Blog started: 25 June 2014

Last updated: 25 April 2024

Quick links

European research tour: dashboardideas.co.uk/international-precedents/europe/

Latest UK updates: dashboardideas.co.uk/history-of-events/2024-2/

Latest videos: dashboardideas.co.uk/videos/

What’s this all about?

Hi there – Thanks for coming to this pensions dashboards blog. It’s a repository I’ve been maintaining for the last 9 years of all the key things published about dashboards in the UK, ever since the idea was first suggested in July 2014 (or actually December 2002).

As of January 2024, the blog includes links to over 520 announcements, updates, reports, commentaries, and so on from Government bodies, regulators, and many other different parties: a truly wide ranging history of ideas and views (some older links may no longer work).

There’s also information about the pensions dashboards other countries have developed, with some important lessons for the UK (recognising key country differences, of course). New in 2023 was my detailed research on the user experiences (UXs) offered by five continental European dashboards.

Seeing all your pensions in one place is a really simple concept to understand. But actually developing the multi-party technological ecosystem to achieve that safely, and understandably for the user, is pretty tricky. There’s a lot to think about: have a look at the Videos page for some simple, digestible explanations.

I’ve also put together some Sample dashboards to feed into the debate on what dashboards should show and how they should look.

More details on me are on the About page. I started this blog for myself, but folk tell me they find it a really helpful body of ideas, so I hope you do too.

Cheers, Richard Smith.

Background

If we’re employed, most of us are now fortunate to be building up money for our retirement through our work. But because lots of us have several jobs during our lives, we end up with multiple bits of pension savings in many different places.

This makes it very hard, almost impossible sometimes, to understand your total pension picture. In fact, only 1 in 5 people understand what they’ve already got to give them confidence they’re on track to have enough money in retirement.

The 80% of UK adults who aren’t sure about this is 30 million people!* It’s a big deal.

Because of this problem, consumer groups, the pensions industry, the Government and many others all think it would be a great idea to develop online “pensions dashboard” services, where people can see all of their different UK pensions, securely, in one place.

This issue isn’t unique to the UK: it exists in many developed countries. Several countries are years ahead of us and have already developed online pensions dashboard services for their people (for example, in Scandinavia, the Low Countries, Israel and Australia).

Denmark’s dashboard (PensionsInfo.dk) is the oldest – it’s been running over for 20 years so is now pretty sophisticated (they’ve even recently launched a demo version in English):

And the 10-year-old dashboard in The Netherlands (Mijnpensioenoverzicht.nl) – or My Pension Overview, known as MPO – is now the top place Dutch people go for information about their pensions, preferring it over their scheme-specific statements because it shows what they want to know: total pension income.

Brief history of dashboards in the UK

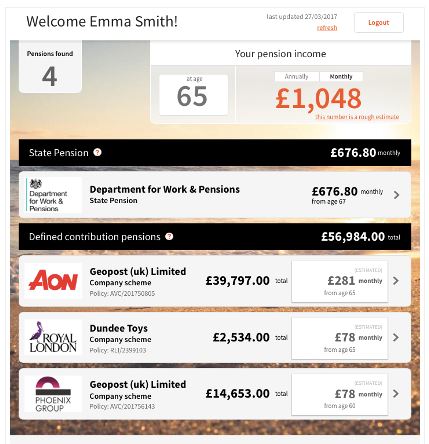

In late 2014, the Financial Conduct Authority (FCA) recommended a pensions dashboard should be developed, and in the 2016 Budget, the Government said it would ensure industry launched one. Industry then developed a prototype dashboard in 2017:

The prototype project, though, highlighted a range of really complex issues on which Government would need to opine. So in 2018, the Department for Work and Pensions (DWP) conducted a feasibility study examining the tricky issues involved, then ran a public consultation. In April 2019, the Government presented a Command Paper to Parliament, committing to make dashboards happen:

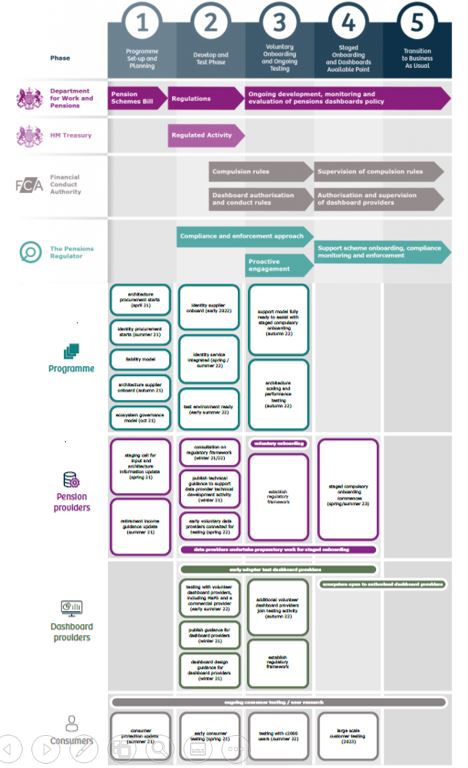

Since then, the Government has brought forward the necessary primary legislation in the Pension Schemes Act 2021 which became law on 11 February 2021, and the detailed secondary legislation in the Pensions Dashboards Regulations 2022 made 21 November 2022.

The Government has also set up a Pensions Dashboards Programme (PDP) run by the Money & Pensions Service (MaPS). PDP is working hard with a wide range of government and industry delivery partners to make pensions dashboards a reality. As part of this, during 2020, I was very fortunate to be able to help PDP develop the dashboards data standards.

The work to develop pensions dashboards is a very significant undertaking, now recognised as one of the most important and complex projects currently underway in the UK.

As of 2024, the programme plan and overall timeline is being reset and the National Audit Office is investigating.

Pensions dashboards are coming to the UK in the 2020s. It’s a big task, but, working together, Government and industry are going to deliver something really wonderful for the UK.

See Full history of events for more details.

So what’s DashboardIdeas.co.uk for?

Developing and maintaining dashboard services for the whole UK will be fiendishly tricky. There are lots of issues to resolve requiring clever thinking and collaboration.

I hope this website, serving as a repository for knowledge, thoughts and ideas on all aspects of pensions dashboards, can help inform debate, and support all those contributing to the dashboards initiative.

See the About page for more details on why I’ve created this blog and brief background on me.

Many thanks for reading.

Cheers, Richard Smith

25 April 2024

* In May 2018, the Pensions and Lifetime Savings Association (PLSA) commissioned Populus Data Solutions to undertake an omnibus poll of c.1,500 UK individuals aged 18 to 65 to examine attitudes towards saving for retirement. The poll found that 8 out of 10 people aren’t sure they’re saving the right amount for retirement, because they lack knowledge about what pensions they’ve already built up. At a national level, using the latest ONS figures available at the time, the non-retired UK population aged 18-65 was 38.0 million, 80% being 30.4 million.