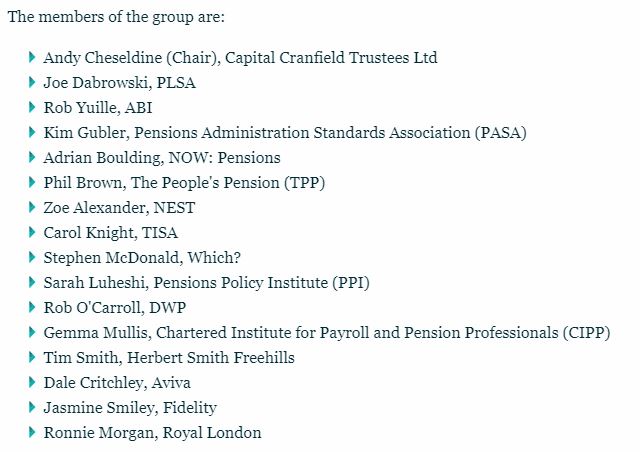

24 March 2021 – Small Pots Group

In a press release, the PLSA and ABI announce the establishment of a group to move forward solutions to the small pots issue.

As set out in the December 2020 report from the DWP-sponsored small pots industry working group, matching and data standards for dashboards will be instrumental in helping with the small pots problem, and completing the dashboards legislation and implementation programme should be the first priority.

The new joint PLSA/ABI-sponsored small pots group will publish a summer progress report.

23 March 2021 – PwC practical guide

PricewaterhouseCoopers (PwC) publishes a detailed practical guide, for pension schemes and providers, on how to prepare for dashboards, based on the information in the Data standards guide published by the PDP in December 2020.

19 March 2021 – SPP open letter

A Pensions Age article reports on some open correspondence between the Society of Pension Professionals (SPP) and the PDP. The SPP want urgent clarity on a number of issues including pension record matching, definition of the pension amounts to be displayed on dashboards, plus legal and technology requirements. They also want details of the staged implementation dates for the requirements on different pension schemes.

In his response, PDP Principal Chris Curry said the procurement for the digital architecture supplier(s) is due to commence imminently, enabling more detail to be added to the timeline. He also said PDP will soon be able to indicate when schemes will see technical specifications, and DWP aims to consult on dashboards regulations later in 2021.

18 March 2021 – New MaPS consumer brand

Exactly five years on from the 2016 Budget, when the Government first committed to making pensions dashboards a reality, the Money and Pensions Service (MaPS) announces its future consumer brand. It’s MoneyHelper, meaning the MaPS pensions dashboard will be the MoneyHelper dashboard.

12 March 2021 – Onboarding update

The PDP Head of Onboarding Paul Noone provides an update in a blog article on the pensions industry’s data readiness and systems preparation for pensions dashboards, as well as thoughts on voluntary onboarding to the dashboards ecosystem (i.e. prior to the compulsion legislation coming into force).

10 March 2021 – 15-year TPR strategy

The Pensions Regulator publishes a 15-year corporate strategy through to 2035. The strategy says that, over this period, technology will drive and enable change in UK pensions. “The pensions system is overdue a technology-driven change and pensions dashboards may be a catalyst for accelerating the pace of this change [and] we expect dashboards to increase transparency and reduce the cost and effort of [members] making decisions”.

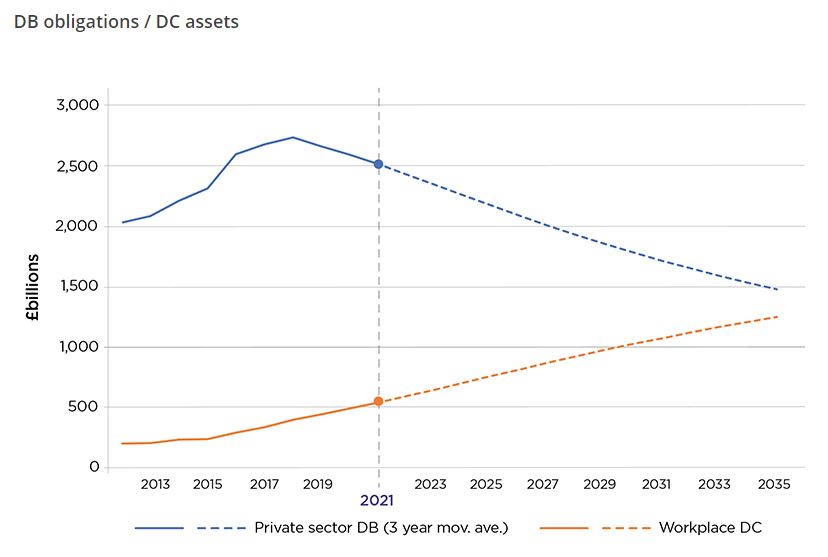

Importantly, a key graph in the strategy shows that defined benefit (DB) pensions will continue to dominate into the 2030s (this graph excludes public sector and state DB pensions):

2 & 3 March 2021 – Regulations timetable

In a written Parliamentary statement (made in the House of Commons on 2 March and echoed in the House of Lords on 3 March), DWP Ministers Guy Opperman and Baroness Stedman-Scott set out a timetable for regulations to be made under the Pension Schemes Act 2021. In relation to pensions dashboards, the statement says:

“We aim to consult on proposed regulations for pensions dashboards later this year and lay draft regulations before Parliament for debate in 2022. Delivery remains on track for 2023 in line with the plans published by the Pensions Dashboards Programme.”

2 March 2021 – Gen X research report

The International Longevity Centre UK publishes a new research report entitled Slipping between the cracks? Retirement income prospects for Generation X. The report highlights just how important pensions dashboards are going to be for people in Generation X (i.e. born between 1965 and 1980). At the report’s launch event, Shadow Secretary of State for Work and Pensions Jonathan Reynolds MP says that, for pensions, “dashboards have to be the fulcrum of the answer to access and transparency”.

2 March 2021 – PASA Guidance note

The Pensions Dashboards Working Group (PDWG) of the Pensions Administration Standards Association (PASA) publishes a Guidance note and a 1-page flier for pension schemes, trustees and providers on how to start getting ready now for pensions dashboards.

1 March 2021 – Digital ID video case study

To support the debate about what level of confidence pension schemes and providers need in a dashboard user’s identity, I’ve published a pensions dashboards digital ID video case study (you can also click the graphic below to watch it on YouTube). Please ask any questions via my details on the Contact page. Many thanks.

26 February 2021 – ID market engagement

The PDP Senior Product Owner for identity, Jon Pocock, summarises in a blog article the identity industry’s response to last year’s market engagement exercise. The feedback from this engagement has fed into the PDP’s current Call for Input from data providers which closes on 19 March.

22 February 2021 – New Programme Director

MaPS announces in a press release that the PDP is to have a new Programme Director, Richard James. Amongst other things, Richard led the HMRC programme to introduce digital Personal Tax Accounts. Interim PDP Programme Director Jamey Johnson is going to NHS Test and Trace, with PDP Operations Manager Tim Reichardt covering until Richard starts in April.

18 February 2021 – Identity call for input

The PDP launches a four-week Call for Input on their proposed Identity approach. Data providers are asked to provide their views on the approach in responses to eight questions by Friday 19 March 2021.

11 February 2021 – Royal Assent

On Royal Assent of the Pension Schemes Bill, the pensions dashboards provisions become law in the Pension Schemes Act 2021. Pensions Minister Guy Opperman says in a DWP press release that “dashboards will hail a digital revolution for savers”. A blog article from PDP Head of Policy David Reid also provides an update on next steps.

8 February 2021 – ERI solution this year

PDP Principal Chris Curry gives an extensive interview to Global Government Fintech. Amongst various topics, Chris confirms that in 2021 “we want to work very closely with the DWP to make some really significant progress on getting industry engagement on how we are going to show [estimate retirement incomes] on dashboards”.

2 February 2021 – PLSA update

In an Employee Benefits article, PDP Steering Group member, and PLSA Director of Policy and Advocacy, Nigel Peaple confirms that, whilst the Pension Schemes Bill shortly becoming law is a reason for celebration, there is still “plenty more hard work to be done before savers finally get to enjoy the benefits of seeing all their pension savings in one place”.

26 January 2021 – PLSA policy priority

Pensions dashboards are confirmed as one of the 6 2021 priorities for the PLSA Policy Board. Small pot solutions, which will be dependent on dashboards data standards, are another of the six priorities.

25 January 2021 – A Living Pension

The Resolution Foundation publishes a report entitled Building a Living Pension, on how much a “living pension” for low to middle income (LMI) families should be and how much should be contributed to deliver that income in retirement . In the report, and its launch webinar, there is considerable discussion about the pros and cons of including the living pension amount on pensions dashboards.

19 January 2021 – Final Bill stages

A House of Lords debate considers Commons’ amendments to the Pension Schemes Bill. Both Houses agreed the text of the Bill, with Royal Assent awaited.

Looking ahead to the drafting of the secondary legislation (regulations) for dashboards, the Minister (Baroness Stedman-Scott) says the Government is prepared to “engage, engage and engage”. In particular, she commits the Government to tabling Written Ministerial Statements during the consultation phases, prior to debating proposed dashboards regulations.

13 January 2021 – Video case study

To support the debate about what information initial pensions dashboards should show, I’ve published a pensions dashboards video case study (you can also click the graphic below to watch it on YouTube). I’ve love to know what you think – let me know your thoughts via my details on the Contact page. Many thanks.

12 January 2021 – Look ahead to 2021

PDP Principal Chris Curry publishes a blog article looking ahead to 2021, covering the Pension Schemes Bill, procurement of the Pension Finder and Digital Identity services, research and pension scheme / provider onboarding.

11 January 2021 – Dormant assets expansion

HMT and the DCMS confirm that, whilst pensions dashboards will seek to reconnect individuals with their pensions, some types of pensions will be included in the expanded dormant assets scheme (i.e. where the pension’s owner cannot be located).

9 January 2021 – Partial matches

Sunday Times Money Editor James Coney starts the year with an article highlighting that pensions dashboards will be “as good as useless” if they can’t find your pensions.

This could be because of inaccuracies in one or more of the items of your personal information held by your pension schemes & providers, and which are used by them to match you to your pensions. Examples could be your Surname or Address being out of date.

This is a major challenge to be overcome by the pensions industry, working closely with the Pensions Dashboards Programme (PDP).

The answer is going to lie in the development of secure and effective “close match” correction processes. For example, even if Surname has changed, National Insurance Number and Date of Birth may match, so this is a “close” but not a “complete” match.

Defining a secure way for the pension provider to update their records to hold the individual’s up-to-date Surname will enable the pension to be found and displayed on the individual’s chosen dashboard. It’s also a win-win for both the individual and the provider because the record keeping has been improved.